Pound Sterling's Recovery Narrative Intact: CIBC

- Written by: Gary Howes

- Ramsden not ready to signal imminent rate hikes

- On day it's reported UK food inflation is falling sharply

- This can boost consumer strength

- Which is supportive of GBP says CIBC

Image © Adobe Images

Falling food prices point to easing pressures on households, which can support the UK's consumer-reliant economy and the British Pound say analysts.

The Pound continues to respect well-trodden levels, but a number of analysts we follow hold a view that when a breakout does occur, it will likely be to the topside.

Aiding this expectation is an improving UK economic outlook, underscored by falling inflation and improving consumer confidence. Fresh evidence of inflation's steady demise comes from the British Retail Consortium (BRC), which reports that shop price inflation has retreated to the lowest level since March 2022 when it printed at 2.5% year-on-year in February.

"There was good news for consumers as shop price inflation fell to its lowest rate in nearly two years," says Helen Dickinson, Chief Executive at the British Retail Consortium.

The BRC says the key to the price correction was a continued moderation in food price inflation as annual prices moderated from 19.1% y/y in March 2023 to 5.0%.

According to analysis from CIBC Capital Markets, the data could have implications for Pound Sterling. "While the BRC shop price correction does not change our Bank of England presumption, it does support the consumer as real earnings continue to move higher. Given the importance of consumer sentiment/spending to the growth dynamic, the BRC correction should further support the GBP recovery narrative," says Jeremy Stretch, an analyst at CIBC Capital Markets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

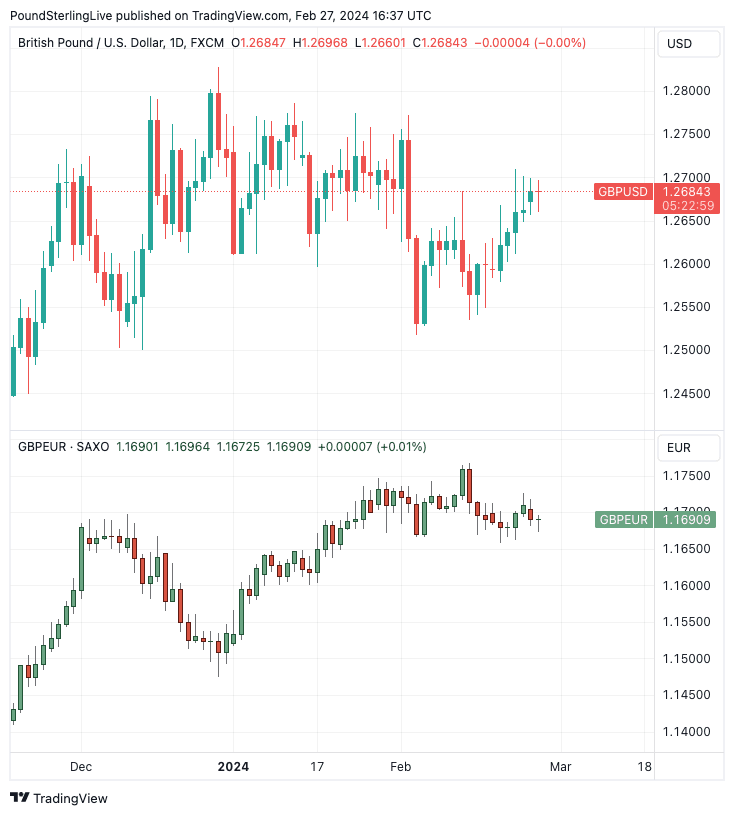

The Pound to Euro exchange rate maintains a hold on the 1.17 area while the Pound to Dollar exchange rate has edged higher over the course of recent days and could soon be on course to test 1.27.

Analysts say the Pound can remain supported in the medium term amidst expectations the Bank of England will hold interest rates at 5.25% for an extended period and would likely only cut after the European Central Bank and U.S. Federal Reserve.

Despite the food price correction, CIBC continues to anticipate the Bank of England will remain reluctant to cut until at least August as wage dynamics and service price pressures remain inconsistent with a durable attainment of the 2% inflation target.

"The BoE is likely to cut rates later, starting in August at the earliest. With that, rate differentials remain supportive for the pound," says David Alexander Meier, an analyst at Julius Baer.

Analysts at Julius Baer recently upgraded their three-month outlook for the Pound against the Euro, seeing EUR/GBP at the lower end of its long-running range at 0.85, which equates with a pound to euro exchange rate of 1.1765.

Above: GBP/USD (top) and GBP/EUR remain well supported. Track GBP with your own custom rate alerts. Set Up Here

The BRC retail price report warns that prices of non-food goods will be more susceptible to shipping costs, which have risen due to the re-routing of imports around the Cape of Good Hope in order to avoid Houthi attacks in the Red Sea.

In addition, Dickinson says retailers face "a major rise" to their business rates bills in April, determined by last September’s sky-high inflation rate.

Bank of England Deputy Governor Dave Ramsden on Tuesday indicated the Bank was maintaining its 'higher for longer' stance, saying inflation pressures remain persistent.

He says he wants more evidence about how long they were likely to remain strong before considering cut to interest rates.

Image © Bank of England

"Although services inflation and wages growth have fallen by somewhat more in recent months than we had expected last autumn, key indicators of inflation persistence remain elevated," Ramsden said in a speech.

Ramsden voted to keep interest rates on hold at 5.25% at the Bank's February meeting, while two members voted for a quarter-point increase and one for a quarter-point cut.

"In terms of my thinking about the future, I am looking for more evidence about how entrenched this persistence will be and therefore about how long the current level of Bank Rate will need to be maintained," he said.

Markets currently see 43% chance of BoE cutting interest rates by June, while a cut to 5% is fully priced for August.

The Pound would likely fall if expectations for June rise provided expectations for the ECB and Fed remain static; likewise, should the odds of a June cut recede, the Pound rise.