Australian Dollar Week Ahead: Forecasting Further Strength

- Written by: Gary Howes

- AUD in strong start to the week

- Supported by global factors

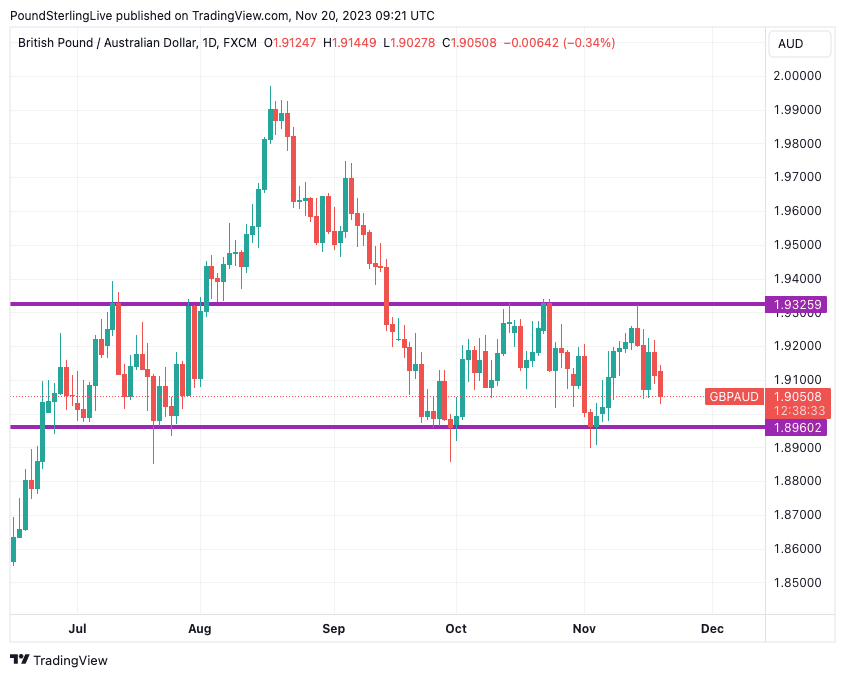

- GBPAUD eyes move to 1.8960

- AUDUSD to test 0.6600

Image © Adobe Images

A benign global sentiment and rising stock markets provide the backdrop for further Australian Dollar gains over the coming days.

The Australian Dollar is stronger against all its major peers - apart from the NZ Dollar - at the start of the new week, and with little interest on the U.S., Chinese or Australian calendars over the coming days, further gains are possible.

Gains for the currency come alongside a rally in Chinese equity markets, confirming the importance of the global backdrop for the Aussie Dollar.

"November is shaping up to become the best month for risk assets this year in what investors have called a brought-forward Santa Claus rally," says Boris Kovacevic, Global Macro Strategist at Convera.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"AUD/USD lifted during the Asian session and is currently trading near 0.6550. A heavy USD amid pricing for a soft landing supports 'risk currencies' such as AUD," says Kristina Clifton, a strategist at Commonwealth Bank of Australia.

"With few major events scheduled, market pricing for a 'soft landing' in the U.S. is likely to remain unchanged this week. Low implied volatility, tight credit spreads, elevated equity markets, and pricing for only 100bp of rate cuts by the FOMC provide an environment for the USD to weaken further for now," she adds.

The Australian Dollar to U.S. Dollar exchange rate is higher by two-thirds of a per cent at 0.6555, the Pound to Australian Dollar exchange rate is lower by 0.40% at 1.9050, and the Euro-Australian dollar rate is at 1.6662.

Track AUD with your own custom rate alerts. Set Up Here.

Commonwealth Bank's strategists say AUD/USD will face resistance as it approaches 0.6600 (which technical charting from CBA shows to be the junction of the 200-day moving average and the 38.2% Fibonacci).

"Low implied volatility, tight credit spreads, elevated equity markets, and pricing for only 100bp of rate cuts by the FOMC provide an environment for the USD to weaken further for now," adds Clifton.

The Pound to Australian Dollar exchange rate looks set for a retest of the lower bound of its September-November range amidst any further AUD strength linked to an extension of the benign global backdrop.

Support at 1.8960 forms the downside target, which is easily achievable this week; however, breaks below here could be difficult to sustain given the apparently strong levels of support in the region.

Above: GBPAUD at daily intervals showing the constraints of a well-understood range.

Although this week is light in terms of data from the U.S., China and Australia, there is interest from the UK, which suggests some GBP-derived moves in GBPAUD.

Interest comes with the Autumn Statement on Wednesday, which should see the government lay out updated tax and spending plans.

Such budget announcements can considerably impact the Pound's value, which fell to near-record lows just over a year ago when Liz Truss's government delivered its ill-fated mini-budget.

Both the Pound and Truss fell as markets fretted about the ability of the UK to pay for the hefty tax cuts and spending increases the new government proposed.

But, the era of Sunak and Hunt is a more considered one that places sustainable finance at its heart, and for this reason, we see very low odds of a major decline in the Pound following 2023's Autumn Statement.

The Pound could benefit if the government convinces markets it has done enough to boost UK productivity, and GBPAUD could then be flipped onto a path that could see it retest 1.9325.

"Speculation has built around a cut in inheritance tax. And extending corporation tax full expensing, which is currently due to end in 2026, looks likely, in conjunction with other measures to boost investment," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Thursday sees the release of the PMI survey for October at 09:30 GMT, and we expect Pound exchange rates to move on any surprises.

The S&P Global/CIPS manufacturing November PMI is forecast at 45.0 in November, up from 44.8 in October. Services are expected at 49.6, largely unchanged on October's 49.5. The headline Composite PMI is expected at 48.8, also marginally unchanged from 48.7 previously.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes