Pound / Canadian Dollar Week Ahead Forecast: Supported at 1.69, BoC Takes the Stage

- Written by: James Skinner

- GBP/CAD finding support near 1.6930

- May recover 1.71 on a BoC anticlimax

- BoC decision to determine CAD outlook

- After jobs & CPI lift hopes of a rate rise

Image © Adobe Stock

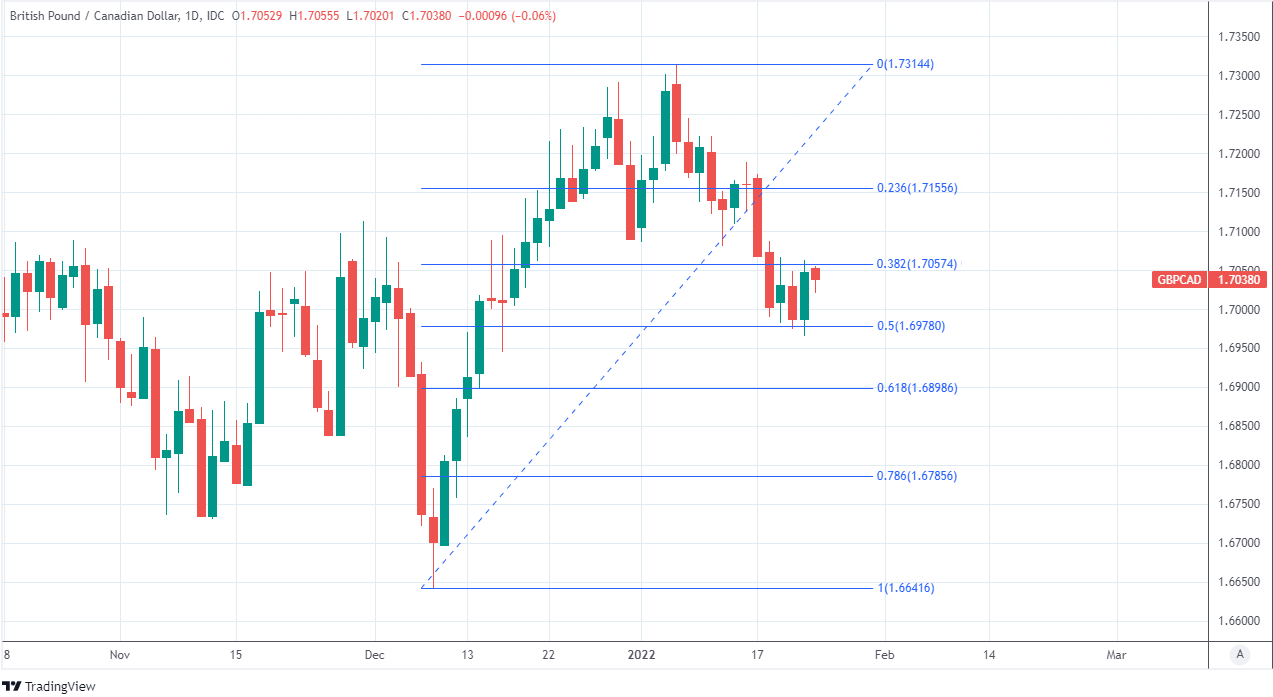

The Pound to Canadian Dollar exchange rate has reversed around half of its December rally to three-month highs but would risk slipping further toward a major support level near 1.69 this week if the Bank of Canada (BoC) surprises the market by lifting its cash rate on Wednesday.

Sterling had traded briefly above the 1.73 handle against the Loonie during the early days of January but it extended a fortnight long retreat to probe momentarily below 1.70 last week when oil prices rose sharply, leading the Canadian Dollar to outperform many major counterparts.

GBP/CAD entered the new week back above 1.70 but would be at risk of sliding back toward 1.6898 in the period ahead if on Wednesday the BoC surprises analysts and investors with a decision to lift its cash rate from 0.25% to 0.50%.

“Market pricing reflects a high degree of conviction that the BoC will pull the rate trigger Wednesday but it is not an absolute certainty (OIS reflect a roughly 70% probability of a hike). Omicron concerns could conceivably keep policy makers sidelined but a hold next week should be accompanied by a hawkish policy statement which clearly lays the groundwork for a hike in March,” says Shaun Osborne, chief FX strategist at Scotiabank.

Above: GBP/CAD at daily intervals with Fibonacci retracements of December recovery indicating likely areas of technical support.

- Reference rates at publication:

GBP to CAD spot: 1.7047 - High street bank rates (indicative): 1.6450 - 1.6570

- Payment specialist rates (indicative: 1.6894 - 1.6962

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Consensus amongst economists suggest the BoC is likely to leave its interest rate unchanged at 0.25% on Wednesday while the Bank’s own guidance from December indicated it would only be in the second quarter of this year before Canadian inflation pressures would be sufficiently strong for policymakers to feel confident that the 2% inflation target is likely to be sustainably met over the coming years.

Despite this, pricing in the overnight-index-swap market suggested strongly last week that there is a greater than 50% probability of a rate rise being announced by the BoC on Wednesday.

A notion that was not discouraged when last Wednesday’s inflation data, which showed the BoC’s three core measures of annual price growth edging further above the 2% target level.

“The BoC’s own Business Outlook Survey showed buoyant sentiment, higher-than-expected inflation, and an unemployment rate below 6%, suggesting the Canadian economy may have already closed its output gap. Taking only this into account, the BoC should hike next week,” says Thomas Flury, an FX strategist at UBS Global Wealth Management.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“That said, lockdown measures have created major uncertainty about whether these numbers are still relevant, so the BoC may wait until March or April before hiking. Should this happen, we would favor buying the CAD—particularly against the euro or the Swiss franc—if it dips following next week’s decision,” Flury and colleagues wrote in a research briefing last week.

The BoC decision is due out at 15:00 Thursday and is the highlight of the week for the Pound to Canadian Dollar exchange rate, which would come under pressure in the event of a decision to lift the cash rate but could also be likely to benefit in the event of a decision to leave rates unchanged.

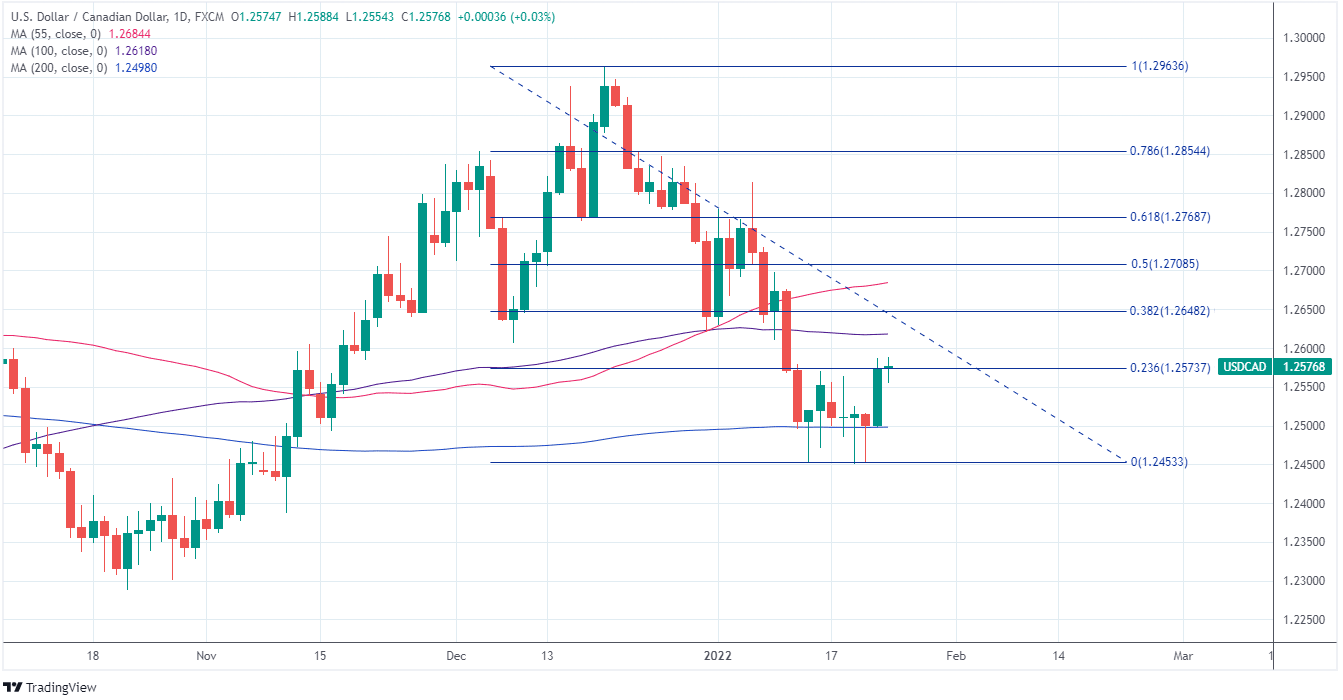

“In the event of a “hawkish hold” we think USDCAD risks edging higher to 1.2600+ (but holding below 1.2650). A “dovish hike”— that is to say a tightening accompanied by a policy statement which suggests patience on the timing of additional rate increases tightening—is perhaps the biggest risk for the CAD next week, given what is priced in and how far rate expectations have shifted,” Scotiabank’s Osborne says.

Osborne and colleagues said last Friday that a BoC decision to leave the cash rate on hold could lift the USD/CAD rate back to 1.26 or above in what would likely be a bullish outcome for GBP/CAD, which tends to closely reflect the relative performances of GBP/USD and USD/CAD but is often also seen rising alongside USD/CAD.

Above: USD/CAD at daily intervals with Fibonacci retracements of December fall indicating likely areas of technical resistance. Major moving-averages indicate technical support and resistance.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Any mid-week rally by USD/CAD back to 1.26 or above could be likely to lift the Pound to Canadian Dollar exchange rate back to 1.71 or above unless in the interim the main Sterling pair GBP/USD comes under pressure.

“USD/CAD has been testing support from the 200-day moving average which comes in at around the 1.2500-level. The main drivers for the CAD’s recent outperformance have been the sharp rebound in the price of oil and building speculation that the BoC will soon start to raise rates. It has encouraged Leveraged Funds to cut back short CAD positions recently,” says Lee Hardman, a currency analyst at MUFG.

“Overall we maintain a bullish outlook for the CAD. Our short-term regression model based on yield spreads and the price of oil is signalling that USD/CAD should be trading closer to the 1.2000-level. One headwind for further near-term CAD gains though is the risk of a deeper correction lower for risk assets,” Hardman and colleagues said in a Friday research briefing.

GBP/CAD would be vulnerable, however, to any sharp declines that occur in USD/CAD whether driven by Wednesday’s BoC policy decision or other factors like oil prices.

Wednesday’s policy decision is the main event for GBP/CAD this week although it’s set to be followed closely by the latest update from the Federal Reserve, which is widely perceived by analysts as an upside risk for the U.S. Dollar and so is potentially supportive of USD/CAD and GBP/CAD.