Pound / Euro Forecast Shows Declines Written into the Charts Ahead of Crunch Brexit Votes

No further concessions on Brexit have been forthcoming from the EU's Chief Negotiator Michel Barnier ensuring the EU-UK Brexit deal will fail this week. Image © European Union, 2018 / Source: EC - Audiovisual Service / Photo: Etienne Ansotte.

- Pound Sterling slips into negative short-term trend

- 1.15 eyed as potential target

-May's Brexit deal faces defeat, uncertainty to rise

The Pound-to-Euro exchange rate was seen to be under pressure at the start of the new week, with 1 GBP buying 1.1553 EUR, by contrast the rate was at 1.1603 at the same point in the previous week.

A positive technical setup for Sterling, in place for weeks now, has been undermined after the currency came under heavy selling pressure last week, with traders cutting back on exposure to the currency ahead of what promises to be a critical week in British politics. Reports out over the weekend suggest the EU-UK Brexit deal is on course to suffer a heavy defeat when it comes to the House of Commons on Tuesday, making it almost inevitable that the government will be forced into requesting an extension to the Brexit process.

Concerning the outlook, there are warning signs on the GBP/EUR charts that further declines are possible over coming hours and days.

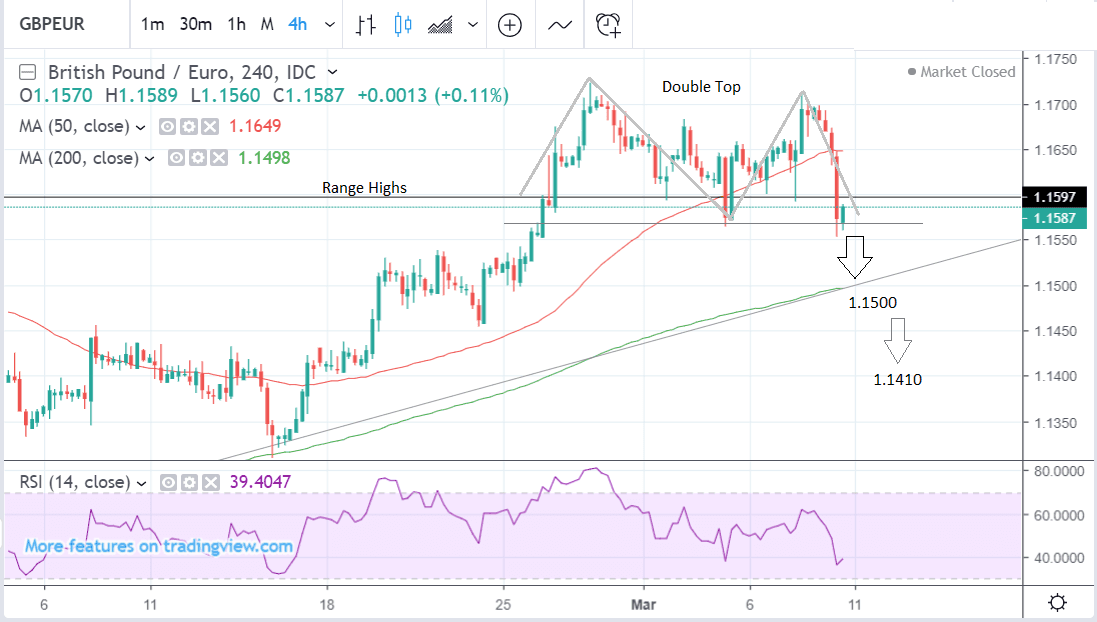

Of particular note is a bearish double top pattern haunting the highs of the 4-hour chart. At the moment it looks complete and ready to break lower to a downside target of 1.1410 but the top of the range highs at 1.1590 is still blocking bears and is likely to present a hard-floor through which they will have to break before the rate can decline.

A move below Friday’s lows at 1.1550 would probably open up a wave of selling down to 1.1500, and the supporting trendline at that level. A break below 1.1485 would then also probably provide sufficient confirmation for a continuation down to a target at 1.1410.

Despite the bearish warning signs, the pair did make a breakout above the range highs the week before last and this will keep bullish hopes alive over a medium-term, multi-week, timeframe.

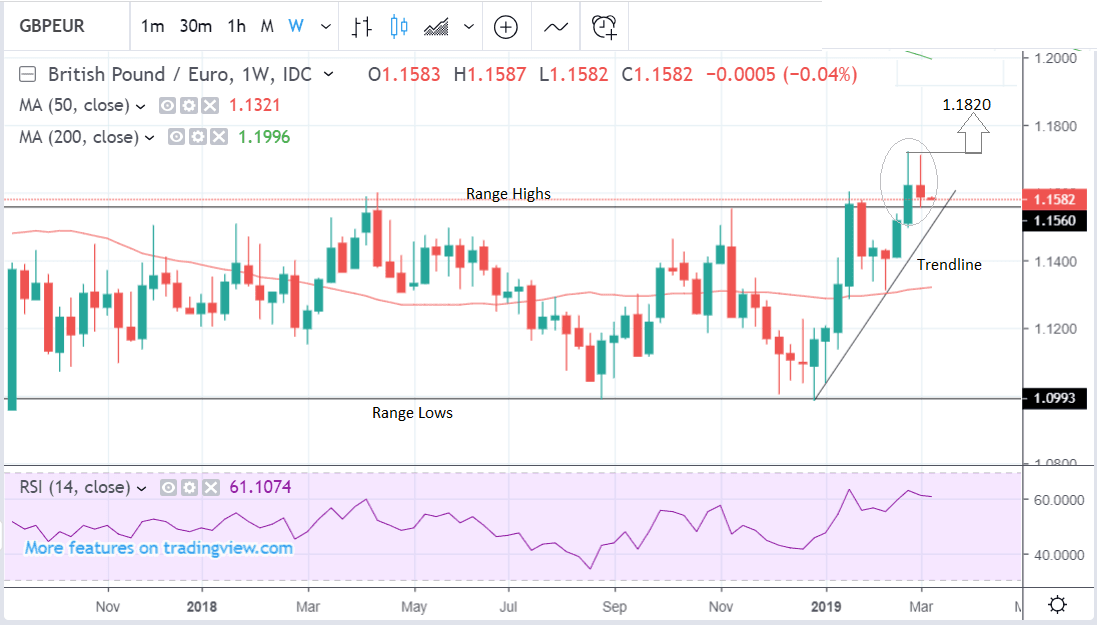

If the exchange rate can break above the 1.1723 highs established at the end of February, it could green-light an extension higher to a fresh target at 1.1820. This is a medium-term objective and not something we would expect to occur this week unless Prime Minister Theresa May's Brexit deal is approved by the House of Commons.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound this Week: It's Crunch-time

The main event for Sterling in the coming week is Parliament’s meaningful vote on Brexit on Tuesday.

With no further concessions on the Irish backstop likely from the EU, and talks being described as being close to breaking down, Theresa May is now unlikely to present the changes required to win and the most probable scenario is that Parliament then moves to vote on whether or not to exit the union without a deal, on Wednesday.

Assuming it does not vote for this outcome - parliamentary arithmetic suggests this is highly unlikely - the next most probable outcome is that Parliament votes on Thursday to decide to request a delay of Article 50 and the whole Brexit process from the EU.

That there will be a delay is currently the consensus expectation. How this will affect Sterling is open to interpretation.

“If lawmakers choose to delay Brexit, a modest rise is attainable for the Pound, while a surprise backing of May’s deal could send the Pound surging above $1.35. But In the unlikely event that a no-deal wins support, sterling could crash below $1.27,” says Raffi Boyadijian, an economist at broker XM.com.

The Brexit deal faces a heavy defeat in parliament on Tuesday because she has so far secured no major changes from the European Union, the leaders of two major eurosceptic factions in parliament said on Sunday.

Nigel Dodds, the deputy leader of the Democratic Unionist Party (DUP) which props up May’s minority government, and Steve Baker, a leading figure in the large eurosceptic faction of her Conservative party, warned “the political situation is grim”.

“An unchanged withdrawal agreement will be defeated firmly by a sizeable proportion of Conservatives and the DUP if it is again presented to the Commons,” they wrote in the Sunday Telegraph.

In further, developments a Sunday Times report says May’s team have been warned by senior Brexiteers that she would get her deal passed only if she offered to resign by June so a new prime minister could lead the second phase of negotiations.

"We think Sterling faces a more difficult road," says James Rossiter, a foreign exchange strategist with TD Securities. "A lot of good news is already in the price and that investors may have gotten a little ahead of themselves in hoping for further positive developments. With the UK's data and event calendar relatively light until the 12th, we think Sterling may start to feel the effects of gravity once again."

The other main release is UK GDP which is forecast to show a 0.2% rise in January after a -0.4% fall in December when it is released at 9.30 GMT on Tuesday.

GDP is forecast to have risen 1.2% from a year ago, up from 1.0% previously. A higher-than-expected rise would support the Pound and vice versa for a lower-than-forecast result.

The trade balance in January is released at the same time as GDP and is forecast to show a -12.2bn deficit compared to -12.1bn previously.

Also released at the same time is manufacturing production and this is forecast to show a 0.0% rise in January month-on-month compared to the -0.7% previously.

Industrial production in January is released at the same time and estimated to have fallen by an even steeper -1.4% from -0.9% previously.

The Euro: What to Watch

The main economic event for the Euro has already come to pass at the time of this article's update.

The industrial slowdown that drove Germany's economy to a standstill late last year was shalllower than previously thought, according to official data released on Monday, although economists say growth is still likely to slow again this year.

German industrial production contracted by -0.8% in January, unwinding an upwardly-revised 0.8% gain from December, when markets had anticipated an increase of 0.5%. Previously, Destatis said output was -0.4% in December.

The main industrial production number for January might appear ugly, however the revision to December's figure means output from the factory space was unchanged in the last two months.

In other words, production stabilised in the new year rather than contracting any further. But economists are warning that growth could still slow even further during the quarters ahead.

"The upshot is that the German economy is likely to return to growth in Q1, but only just, after performing very poorly in the second half of last year," says Jack Allen, an economist at Capital Economics.

The Euro found marginal support on the data with markets believing much of the news coming out of the Eurozone's economy has already been factored into the thinking of the European Central Bank (ECB) which last week struck a cautious tone on the need to raise interest rates, with the outcome of their March policy meeting sending the Euro exchange rate complex lower.