Little for Pound Sterling to Welcome in April's Wage and Employment Data

The British Pound consolidated recent gains against the Euro and US Dollar on global foreign exchange markets after markets digested some unsavoury news that real wage growth in the UK is now falling.

Sterling had spiked higher on news in the labour market report covering February and March whiched showed that average earnings - with bonuses included - rose 2.3% in the three months to February.

This is faster than the 2.2% expected by markets and explains the initial jolt higher.

The previous month's release was revised higher from 2.2% to 2.3%.

However, dig a little deeper and the data is less encouraging.

Economists point out that much of the gain is due to bonuses and might not be as self-sustaining as the initial headline suggests.

"Granted, the 2.3% headline rate of pay growth was a little stronger than we had expected. But that does not represent any pickup from the previous month’s outturn. And, as a better read of the underlying picture, we often prefer to look at private sector wage growth, excluding bonuses. This measure saw a slowing from 2.7% to 2.4% growth – much softer than the 3.0% local peak seen last November," says Chris Hare at Investec in London.

Hare says real incomes are now being squeezed and therefore domestic cost pressures are being kept in check .

In all, the picture is mixed and will take more before markets anticipate the Bank of England will raise interest rates sooner than currently planned. Remember, higher interest rates = a stronger Pound.

"Because the ‘overshoot’ of CPI inflation above the Bank of England’s 2% target is set, we think, to be driven entirely by the temporary effect of past falls in the pound, the MPC will see no reason to raise rates any time soon. Our forecast is for Bank rate to remain on hold at 0.25% for the whole of this year and next," says Hare.

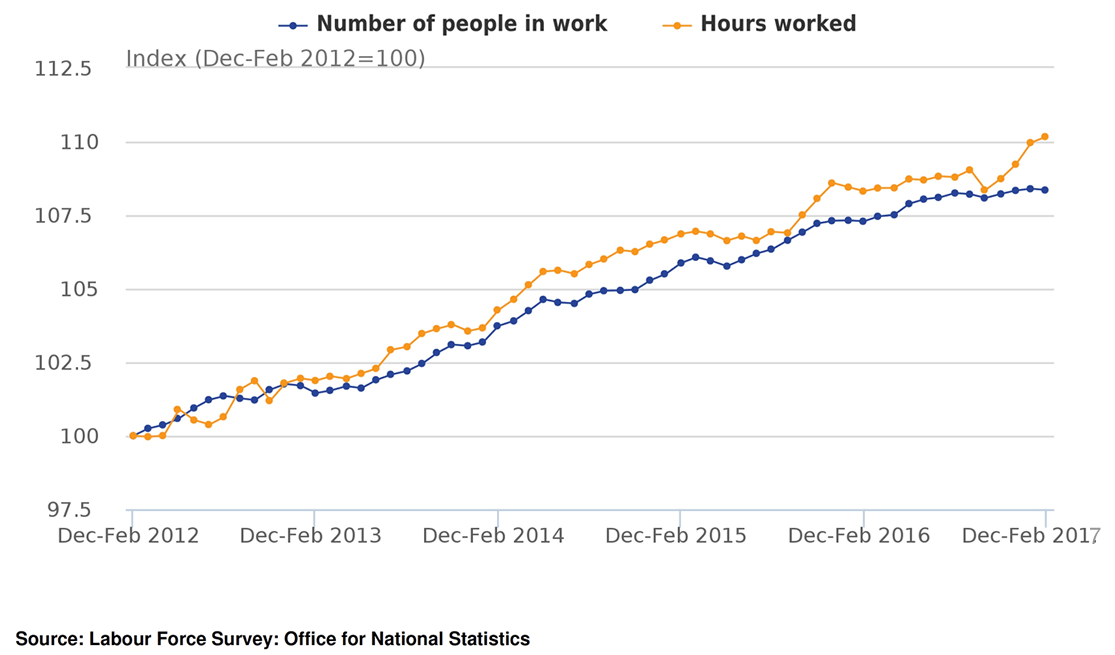

The Bank will however also be aware of the following graph released by the ONS:

As can be seen more hours are being worked but the workforce is more or less staying at a constant size which tells us the productivity of the workforce is increasing.

Hence we would expect workers to get paid more. Ever since the 2008 financial crisis and ensuing recession economists have been stumped by the low level of productivity - also known as labour market slack - in the UK workforce and the trend of late suggests finally productivity is picking up.

"We remain optimistic that the decline in labour market slack will feed through into at least some pick-up in nominal wage growth. In any case, consumer spending should be supported by strong confidence, jobs growth, and supportive credit conditions," says Paul Hollingsworth, UK Economist at Capital Economics.

However, analyst Daniel Vernazza at UniCredit Research interprets the above differently:

"There has been a relative shift away from large-scale hiring and towards using existing workers more intensively. It is suggestive of firms standing still, putting to work existing staff more intensively for unchanged – or weaker – pay growth."

Looking ahead, it is easy to understand why economists are not optimistic, particularly as the UK enters tough Brexit netotiations.

Gains in the Pound will have also been tempered by news that the claimant count rose by 25K people in March; analysts had forecast the claimant count to fall by 3K.

"A sharper-than-expected slowdown in employment growth is yet another hint that economic activity may be decelerating. That, along with continued subdued wage growth, provides support for leaving UK interest rates at their current very low level," says a note from Lloyds Bank to their commercial clients in the wake of the data release.

Note that geopolitics appear to be influencing Sterling at present and we are therefore inclined to place more emphasis on headlines over the course of the coming 48 hours.