Australian Dollar Forecast to Dip Again at NAB

- AUD tipped to fade recent recovery

- Return of investor anxieties linked to covid-19 expected

- The key issues to watch this week

- Consensus bank forecasts for GBP/AUD now ready for download at Global Reach

Image © Adobe Images

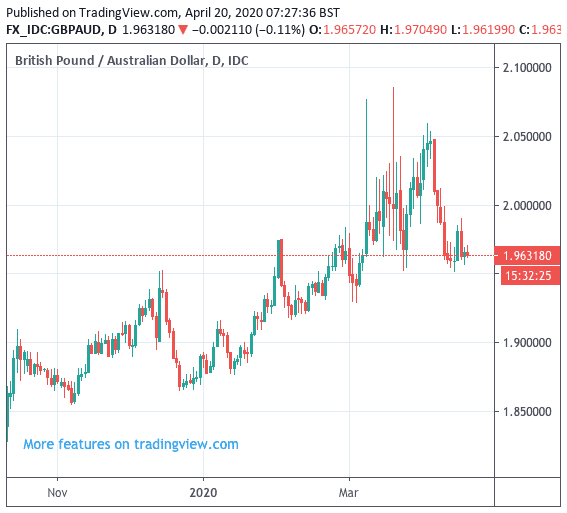

- GBP/AUD market rate: 1.9617

- Bank transfer rates (indicative): 1.8930-1.9068

- FX specialist transfer rates (indicative): 1.9159-1.9440 >> More information

The Australian Dollar's recent three-week rally against the likes of the U.S. Dollar, Euro and British Pound could be at risk of capitulating, if the expectations of analysts at Australian lender NAB are proven correct.

In a note to clients, analysts at NAB's economic research department say the Australian Dollar's recent rally owes itself to a stabilisation in both investor sentiment and rising commodity prices, but "the risk of a reality check" looms.

"The risk of a reality check from incoming corporate earnings and guidance, and the likely duration of Covid-19 containment strategies, suggest the AUD is at risk of a drop back below 0.60 during Q2," says Ray Attrill, Head of FX Strategy at NAB in Sydney.

The Australian Dollar-U.S. Dollar exchange rate sunk to its lowest level since 2002 at 0.5509 on March 19 as a market meltdown, owing to the rapid global spread of covid-19, saw investors sell Australian Dollar exposure and opt for the relative safety of the U.S. Dollar.

But the liquidation in AUD-based assets also saw the currency fall against the Euro and Pound, with the Pound-to-Australian Dollar exchange rate rallying to 2.0852 and the Euro-to-Australian Dollar to 1.9808 during this period.

Above: Monthly AUD/USD chart showing long-term lows in AUD value

March 19 proved to be something of a turning point for markets as the U.S. Federal Reserve announced measures to increase the supply of dollars into the global economy via swap lines with other central banks. This stabilised demand for dollars and further calmed markets, which in turn allowed currencies such as the Australian Dollar to recover.

"Its subsequent sharp recovery owes much to both the recovery in risk sentiment and some key commodity prices," says Attrill.

The AUD/USD exchange rate has since recovered back to 0.6344, GBP/AUD has faded back to 1.9632 and EUR/AUD to 1.7088.

Above: Daily GBP/AUD chart showing recent AUD recovery

Attrill says that more puzzling to many than the sharp fall in the Australian Dollar was the sharp recovery, which risked the currency looking 'stretched' on NAB's short-term fair value models.

Concerning the outlook, NAB can't be confident that the March lows in the Australian Dollar will not be reached once more; "risk of a swift return to test the March lows is much reduced," says Attrill, "yet when we think about AUD's fall and rise in terms, principally of swings in risk sentiment, we aren't so confident".

The outlook for the Australian Dollar therefore ultimately rests largely on whether another episode of 'risk off' market sentiment transpires once more.

"If the apparent market confidence that a lifting of lockdowns within the next few weeks will occur and be the 'end of it' as far as infection curves go proves misplaced, then at least a partial reversal in risk sentiment is to be expected," says Attrill.

Aussie Dollar this Week

Turning to the immediate outlook for the Australian currency, it is little wonder that most market analysts are focussing on global conditions as being the ultimate driver of shifts in value.

"While not a high conviction call, this week we anticipate poor economic data around the world will steal the spotlight. We also expect US corporate earnings reports will reinforce the bleak economic outlook. As a result, we expect the USD to lift this week," says Joseph Capurso, foreign exchange strategist with Commonwealth Bank of Australia (CBA).

CBA expect the "Great Lockdown" to send the US economy into its deepest contraction since 1946 and see U.S. economic data deteriorating further this week.

Any downshift in investor sentiment linked to disappointment here will likely weigh on the Australian Dollar.

CBA expect the April Markit PMIs to plumb to new cyclical lows when numbers are released on Thursday.

Also on Thursday watch initial jobless claims which will be in focus because this week’s instalment will cover the survey period for non‑farm payrolls.

"AUD/USD upside will be capped if market attention turns to the deteriorating global economic outlook as we expect," says Capurso.

Domestically, Reserve Bank of Australia Governor Lowe provides an economic and financial market update on Tuesday.

"Any comment by the RBA on the economic impact of the coronavirus on Australia and the RBA’s continued asset‑purchasing programme will be closely watched by the market," says Capurso.