Week Ahead Pound-Australian Dollar Rate Forecast: Short-term Favours AUD, Coronavirus Developments Key

- GBP/AUD short-term weakness likely

- PBoC intervention boosts AUD

- Slowdown in coronavirus infections adds to AUD strength

- RBA to be longer-term drag say analysts

Image © Adobe Images

- Spot GBP/AUD at time of publication: 1.9263 -0.30%

- Bank transfer rates (indicative): 1.8594-1.8728

- Specialist transfer rates (indicative): 1.8950-1.9095 >> Find out more

The Pound-to-Australian Dollar exchange rate is pointed lower in the near-term - a timeframe we define as the coming week - but how the pair evolves over coming days ultimately depends on news flow out of China concerning developments regarding the neo-coronavirus outbreak.

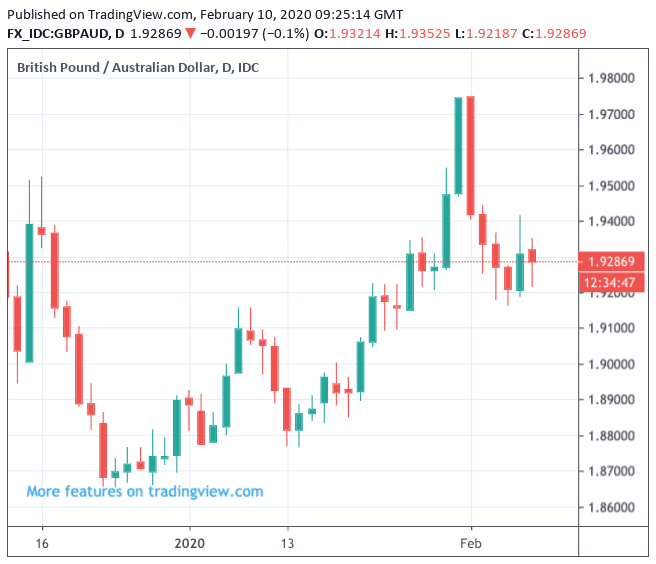

Sterling has fallen against the Australian Dollar in four of the past five days, price action that suggests short-term momentum has swung back in favour of the Aussie.

However it is difficult to get a decisive handle on where the GBP/AUD exchange rate might travel over coming days as the pair is so heavily influenced by global investor sentiment towards the coronavirus outbreak. In short, this is likely to be a headline driven exchange rate.

Monday sees the exchange rate falling back again to 1.9253 as the AUD "outperformed in the Asia session," says Kim Mundy, FX strategist with Commonwealth Bank of Australia. Mundy says the outperformance comes amidst news of "further further targeted PBoC easing and news reports that some Chinese production would re‑start."

China is Australia's largest trading partner and the country's exposure to developments in the Chinese economy mean the Australian Dollar often trades as a proxy to sentiment towards China. "AUD upside will remain limited while there is ongoing uncertainty around the coronavirus, and its subsequent dampening impact on the Chinese and global economy," says Mundy.

Above: GBP/AUD charts suggests Sterling has lost upside momentum

The general reaction function of the Aussie is to fall when markets grow nervous of the coronavirus while it rises when fears subside. News that the Peoples Bank of China (PBoC) is stepping up support measures to dampen the economic impact of the virus is therefore on balance supportive of the Australian Dollar.

The PBoC will reportedly start issuing loans totalling 300 billion yuan via its re-lending programme as part of measures to help businesses impacted by the coronavirus outbreak.

Bloomberg reports the central bank will provide the first batch of special re-lending funds on Monday and will offer the facility weekly to banks later this month.

Under the funding facility, nine major national banks and some local banks in ten provinces and cities are qualified for the special funding, according to PBoC Deputy Governor Liu Guoqiang.

Further aiding sentiment is news that major firms are to start production again following an extended Chinese new year holiday period aimed at restricting the movement of people. "Risk markets have developed a mild recovery on the back of continued Chinese stimulus to the economy to combat the effects of the coronavirus, along with reports that a number of major manufacturers, including Sony and Apple, have been given the green light by Chinese authorities to resume production," says Robin Wilkin, Cross-Asset Strategist with Lloyds Bank.

"Many Chinese firms have instructed their employees to return to work today, sparking a rise in Chinese stocks, the Yuan, and the Australian Dollar," says Joshua Mahony, Senior Market Analyst at IG. "This relief may be a little premature given the lack of any progress in reversing the course of the coronavirus. With the death count in in the Hubei province alone topping 900, there is a fear that many remain unaccounted for in both China and further afield. While a rise in business activity certainly lessens the potential economic impact of this crisis, it will also likely heighten the rate of infection going forward."

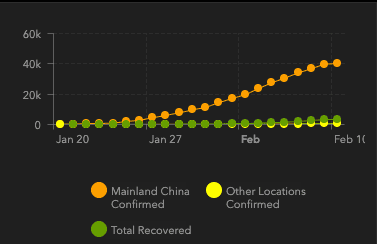

Meanwhile, data out of China concerning the spread of the virus confirms that the infection rate remains on a downward trajectory.

"AUD is outperforming in moderately risk-on markets overnight. The pace of increase of reported Coronavirus cases continued to slow over the weekend, with the rate of daily increase falling to 8% from 10-20% over the last week," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Johns Hopkins CSSE reports that the total confirmed cases stand at 40561 as of Monday, with 910 deaths recorded and 3436 recoveries.

Image courtesy of Johns Hopkins CSSE

The above graphic shows the rate of increase in confirmed cases is starting to flatten out, in line with last week's expectations for such an outcome to transpire. It is in this environment that the Aussie Dollar is recovering and we would expect further GBP/AUD underperformance as a result.

However, the currency still has some distance to travel before it overturns the declines it has recorded against a suite of currencies in 2020.

"The Australian dollar is the worst performer in the G10 space since the news around the coronavirus came out and has just touched its weakest level vs USD since 2009," says Chris Turner, Global Head of Strategy at ING Bank in London. "Not even the surprisingly upbeat tone by the RBA has been able to turn the tide for the AUD, which is still suffering from its high exposure to China, commodities and global risks in general."

Turner says there is a lack of domestic data releases that could inform trading in the Aussie Dollar, as such "the coronavirus will be once again the primary driver of currency movements."

Looking further ahead, ING Bank continue to expect the Australian Dollar to underperform its "pro-cyclical peers if sentiment remains choppy".

The obvious risk were are interpreting here is that the coronavirus saga drags on and leaves a lasting and material impact on the Chinese economy, which will ultimately feed through to lower demand for Australian exports.

ING Bank are however also seeing "a bigger deal of downside risk as we expect an RBA cut in the next months", in addition Turner and his team "also see the bushfire emergency add idiosyncratic downside risk."

"The ongoing economic impact of the Australian bushfires and Australian drought will also limit AUD upside," adds CBA's Mundy.

The Reserve Bank of Australia (RBA) last week opted to keep interest rates on hold at 0.75%, while issuing an upbeat assessment about the outlook for the economy.

The upbeat tone was cited as being behind the Australian Dollar's rally that came in the wake of the February RBA meeting and contributed to the overall strength of the currency last week. However, a number of analysts we follow suggest the RBA's upbeat tone struck as being out of kilter with the reality on the ground.

In particular, there is a feeling the RBA has underestimated the impact of the coronavirus and therefore further cuts to the interest rate might be needed in the future.

"The RBA have hilariously used their Statement on Monetary Policy this morning to make clear that rates are on hold right now, and that further rate cuts could do more harm than good with only two left in the can before QE has to start. I always guessed these guys spent all day on the Domain.com property website, but the timing is pure black comedy, as is their call that the unemployment rate will be going down and not up just as Chinese tourism collapses," says Michael Every, Senior Strategist for Asia-Pacific at Rabobank.

The general rule of thumb is that when a central bank cuts its interest rates, the currency it issues declines in value.

Therefore if the RBA does have to row back on its current view and start sending out messages that another interest rate cut is required in coming months, we would expect to see AUD weakness and the GBP/AUD exchange rate to start pointing higher.