Euro Rescued by ECB's Schnabel & Knott, Rebounds against the Pound & Dollar

- Written by: Gary Howes

- EUR punishes its doubters

- As ECB board members turn hawkish

- Schnabel, Knot say time to exit ultra loose policy settings nears

- Show limited concern for current Covid wave

Above: File image of ECB Board Member Isabel Schnabel Image © European Central Bank

Is the Euro defying the Eurozone's 'fourth wave' of Covid anxieties?

Price action on Tuesday suggests it might be: the single currency has rallied against the Pound, Dollar and other majors, helped by supportive comments from council members of the European Central Bank (ECB).

Isabel Schnabel, a Member of the Executive Board of the ECB said "the risks to inflation are skewed to the upside" and she joined a fellow board member in playing down the negative impact of renewed Covid restrictions in the Eurozone.

"If a member of the ECB's Executive Board calls inflation risks 'skewed to the upside', this is a clear signal that the gradual exit from ultra loose monetary policy is about to start," says Carsten Brzeski, Global Head of Macro at ING Bank.

"The last time the ECB had such a risk assessment on inflation was in 2014!" he adds.

Ahead of the commentary the Euro had been struggling, weighed down by investor concerns relating to a new wave of Covid infections spreading across Europe.

But the single currency performed a turnaround after Schnabel said in an interview that uncertainty had increased as to when inflation will fall back to the ECB's 2.0% target, and "we have to take this increased uncertainty into account."

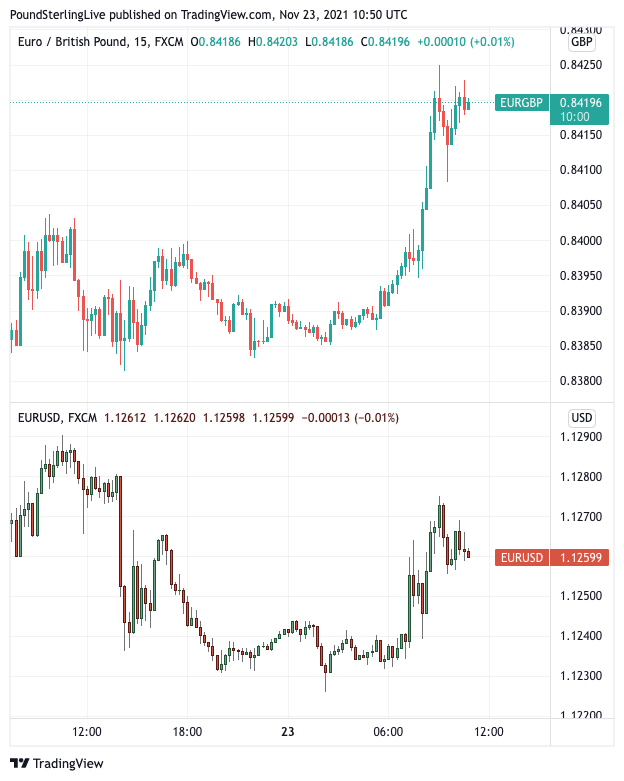

Above: The Euro lifted off lows against the Pound (top) and Dollar (bottom) following an apparent hawkish shift at the ECB.

- GBP/EUR rates at publication:

Spot: 1.1877 - High street bank rates (indicative band): 1.1560-1.1644

- Payment specialist rates (indicative band): 1.1770-1.1820

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Schnabel said "it remains plausible to stop Pandemic Emergency Purchase Program (PEPP) purchases in March next year." PEPP is the ECB's Covid emergency quantitative easing programme that sees the Bank provide liquidity to the economy via its purchase of government and corporate bonds.

When PEPP ends is important in that it signals as to how soon interest rate rises could follow.

Schnabel addressed the imposition of new restrictions to curb the spread of Covid in some Eurozone states, saying "while rising coronavirus cases and new containment measures might dampen economic activity in the short run, they are unlikely to derail the overall recovery."

This punctures the narrative that rising Covid cases in the Eurozone would press the ECB into a more 'dovish' stance, whereby it reiterates the need for supportive monetary conditions to support the recovery.

Such a 'dovish' stance tends to lend itself to a weaker Euro, but when investors sniff a 'hawkish' shift the currency finds itself supported.

Indeed, Schnabel's comments suggest the ECB is now more concerned about surging inflation than it is about Covid restrictions.

Holger Schmieding, an economist at Berenberg Bank says the ECB is right to steer a steady course and avoid overreacting to rising Covid waves.

He says it would be "a major mistake" to change course.

"The autumn wave of the pandemic looks set to get worse before it may abate. However, no wave has so far lasted longer than two to three months. Chances are that rapid inoculation progress, rising rates of natural immunity especially among younger age groups and more effective treatments of Covid-19 that seem to be in the pipeline for early 2022 will have brought the pandemic under control again well before the ECB’s pandemic emergency programme is set to expire on 31 March 2022," he says.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

ING's Brzeski says this is the first time in a long time that an ECB Executive Board member comes up with a hawkish comment.

He says it confirms ING's view that ECB will announce the tapering of its asset purchase programme at its December meeting.

Underpinning Schnable's message was her view that central banks need to retain optionality to be able to respond to all contingencies and committing policy for too long could constrain policy choices should upside risks to inflation materialise.

The subtext here is that the current status quo of lower-for-longer interest rates that ECB policy embodies can be challenged when circumstances change.

"Schnabel’s interview gives, in our view, clear hints at how the ECB will try to cautiously join the exit lane," says Brzeski.

Markets are taking notice of the comments:

Money markets resumed factoring in a 10-basis-point rate increase from the ECB in December 2022, after briefly pricing it out last week.

The Euro to Dollar exchange rate rose back to 1.1262, the the Euro to Pound exchange rate rose a third of a percent to 0.8422 (Pound to Euro fell back below 1.19 to 1.1875).

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

A potential 'hawkish' shift by the ECB was further underpinned by ECB board member Klaas Knot who said in an interview that ECB interest rates will likely rise after 2022.

This is important as it opens the door to a 2023 rate hike, contrasting to the ECB's favoured guidance for a rate hike in 2024.

Knot also played down the impact of renewed Covid restrictions in countries such as Austria and the Netherlands.

While the measures "will surely have a moderating impact on economic activity, the impact on inflation will actually be more ambiguous, because it might also reinforce some of the concerns we have around supply bottlenecks," he said.

"I don’t think myself that it will have an impact on our intention to wind down the pandemic emergency purchase program," he added. "“After all, its dual objectives have already been accomplished."

This pivot at the ECB is an interest one, particularly as it comes at a time of increased anxiety towards the Eurozone economy owing to rising Covid cases and tighter restrictions.

It shows the ECB believes the economy will withstand restrictions and that underlying currents remains supportive of a strong rebound in 2022, warranting less monetary support.

"As long as a broad-based protracted downturn is avoided, the EUR could be able to hold back against a renewed spot sell-off, as attention could then shift back to underlying macro developments," says Valentin Marinov, Crédit Agricole's head of FX strategy.