Australian Dollar Week Ahead Forecast: GBPAUD Well Supported, AUDUSD Tipped for Upside

- Written by: Gary Howes

- GBPAUD to stay well supported

- AUDUSD tipped to see some upside short-term

- Aussie jobs data forms domestic highlight

- AUD to be buffeted by Fed midweek

Image © Adobe Images

The Australian Dollar is tipped to see some upside against the U.S. Dollar but should prove unable to make any major advance against the Pound in a week dominated by the U.S. Federal Reserve decision, Bank of England and Australian jobs data.

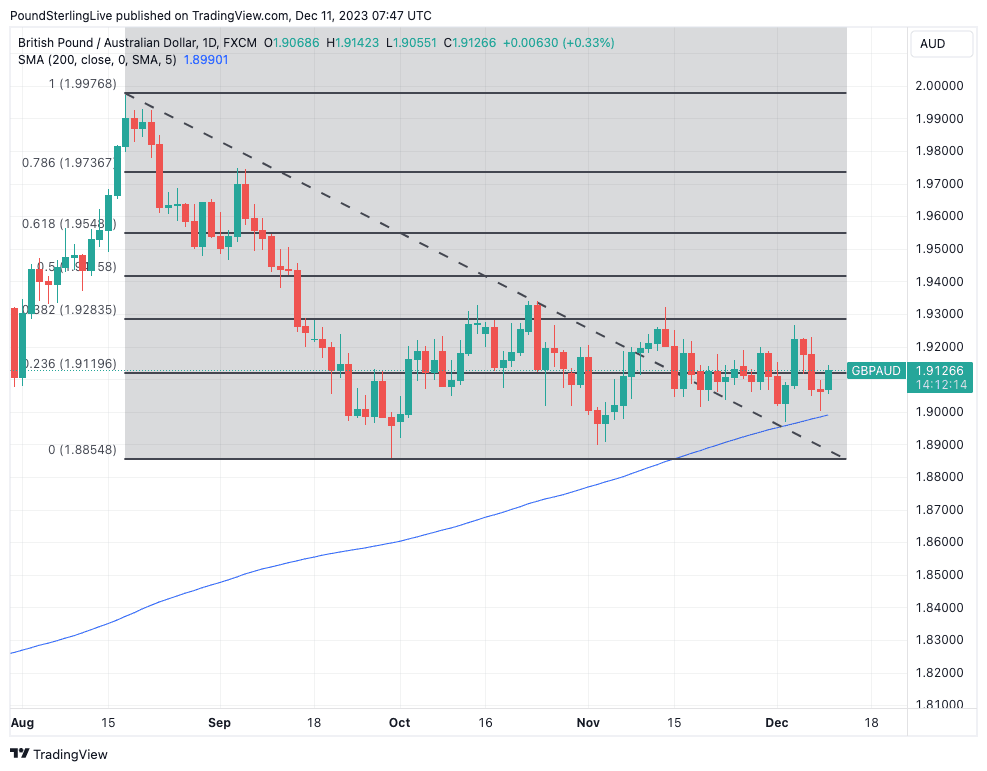

The Pound to Australian Dollar exchange rate (GBPAUD) remains well contained in its recent ranges, with the 1.9111 level (Fibonacci retracement of 23.6% of the August-September decline) acting as a fulcrum.

As the below shows, the pair is hugging this area, making for a fairly predictable exchange rate and we struggle to see any calendar events that could break the impasse:

Above GBPAUD at daily intervals with Fibonacci levels annotated. Track AUD with your own custom rate alerts. Set Up Here.

Any disappointments to the Aussie over the coming days would result in GBPAUD rallying back towards the resistance at 1.9283, which forms the 38.2% Fibonacci retracement and has acted as a solid reference for the topside in GBPAUD since October.

Moves beyond here remain a big ask and not something we would position for the near term.

Should this week's Australian labour market report beat expectations, or the Bank of England result in Pound Sterling weakness, GBPAUD weakness could extend to support at the 200-day moving average, currently located at 1.8990.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The 200 DMA is denoted by the blue line in the above chart, and as we can see, it has provided some support on two occasions recently, which suggests the downside is limited from here.

But, those watching GBPAUD should be aware of any break below the 200 DMA on a sustained basis as this would signal a major trend change, in favour of GBPAUD weakness, was underway.

The Bank of England is just one event in a busy calendar week for the Pound; those watching GBPAUD can see what else to expect from the UK here.

Meanwhile, the Australian dollar is tipped to be well supported over the coming days by Kristina Clifton, a foreign exchange strategist at Commonwealth Bank.

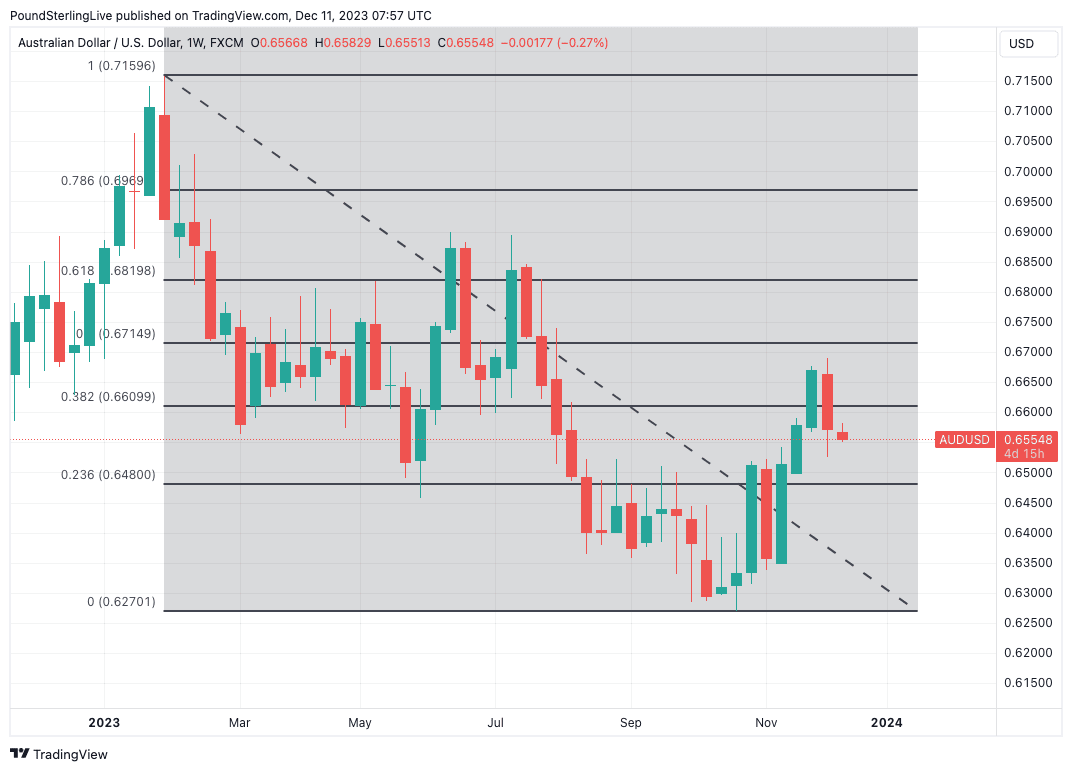

"AUD/USD can track higher this week, possibly through 0.6714 resistance (50% fibbo). The resilience of the Australian labour force in November may provide some support to AUD/USD," says Clifton.

Above: AUDUSD at weekly intervals showing 2023 price action and the 50% fibbo line mentioned by the above analysis.

However, Commonwealth Bank expects limited upside to AUD and Australian interest rates while CPI inflation is softening and market pricing for other central banks’ policy rates has shifted strongly to rate cuts in early 2024.

Accordingly, any strength in the Aussie is likely to have a limited shelf life. Much will depend on the foreign exchange market's key event of the week: the Federal Reserve decision.

Markets are not expecting any change to U.S. interest rates, but the guidance from the Fed and Chair Jerome Powell's commentary will be crucial.

"If the Aussie is to make another run at resistance at 0.6723 (1 August high), it looks to be increasingly reliant on the FOMC delivering an even more dovish pivot than seems to be already priced in. Otherwise, we could see consolidation with most trade in the 0.6500-0.6650 region," says Martin Whetton, a strategist at Westpac.

Market expectations for Fed rate cuts in 2024 have recently risen, weighing on the U.S. Dollar through November and prompting a rebound in the risk-sensitive Aussie Dollar.

Track AUD with your own custom rate alerts. Set Up Here.

But the U.S. Dollar rebounded on Friday following a stronger-than-expected labour market report, serving as a reminder that the U.S. economy can continue to surprise. It also serves as a warning the Fed might push back against recent rate cut expectations, raising the potential for the Fed to undermine the Australian Dollar.

Don't forget that the Australian Dollar is highly sensitive to global sentiment, not just against the U.S. Dollar but against most other G10 currencies, meaning any 'hawkish' Fed event could broadly undermine the Aussie.

In Australia this week, the Westpac–MI Consumer Sentiment will be watched on Tuesday, but Thursday's employment release will likely have the biggest market impact.

The market looks for Australia to have added 10K jobs in November, which would be lower than the 55K added in October. The unemployment rate is anticipated to have notched up to 3.8% in November from 3.7% in October.

Should the data come in firmer, the Aussie can catch a bid. Expecting such an outcome are the economists at Westpac:

"Our above consensus forecast for a 25k lift in employment speaks to the fact that employment’s momentum continues to outpace expectations, and we think that will remain the case over the near–term."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes