Pound 'Topping' vs. Swiss Franc, but Longer-Term Outlook Remains Constructive

Image © Adobe Images

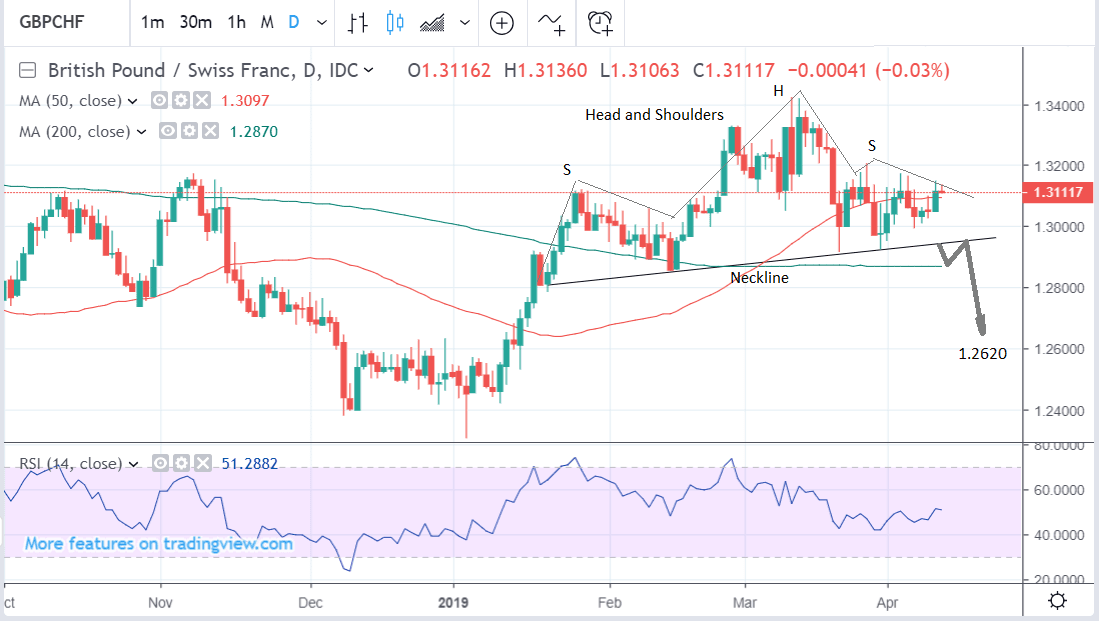

- H&S pattern looming on daily chart; 1.3000 key

- Further out 50-month MA capping gains

- Looming EU-U.S. tariff war could benefit Franc

The Pound-to-Franc exchange rate is trading around the 1.3110s at the time of writing with the pair marginally up on the day, and 0.65% higher this week.

Concerning the outlook, we are overall bearish from a technical perspective in the short-term conditional upon a break below 1.3000 initially, but then also 1.2850 after.

The longer-term charts, however, look more bullish, and suggest the possibility of eventual gains.

Starting with the shorter-term bearish case, we see a probable head and shoulders (H&S) top reversal pattern forming on the daily chart, with an as yet incomplete right shoulder.

The H&S has a neckline just below the 1.3000 level. If the exchange rate can break below the neckline on a daily closing basis, however, it will confirm more downside along the lines suggested by the pattern. This would normally be expected to move at least 61.8% of the height of the pattern lower, to a target at 1.2620.

The one obstacle to the scenario described above is the 200-day moving average (MA) situated at 1.2870. This is likely to present a hard floor to the rate after it has broken through the neckline. This will probably result in bounce back up to the neckline, before a resumption lower again. If this plays out, we would also want to see a clear break below the 200-day, confirmed by a move below 1.2850.

Another bearish factor on the daily chart is the weak and diverging RSI momentum in the lower pane. This has declined during the formation of the H&S whereas price action has, if anything, been rising slightly. The divergence is a mildly bearish sign.

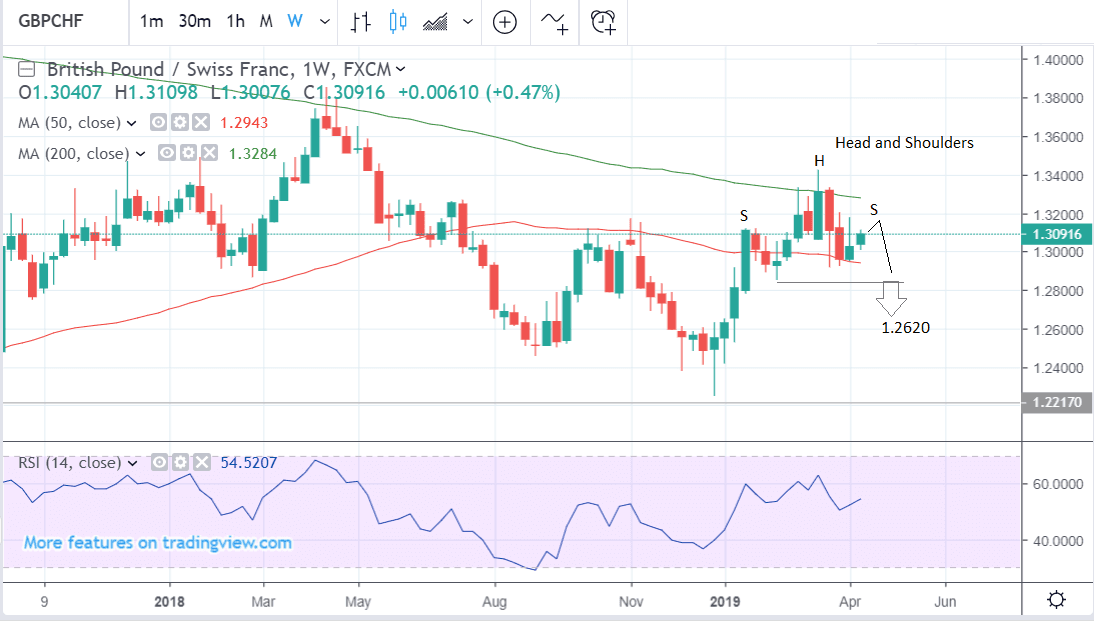

The weekly chart shows that the pair is trading between two major MA’s - the 200-week which is capping gains at the highs, and the 50-week MA, which is putting a floor under at 1.2940 under the lows.

It is overall rather neutral except for the outline of the H&S which is more clearly visible on the daily chart.

Momentum is also rather strong on the weekly chart which is necessarily favouring a forecast for more downside.

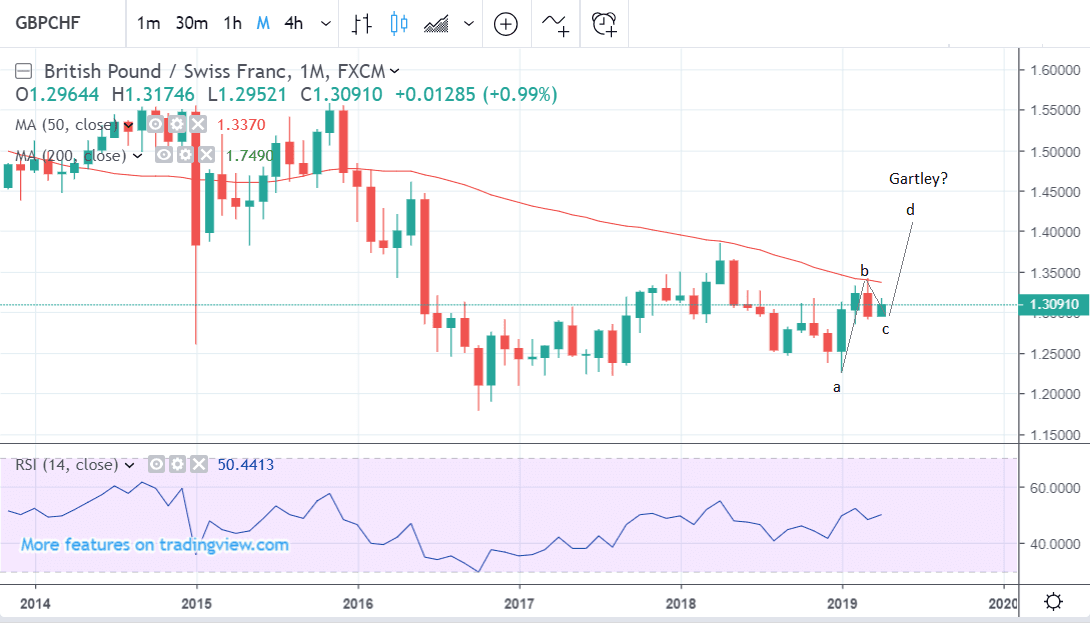

Finally, we come to the more bullish monthly chart, which is showing the pair consolidating after touching the 50-month moving average (MA).

Before then it had risen up quite strongly after basing at the early January lows. This drive higher in the early part of the year suggests the overall trend could be more constructive.

The move up could even be the first leg of an unfinished Gartley pattern, also known as an ABCD pattern. Gartley’s are essentially three-wave zig-zags in which the first and third waves are of a similar length, making them useful forecasting tools.

GBP/CHF is, in fact, forming a Gartley pattern then the third wave has yet to form but when it does it will propel the exchange rate higher, breaking above the 50-month MA in the process and potentially heralding the start of a new medium-to-longer-term uptrend.

Risk trends are going to be the most important fundamental driver of the Swiss Franc because it is a safe-haven currency which means it attracts investor capital inflows when global financial markets become turbulent.

One major source of global market risk at the moment is the potential for an escalation in the brewing tariff tensions between the U.S. and Europe.

A raft of U.S. tariffs on European goods were announced on Tuesday, targeting EU-manufactured aircraft, motorcycles, cheese and wine totalling a value of US$11bn.

The possibility of these tariffs being extended to include EU cars is a major market concern.

In a tweet overnight, U.S. President Donald Trump hinted at an escalation of a tariff war with the EU:

"Too bad that the European Union is being so tough on the United Kingdom and Brexit. The E.U. is likewise a brutal trading partner with the United States, which will change. Sometimes in life you have to let people breathe before it all comes back to bite you!"

A potential U.S.-EU tariff war could seriously impact on the global economy and lead to an increase in safe-haven flows into the Franc.

"The direction is worrisome," says Mark Matthews with Julius Baer, "what started as a dispute between the world’s two largest commercial aircraft manufacturers is now spreading to other sectors, and the European Union (EU) said it is ready to respond in kind."

"Even if we are only talking planes and agriculture, for now, tariffs on cars are likely to become an issue again soon. And that would really hurt the European economy," says Ulrich Leuchtmann, an analyst with Commerzbank in Frankfurt.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement