CIBC Temper Canadian Dollar Forecasts for 2022

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar is forecast to start 2022 "with a whimper" by the Canadian Imperial Bank of Commerce (CIBC), one of Canada's 'big five' banks.

But weakness in the currency could peak at 1.32 USD/CAD in the third quarter of 2022 before recovering, although for GBP/CAD forecasts show Sterling would be ascendent in the second half of 2022.

CIBC - a lender and investment bank with over 11 million clients worldwide - says the Canadian Dollar's strong 2021 performance has recently been undermined by the arrival of Omicron, which puts a January rate hike at the Bank of Canada in jeopardy.

"The loonie was on a rollercoaster at the onset of the discovery of the omicron variant but has since come full circle, and is sitting marginally weaker," says Katherine Judge, Director & Senior Economist at CIBC Capital Markets.

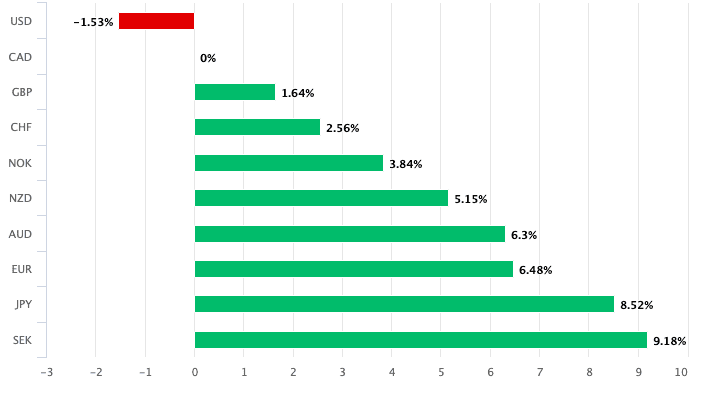

Above: The Canadian Dollar is the second-best performing major currency of 2022.

- Reference rates at publication:

GBP to CAD spot: 1.7085 - High street bank rates (indicative): 1.6487 - 1.6607

- Payment specialist rates (indicative: 1.6965 - 1.7000

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar remains one of 2021's top performing major currencies, having been bolstered by the Canadian economy's strong economic rebound that is in part thanks to the country's proximity and close trade ties with the stimulus-fuelled U.S.

The strong data has allowed for the Bank of Canada (BoC) to rapidly ease back on its Covid pandemic support and point to the need for higher interest rates in the future, dynamics which are supportive of the currency.

Furthermore, a surge in oil prices over 2021 has improved the country's terms of trade given the importance of Canadian oil exports to exports.

But, in a monthly currency update CIBC says the economy will suffer a slowdown linked to the Omicron variant which is tipped to set back services employment and ensure weak first-quarter GDP growth.

However, CIBC do see demand "roaring back once this wave passes".

CIBC anticipates the BoC to proceed with 150 basis points worth of rate hikes in the next two years, divided equally between 2022 and 2023.

But Judge says the foreign exchange market is not prepared for the scale and pace of interest rate hikes at the Federal Reserve, which should deliver yet further U.S. Dollar outperformance in early 2022.

They anticipate the Fed to hike rates in the second quarter of 2022, at which point markets will move to price in yet further Fed action, pushing USD/CAD to 1.32 in the third quarter of 2022.

"Also weighing on the loonie in early 2022 will be a lack of upside in commodities. Demand for oil will be hampered in the near term by the spread of omicron globally," says Judge.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But by late 2022 CIBC expects to see "a shift in the tides for the loonie" - this as the market prices in a more aggressive Federal Reserve policy post-2022.

The broad trend in the USD could therefore be towards depreciation of the Dollar as other advanced economy central banks move to normalise rates.

The U.S. Dollar to Canadian Dollar exchange rate is forecast at 1.29 by the end of the first quarter, 1.30 by the end of the second quarter, 1.32 by the end of the third quarter and 1.31 by the end of 2022.

The Pound is meanwhile anticipated to fall over coming weeks but then outpace the Canadian Dollar's own recovery against the U.S. Dollar later in 2022.

As such CIBC forecast the Pound to Canadian Dollar exchange rate at 1.69 by the end of the first quarter, 1.68 by the end of the second quarter, 1.72 by the end of the third quarter and 1.73 by year-end 2022.

The Euro to Canadian Dollar exchange rate is forecast 1.43, 1.43, 1.45 and 1.44 for the above time points.