Euro Jumps against Dollar as Markets see Odds of Democrat Clean-sweep Grow

- Euro bid, Dollar sold

- Investors respond to improved visibility on Nov. vote

- However some say too soon to sell USD

Above: Kamala Harris, Joe Biden. Photo by Adam Schultz / Biden for President

- EUR/USD spot rate at time of writing: 1.1785

- Bank transfer rate (indicative guide): 1.1373-1.1455

- FX specialist providers (indicative guide): 1.1550-1.1679

- More information on FX specialist rates here

The Euro-to-Dollar exchange rate has jumped 0.5% at the start of the new week to reach fresh two-week highs at 1.1786, amidst an atmosphere of broad-based Dollar weakness amidst growing evidence of a clear outcome to the U.S. November presidential vote.

A new national poll fuelled growing expectations for a Democrat sweep of both the Presidency and Congress, while the apparent improved health of the President helped improve visibility for investors who have for some weeks been fearful of a disputed outcome to the vote that would potentially cripple the economy.

"The U.S. Dollar softened as risk appetite improved to begin the week. The dollar slipped against the euro and sterling and fell to two-week lows against the Canadian dollar. The buck is taking its cues from wavering U.S. political developments. Reports that President Trump is on the mend after testing positive last week for Covid-19 offered some reassurance to global markets," says Steven Jon Colangelo, FX Dealer at Western Union.

Trump signalled on Monday he was preparing to return to the White House imminently with media outlets reporting he is agitated for a swift release from hospital. Markets see Trump's health as being important for elections being held in a timely and credible manner manner; serious health complications for Trump would potentially translate into complications for the outlook of U.S. politics and the economy.

"The president’s health is critical to keeping the coming election on track and can factor in to whether Washington soon agrees on a massive stimulus package at a time when the U.S. economy is showing mounting signs of slowing," says Colangelo.

Trump was demanding to go back to the White House on Sunday, two sources familiar with the situation told CNN and reports suggest doctors are due to make a call on the President's health at some point later on Monday.

The market is reacting to levels of certainty around the outcome of the vote, and any developments that occur that improve certainty are likely to be interpreted as positive by investors who tend to buy stocks, commodities, risk-on currencies while selling the Dollar in such an environment.

Above: EUR/USD at four-hour intervals. If you would like to lock in current rates for use at a future point, thereby securing your international payments budget, please learn more here.

In addition to Trump's health polling data is now starting to hint towards a decisive outcome for the election, which will likely aid improvements in investor risk sentiment.

"Overall, the polls show a sizeable and stable Biden lead, effectively since the spring, both nationally and in swing states. Of the seven swing states we consider key, Biden polls competitively in four and above the margin of error in three. In other words, the polls say to take seriously the chance of a landslide election," says Daniel Ahn, Chief US Economist at BNP Paribas.

Analysts say a clear-cut win by either candidate would be welcomed by markets as it would mean any existing uncertainty surrounding the vote evaporates immediately. A Democrat sweep would meanwhile likely open the door to a sizeable stimulus package being introduced early by the new administration, which would help bide the economy over until a real and sustainable post-covid recovery can take hold.

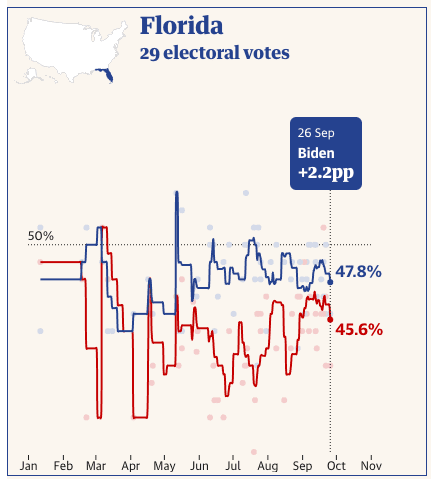

Above: "Florida has voted for the winner of the presidential election in every election since 1996." - BNP Paribas. Graphic courtesy of The Guardian.

Expectations for a Biden win grew on the weekend after a new national poll showed President Donald Trump is now 14 points behind Biden, less than a month until the election day.

A NBC/Wall Street Journal survey indicating a 53-39% advantage for Biden. The poll was taken immediately after last Tuesday’s tumultuous first presidential debate in Cleveland, at which an argumentative president constantly interrupted both his rival and the moderator Chris Wallace.

Polls have a consistent lead for Biden, and given that pollsters have adjusted their methodology to avoid missing Trump's 'hidden' support, markets are consistent in pricing his victory.

Regardless, uncertainty will nevertheless remain a feature of the near-term timeframe with investors unwilling to shake the fear of a close result which could result in weeks of legal challenges, creating conditions for financial market weakness.

"We note many uncertainties around this election, including its occurrence during a historic pandemic, a higher-than-normal incidence of mail-in ballots, and allegations by the incumbent, made without evidence, of voter fraud that could lead to a drawn-out and contested election," says Ahn.

Should the trend swing away from a clear outcome once more and uncertainty begins to creep in the experiences of recent weeks would suggest a 'risk off' reaction would play out once more, in which stocks fall and the Dollar rises.

This view leaves a number of strategists at the major financial institutions opting to sit on bets that favour the Dollar against the Euro over the near-term.

"The outlook for EUR in the short term has taken a turn, with that US stimulus delayed another two weeks or more with renewed COVID-19 social distancing measures in several euro area countries this past week. There is potential for a delay in EU recovery fund negotiations and dovish commentary by the ECB. This is why we entered short EUR/USD on the break of 1.17 in cash," says Jordan Rochester, a foreign exchange strategist at Nomura.