UK Inflation Runs Hotter than Expected, Helps Pound Sterling Recover Some Lost Ground

- GBP in recovery mode Wednesday

- Inflation rises more than expected in June

- But rise in inflation could be momentary blip

Image © Adobe Stock

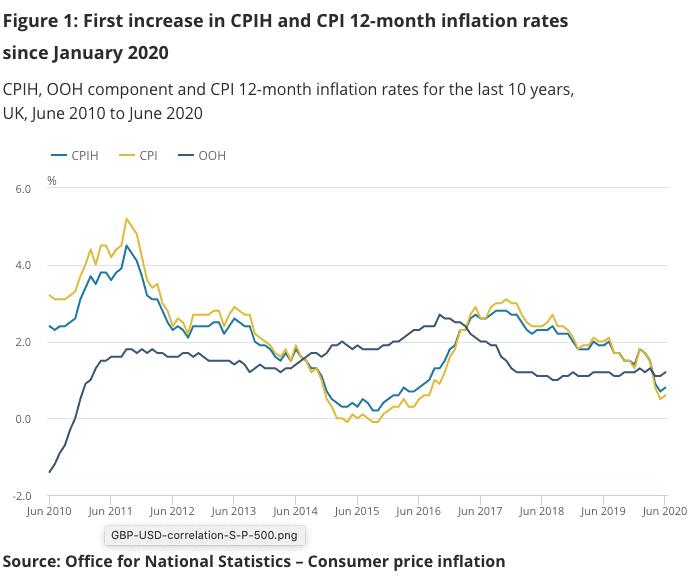

UK inflation as measured by the Consumer Prices Index (CPI) rose 0.6% year-on-year in June 2020, up from 0.5% in May according to the Office for National Statistics. The CPIH measure of inflation - CPI + owner occupiers' housing costs - was 0.8% year-on-year in June 2020, up from 0.7% in May 2020.

This was the first uptick in inflation recorded for 2020, underlying the exceptional deflationary pressures triggered by the covid-19 economic slump.

The rise of 0.6% comes against market expectations for a reading of 0.4% and is therefore, on balance, supportive of Sterling as it could prompt the Bank of England to hesitate when considering cutting interest rates further.

Indeed, steady inflation is typically symptomatic of a healthy economy and should CPI rise back towards 2.0% over coming weeks it would reflect the recovery in the economy from its covid-19 collapse. "There will be relief that the spectre of deflation is receding. Weak consumer confidence and falling prices are a toxic combination, as shoppers tend to postpone purchases when they think prices might get cheaper in coming months," says Ulas Akincilar, Head of Trading at INFINOX.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

According to the ONS, the biggest upward contribution to prices came from recreation and culture, where prices overall rose by 0.2% between May and June this year, compared with a fall of 0.4% between the same two months a year ago.

Within this broad group, the upward contribution came from games, toys and hobbies, particularly computer games and computer games consoles. The largest downward contribution to inflation was food and non-alcoholic beverages, with prices falling by 0.6% this year, compared with a rise of 0.1% a year ago.

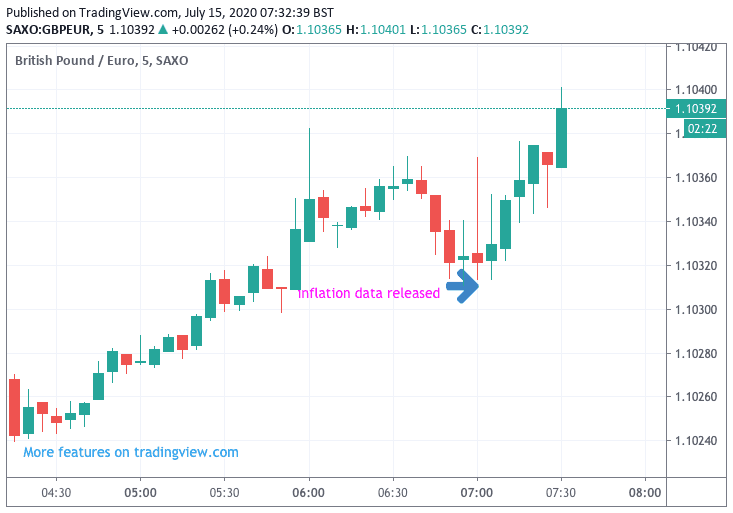

Following the release of the data there was a tick higher in the value of Sterling which had been recover the ground it lost over the course of the first two days of this week. Should inflation continue to rise markets would assume the Bank of England would refrain from cutting interest rates further, and the foreign exchange textbook says this would be on balance supportive of Sterling.

Above: The Pound-to-Euro exchange rate has recovered lost ground through the course of Wednesday.

But readers should note the primary driver of Sterling in the short-term appears to be the ups and downs of global stock markets, and a recovery in markets today appears to be the prime driver of the recovery.

However, it is too soon to suggest that inflation is on the way back up. We reported earlier this week that the UK economy could in fact soon see deflation, where prices start to fall, thanks to the initiatives announced by UK Chancellor Rishi Sunak last week, where VAT for certain sectors of the economy was slashed in an effort to get coy consumers out and spending once more.

"The reduction in the standard rate of VAT from 20% to 5% between 15th July 2020 and 12th January 2021 for the hospitality/tourism sector and August’s “Eat Out to Help Out” (EOHO) Monday to Wednesday discount scheme, which were announced by the Chancellor last week, will both reduce consumer prices," says UK Economist Paul Dales at Capital Economics.

However, in a sign that consumers might stand to benefit is news pub chain giant JD Weatherspoon have announced deep cuts to drink and food sales, which other companies looking to boost turnover might follow given the precedence being set.

"One consequence of the new policies announced by the Chancellor last week is that the UK will soon enter a period of deflation. But this will be the good form of deflation, which is temporary, boosts real incomes and incentivises people to spend, rather than the bad form of deflation, which is persistent, reduces wages, increases debt burdens and prompts people to postpone spending," says Dales.

Figures from Capital Economics shows the VAT cut is equivalent to a price reduction of 12.5% (i.e. £100 / 1.20 x 1.05 = £87.50). They estimate it applies to about 9% of the CPI basket (i.e. accommodation, admission to attractions and food/non-alcoholic drink from restaurants, pubs, bars and cafés).

Their research shows that theoretically if all eligible items were reduced in price by 12.5%, the consumer price index would fall by 1.1% and inflation would ease by 1.1 percentage points.