Pound / Canadian Dollar Week Ahead Forecast: Stalled by Resistance on Charts

- Written by: James Skinner

- GBP/CAD rally stalled by resistance near 1.2750

- Supported above 1.7037 as consolidation looms

- CA jobs, U.S. data eyed as UK calendar quietens

- BoC risks, bullish market may limit upside in Jan

Image © Adobe Stock

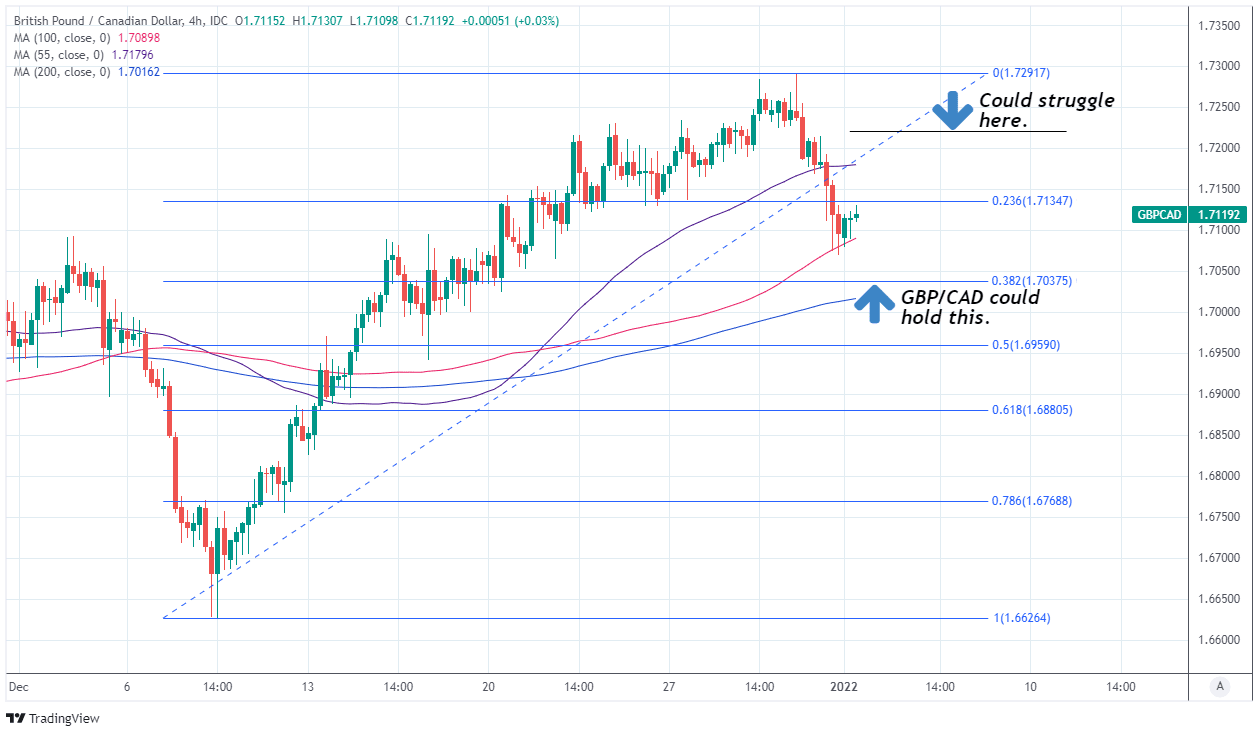

The Pound to Canadian Dollar exchange rate’s festive rally was stalled by resistance around 1.7250 on the charts before the new year and may give way to a period of consolidation over the coming days, although Sterling could also be likely to benefit from technical support in the nearby 1.7137 area.

Sterling was the best performing major currency for the final week of 2021 although its rebound against the Loonie was frustrated by a technical obstacle on the charts and had prompted GBP/CAD to retreat back beneath 1.72 in time for year-end.

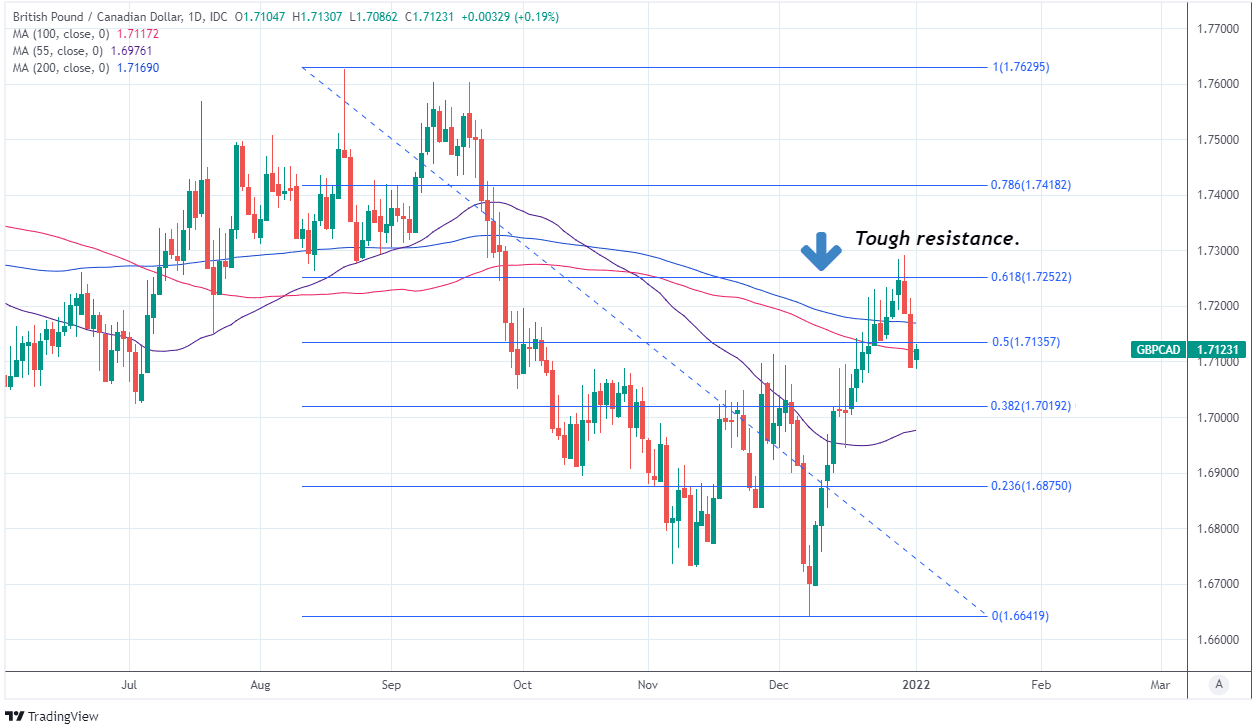

GBP/CAD lost momentum around 1.7250 and at levels that coincide closely with the 61.8% Fibonacci retracement of GBP/CAD’s September fall from above 1.76, a technical roadblock that could potentially prompt a period of consolidation for GBP/CAD this week.

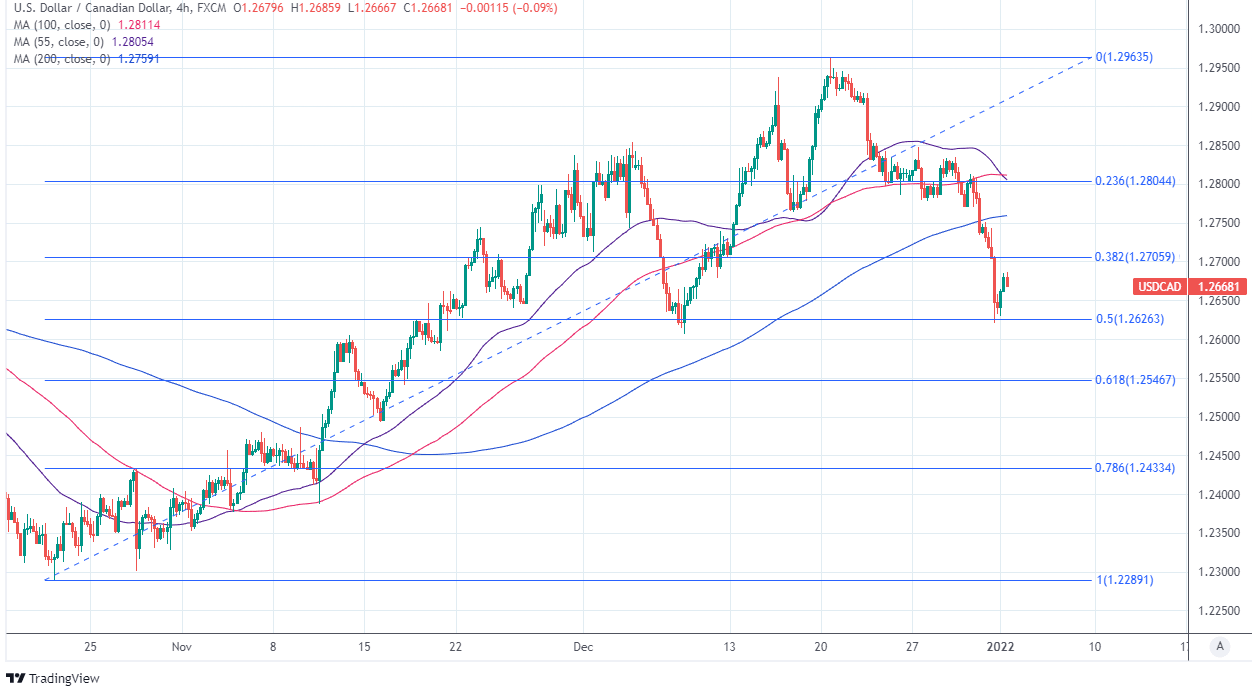

Last week’s retreat by GBP/CAD from above 1.72 coincided with an influential break lower in USD/CAD beneath 1.28, which saw the U.S. Dollar falling quickly back to its December lows near 1.26 as the Canadian Dollar rallied against many major counterparts into year-end.

“Technically, the key resistance area for USD/CAD still stands at 1.2949/52, with a daily close above it to result in an acceleration of the bullish momentum. Meanwhile, the trendline at 1.2628 serves as the pivot for our bullish view. Our 1-3 month technical target remains at 1.2950,” says Alvin Tan, chief Asia FX strategist at RBC Capital Markets.

Above: Pound-Canadian Dollar rate at 4-hour intervals with Fibonacci retracements of December recovery indicating likely areas of technical support.

- Reference rates at publication:

GBP to CAD spot: 1.7172 - High street bank rates (indicative): 1.6570 - 1.6690

- Payment specialist rates (indicative: 1.7017 - 1.7086

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Whether or not USD/CAD can sustain that break lower will be an insightful indicator of the Pound-to-Canadian Dollar outlook given that GBP/CAD always closely reflects the relative performances of USD/CAD and GBP/USD but often tends to come under pressure when USD/CAD is falling.

The GBP/CAD rate could benefit this week and in January if RBC Capital Markets is right about USD/CAD being likely to recover back to 1.29 and above in its one-month outlook, and could be likely to struggle if the breakdown in USD/CAD is sustained.

“We expect further gains to materialize in the weeks and months ahead supported by the beginning of the BoC’s quick tightening cycle,” says Shaun Osborne, chief FX strategist at Scotiabank, who looks for USD/CAD to remain under pressure in the weeks ahead.

“Next Friday’s jobs report, where economists expect a pronounced deceleration from November’s 154k gain, will inform expectations for the late-January meeting,” Osborne and colleagues said in a Friday research note.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Canadian economic data and any changes in market expectations for the Bank of Canada’s (BoC) January monetary policy decision are potential downside risks for GBP/CAD in the weeks ahead if they lead the market to anticipate an improved chance of an increase in the cash rate this month.

The BoC stuck to its guns in December when simply reiterating its earlier guidance that Canadian interest rates are unlikely to rise before the second quarter of 2022, weighing on the Canadian Dollar at the time, although there are reasons why that could change in the new year.

“Markets are currently expecting roughly four BoC hikes by the July meeting, with the first one fully price in by March though still assigning about 2/3 odds of a January hike (we expect a hold),” says Scotiabank’s Obsorne.

Canadian GDP data has recently cast the economy as stronger than the BoC expected last quarter while other figures have shown inflation pressures rising further, and in the meantime the Federal Reserve has signaled that it could lift U.S. interest rates as soon as March.

Above: USD/CAD at 4-hour intervals with major moving-averages and Fibonacci retracements of late October rally indicating possible technical support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

In addition, the Bank of England (BoE) lifted Bank Rate from 0.1% to 0.25% in December and warned that further increases could be likely in the months ahead, all of which help to make January’s BoC decision a closer call than it was last month, which is why the strategy team at Saxo Bank has a bearish outlook for the Pound-to-Canadian Dollar rate and have recommended that clients bet against it in January.

“The idea is that the omicron variant concerns will continue to fade, helping the US and Canadian economies to continue full steam ahead early in the year and for the outlook for both the Fed and BoC to shift higher relative to the outlook for the Bank of England, which the market has set about as hawkish as possible,” says John Hardy, head of FX strategy at Saxo Bank.

“As well, a clearing of omicron uncertainty and clear rebound in international travel and more constructive outlook for crude oil could give the Canadian dollar an additional boost,” Hardy and colleagues said in a briefing to clients last week.

Canadian employment data due out this Friday and the inflation figures expected on January 19 are the key appointments for the Loonie and Pound-to-Canadian Dollar rate ahead of the BoC decision in late January, with the Canadian currency likely benefiting from upside surprises.

In the meantime, a quiet economic calendar in the UK and Canada likely leaves GBP/CAD taking its cues from the broader mood and trends in global markets as well as from the U.S. Dollar’s response to an action-packed U.S. calendar.

Above: Pound-Canadian Dollar rate at daily intervals with Fibonacci retracements of September decline indicating likely areas of technical resistance.