Headache for the SNB as Swiss Franc is Forecast to Strengthen Further by Analysts

- Franc dominance a feature of 2020 markets

- Further gains possible say analysts

- EUR/CHF tests key 1.08 area, SNB intervention eyed

Image © Adobe Images

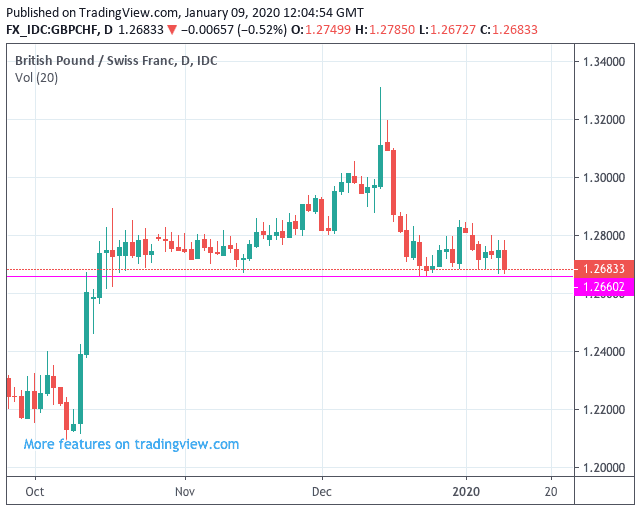

- Spot GBP/CHF exchange rate: 1.2681, -0.57%

- Indicative rates on offer at the bank: 1.2240-1.2330

- Indicative rates on offer with money transfer specialists: 1.25-1.2570 >> Get your quote

The Swiss Franc's strong run against the Pound and Euro could well continue according to a number of foreign exchange analysts we follow.

The Franc has been one of the better performing major currencies of the past few weeks, and demand has only spiked in the wake of geopolitical tensions involving Iran and the U.S. in the Middle East.

The Franc is considered to be one of the few genuine 'safe haven' assets in global financial markets, advancing when global investors look to exit investments that might struggle in times of market and geopolitical stress.

However, even with Iran and the U.S. apparently standing back from the brink, cemented by U.S. President Donald Trump's press conference on Wednesday where he said he was ready to seek peace, the Franc has threatened to advance still further.

The Pound-to-Franc exchange rate is threatening to break below a key support line, loosely located around 1.2660:

If the exchange rate breaks down here, further losses can be expected and the Pound will be considered to be in a downtrend against its Swiss counterpart.

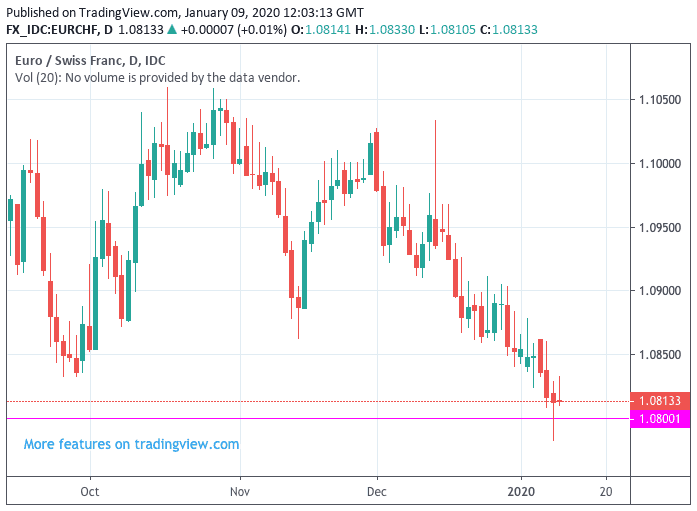

The Euro-to-Franc exchange rate is however the key reference exchange rate when considering the Franc's outlook, as the Eurozone and Swiss economies are so closely intertwined. Indeed, the Swiss National Bank (SNB) tends to target a relatively stable EUR/CHG exchange rate, and the 1.08 level is believed to be a line the Bank is intent on defending.

Any Franc strength that pushes EUR/CHF below 1.08 is seen as negative for the Swiss economy as it prices French exports out of the international market. "EUR/CHF shortly breached the 1.08-level to the downside yesterday. The geopolitical situation simply fuels the demand for safe havens, amongst them the Franc. Positive price data makes little difference under these circumstances," says Antje Praefcke, a foreign exchange strategist with Commerzbank in Frankfurt.

And, we saw EUR/CHF dip below 1.08 briefly on Wednesday in the wake of news Iran had fired rockets on U.S. airbases in Iraq.

A break below 1.08 immediately puts the Franc on the radar for foreign exchange traders, as the question now becomes whether Swiss authorities will intervene in the market.

"Sometimes one can almost feel sorry for the Swiss National Bank. As soon the inflation rate rises a little again external factor significantly push the Swiss franc upwards again," says Praefcke. "While risk aversion on the markets keeps rearing its head the SNB will (have to) intervene on the markets to dampen the Franc’s appreciation so as to prevent downside pressure on inflation taking hold.

Analysts at Swiss investment bank Julius Baer have meanwhile raised their forecast for the Franc by revising lower their 3-month forecast for EUR/CHF from 1.10 to 1.08.

"As a ‘safe haven’, the Swiss franc will likely remain under appreciation pressure in the coming months due to the delay of the overall cyclical bottoming out in major developed economies during the current winter and recently risen geopolitical worries," says Janwillem Acket, Chief Economist at Julius Baer.

Acket says appreciation pressure on the Franc remains apparently high, and he says there is evidence the SNB has already been involved in the foreign exchange market trying to prevent the currency from strengthening. This evidence is drawn from an increase of domestic deposits of Swiss banks at the SNB by CHF 3.5bn just last week.

"We can only explain this recent renewed franc strength with last week’s disappointing December purchasing managers’ indices, showing lower manufacturing momentum in major developed economies like the US, the Eurozone (Germany in particular), the UK and Japan, which is delaying the cyclical recovery in these economies. In addition, geopolitical tension has risen again in the Middle East," says Acket.

And there are other potential drivers of further Swiss Franc strength on the horizon. Robert Howard, an options analyst at Thomson Reuters this week released a note saying the Swiss Franc could rise further if France and the United States fail to resolve a row over a French digital tax.

On Tuesday, French Finance Minister Bruno Le Maire said the two countries had set a two-week target to try and resolve the issue, before a meeting planned at the World Economic Forum (in Davos from Jan. 21-24).

"Do we want a deal on the digital tax ... or are we bracing ourselves for a confrontational mode, which won't be a conflict between France and the United States but a trade conflict between the European Union ... and the United States?" Le Maire said.

Washington has threatened to impose duties of up to 100% on imports of champagne, handbags and other French products worth $2.4 billion after a U.S. investigation found the French tax would harm American technology companies.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. They offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement