Hedge Funds in 'Aggressive' GBP Buying Spree

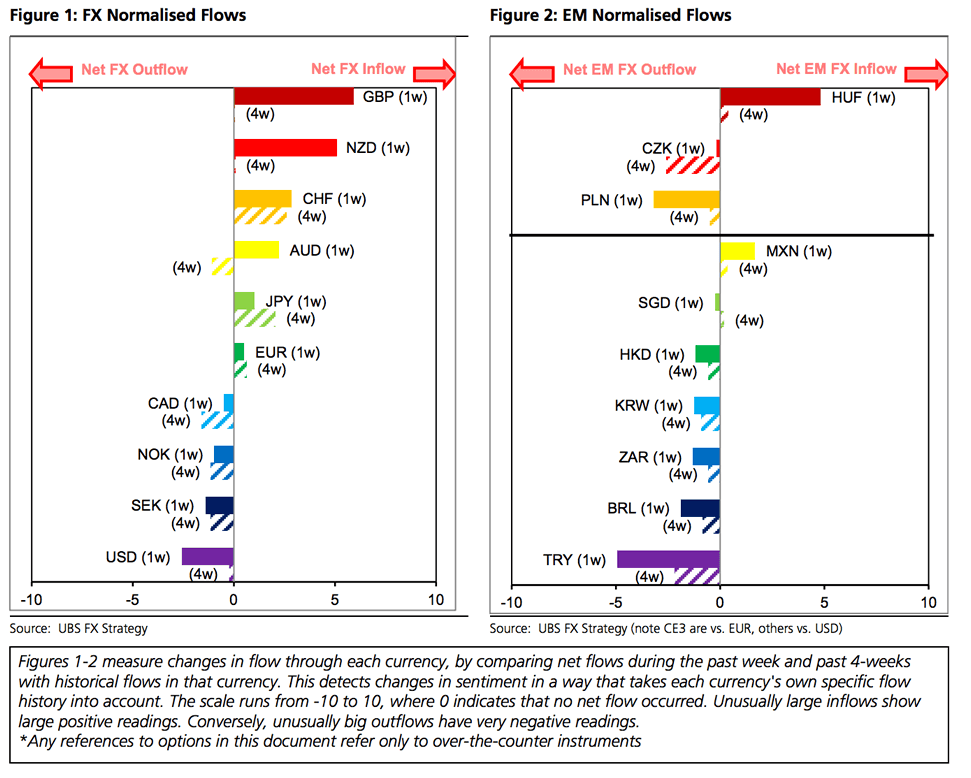

Latest data concerning the flows of foreign currency shows the British pound has been subject to ‘aggressive’ buying.

UBS report that sterling recording its strongest net inflow in more than three years during the week end 19th of May.

“Around half of GBP net inflows came on Wednesday, as some EU referendum polls showed signals in favour of the remain campaign and GBPUSD rallied two big figures as market expectations shifted,” says Jeremy Chandler, a strategist with UBS Global Research.

“Asset managers and hedge funds were strong GBPUSD buyers, largely accounting for the entire flow, while corporates and private clients showed little directionality,” says Chandler.

EURGBP was sold on the whole, with hedge funds and asset managers again leading the GBP inflows

The surge in demand saw many GBP currency pairs looking overbought and prone to a correction.

Price action in the week beginning 23rd of May has confirmed demand has indeed waned as these overbought conditions are correcting.

The USD was net sold throughout the week, despite a rally in the DXY driven by increased Fed tightening expectations for this year.

EURUSD was bought for a third consecutive week despite the EUR to USD exchange rate declining. All client categories were net buyers with hedge funds leading the inflows.

Data shows NZD also saw very strong net inflows (the highest in 9 months), with AUD following closely behind, while the CHF continued a strong run of inflows now spanning 7-weeks in a row.

According to UBS the demand for NZD was largely driven by hedge funds. AUDUSD saw decent buying, with hedge funds again accounting for the majority of the net-inflows, while other UBS clients showed modest buying interest.

In EM, TRY and PLN both saw strong sellers, while HUF received strong inflows.