The Euro Faces a Soft end to 2018 thanks to Merkel's Resignation as CDU Boss

- Written by: James Skinner

Image © European People's Party, Reproduced under CC licensing

- Merkel's drubbing in Hesse prompts resignation as CDU chair.

- Collapsing support for establishment means migraine for Euro.

- Could have implications for handling of Italian budget row with EU.

The Euro has entered the new week on its back foot after the outcome of another regional election in Germany saw the single currency's political headache turn into a migraine on Monday.

Chancellor Angela Merkel was dealt another drubbing on Sunday, when voters in the state of Hesse abandoned Germany's stalwart of consensus-coalition politics in favour of emerging voices on the right and left of Germany politics.

The Chancellor has since said she will be stepping down as the head of the CDU but would like to stay on as Germany's Chancellor.

Merkel's Christian Democratic Union received just 27% of the vote in Hesse, down from 38% previously, while grand coalition partner the Social Democrats garnered just 19.2% of the vote, which is also a loss of around 10%.

The Green Party gained 19% of the vote in Hesse this time around, almost doubling their 2013 haul of ballots, while support for the Alternative for Deutschland (AfD) rose from 4% to more than 12% on Sunday.

This is the second vote in just as many weeks that has seen electoral support for Angela Merkel suffer a notable decline.

There is now a risk the fragile coalition government in Germany collapses over coming months, with economists looking to the annual CDU conference in December as the next likely flash point.

"The Euro has had a volatile start to the week, with the news that Angela Merkel is likely to leave her post in December shaking confidence in the region. There is no guarantee that Merkel’s decision to leave will have any negative impact upon Europe or Germany, yet it does add an element of uncertainty which could hold back confidence in the Euro in Q4," says Joshua Mahony, analyst at IG.

For the time being, Merkel appears safe as Chancellor but the longer that time goes on without signs of a revival in the CDU's electoral fortune the more that doubts over the tenability of her position may grow.

"If she manages to stay on as chancellor after the CDU elects a new leader, probably on 7 December, she would still be seen as a lame duck," says Holger Schmieding, chief economist at Germany's Berenberg Bank. "Even in the likely case that she remains chancellor for now with somebody else leading the CDU, her first step towards the exit adds to the risk that her coalition partner SPD will walk out of the Berlin coalition in late 2019 upon a mid-term review."

#Euro heading south on Merkel reports - new front of political risk in Europe pic.twitter.com/nwZOlhHrWB

— Neil Wilson (@marketsneil) October 29, 2018

Schmieding says that if Chancellor Merkel were to be forced out of office the most likely result would be a continuation of the current coalition government.

This is headed by the CDU and SPD but supported by the Greens and Free Democratic Party at the margins. It gives all Germans representation in government, barring supporters of the AfD.

"Their similar views on key issues such as NATO, EU and euro reflect a national consensus. While individual sectors may be affected, for example with the Greens insisting on a faster exit from coal, the outlook for small-scale reforms in Europe and for dealing with Italy and Brexit would not change dramatically," Schmieding says, in a note to clients.

German politics matter for the Euro because the single currency is underwritten by the central European country and its public purse, which is the largest and most solvent in today's debt-laden Europe.

Changes at the top of Germany's political hierarchy can have significant implications for all of the Eurozone given the nation's clout as far as policy-making in the European Union institutions.

"Recent strength of the Greens could tug Germany more to the left," says Mark McCormick, North American head of FX strategy at TD Securities. "That would be a medium-term positive, though EURUSD is trading at 'fair value' now."

Above: Eurio-to-Dollar rate shown at hourly intervals.

The Euro was quoted 0.04% higher at 1.1403 against the Dollar Monday, but it's fallen 1.8% in the last month and is now down 4.9% for 2018.

The Euro-to-Pound rate was 0.01% higher at 0.8876 while the single currency was still weaker against around half the G10 basket.

Above: Euro-to-Dollar rate shown at daily intervals.

"In the current climate of uncertainty over Italy, the euro-zone needs a safe pair of hands more than ever and Mrs Merkel has been key to brokering compromises in the past. Given her weakened position, an agreement over Italy’s Budget may take longer to reach, increasing the threat of contagion to other markets and adding to the risks to Italian banks," says Jennifer McKeown, chief European economist at Capital Economics.

Advertisement

Bank-beating exchange rates! Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Italy in Focus

Monday's second helping of German politics comes just days after the European Commission demanded that Italy revise its 2019 budget plan to make it consistent with the bloc's fiscal rules.

This has set the stage for a possible clash between the Mediterranean nation's "populist" government and European Union's officials.

Italy now has until November 13 to submit its revised plan to the Commission for approval. If it fails to meet the deadline it could face sanctions, which would almost certainly stoke the fires of anti-Euro sentiment among voters and potentially endanger the nation's place as a member of the single currency bloc.

Ratings agency Moody's downgraded the country's debt to Baa3, one notch above "junk" status, last week in response to the budget plan. But S&P left its rating unchanged, two notches above "junk".

Above: Italian 10-year bond yield.

The budget row has already seen investors dump Italian government bonds by the bucket load, forcing prices lower and yields higher in recent weeks.

Bond markets are now demanding higher interest rates for lending to the Italian government, which has its own implications for the budget deficit.

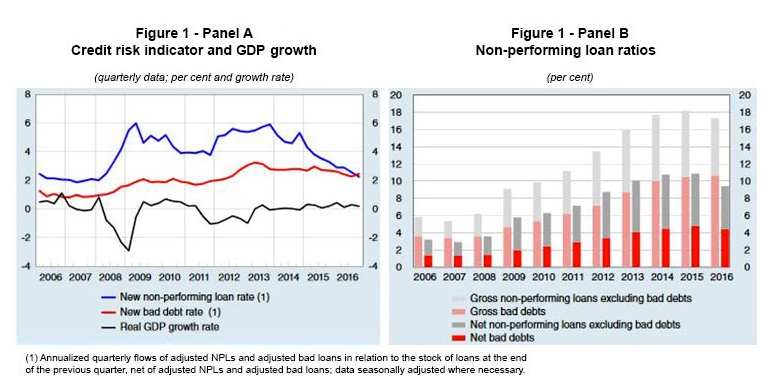

Moreover, there is a danger that price action in the bond market will undermine the nation's banking sector, which is already the most troubled in Europe.

Italian banks have parked substantial amounts of their "regulatory capital buffers" in government government bonds.

But with bond prices now falling, so too is the value of the already-stretched capital buffers propping up the nation's banks.

Italy's banks are already creaking because defaulted loans account for almost one fifth of all assets in the banking system.

Writing off these debts is a significant task that has already eaten into the capital reserves of the nation's banks. If those reserves are further eaten away by bond market losses in the months ahead, then the Euro could begin to take note.

Above: Bank of Italy graph detailing bad loan build up in the nation's banking system.

Advertisement

Bank-beating exchange rates! Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here