HSBC: Buy Australian Dollars

Image © Adobe Stock

- GBP/AUD spot rate at publication: 1.7449

- Bank transfer rate guide: 1.6840-1.6960

- Independent provider rate guide: 1.7360

- Find out more about better exchange rates here

Foreign exchange strategists at HSBC have recommended buying the Australian Dollar on the expectation that further gains for the antipodean currency to gain exposure to the global economic recovery and rising commodity prices.

In a client briefing out on Wednesday, Jan. 06, HSBC strategist Paul Mackel says his team are recommending a buy on AUD/CHF, with an expectation the exchange rate can rally towards 0.7150.

Mackel, who is HSBC's Global Head of FX Research, says "we like the AUD due to its high beta to the global growth recovery and rising commodity prices."

By contrast, HSBC strategists are are less upbeat on the Swiss Franc due to its “safe haven” status and Switzerland's struggle to generate upside inflation which means the prospect of the Swiss National Bank (SNB) raising interest rates from below 0% is remote.

In short, HSBC are recommending a reflation trade that has become the consensus market position ever since investors started to believe 2021 would see the covid-19 crisis come to an end, allowing for a global economic recovery.

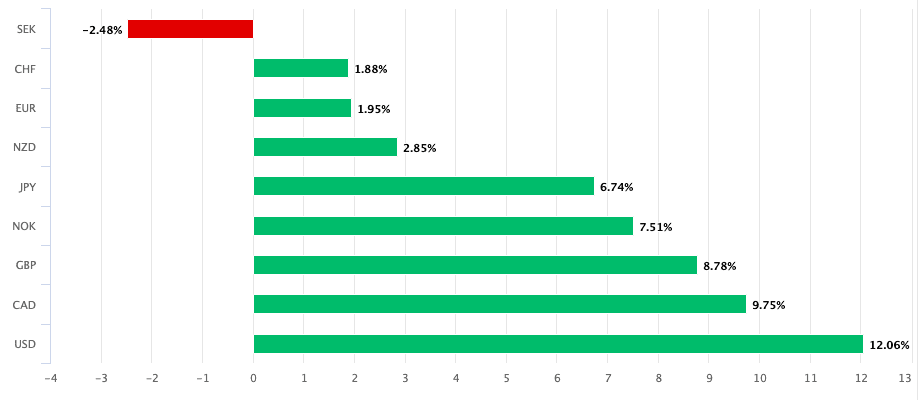

The Australian Dollar has performed strongly across a number of timeframes: over the course of the past year it has rallied against all its G10 peers apart from the Swedish Krona. It recorded an advance of 12% against the U.S. Dollar and a 8.90% gain on the Pound.

Over the past month it has outperformed all G10 peers, notching up a 5.0% gain on the U.S. Dollar and a 3.40% gain on the Pound.

Despite the impressive gains on multiple timeframes, HSBC strategists say there is more to come.

"2021 has started with broader ‘risk-on’ sentiment and we think this will likely continue," says Mackel.

"Fiscal and monetary policies are slated to stay accommodative as economies recover from the impact of the pandemic, and any near-term downward sentiment from renewed virus spreads currently looks to be offset by vaccine rollouts. Thus, positive risk sentiment looks likely to remain in place and in our view, long AUD-CHF is the best way to express this in G10 FX," he adds.

HSBC expect the Franc to underperform, as a global recovery underway will likely see demand for 'safe havens' dry up.

"While the CHF benefited from this status in 2020, this may not sustain in 2021 and the foreign flows that have propped up the CHF thus far are unlikely to continue," says Mackel.

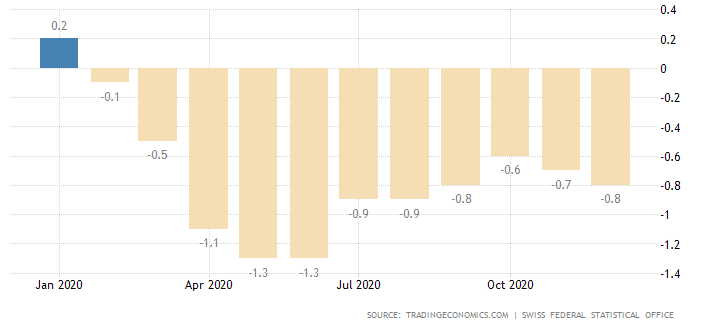

Switzerland meanwhile has something of a deflation problem, with the country recording negative rates of inflation in all but one month of 2020.

Above: Swiss deflation in 2020, image courtesy of TradingEconomics.

The fall in prices means that the SNB's attempt to reflate the economy via negative interest rates is not having the desired effect. While cutting interest rates further will unlikely shift the dial, most economists are of the view raising interest rates is a remote possibility.

"Domestic economic struggles to generate inflation imply that ultra-loose monetary policy will persist in the months, if not years ahead, providing little policy support for the currency. Even if the CHF does unexpectedly strengthen, it is likely that FX intervention by the SNB will curb excess strength, given the inflation panorama," says Mackel.

Research courtesy of FXwatcher.com

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}