Pound Sterling Rises After Bank of England Keeps Door Ajar to Further Hikes

- Written by: Gary Howes

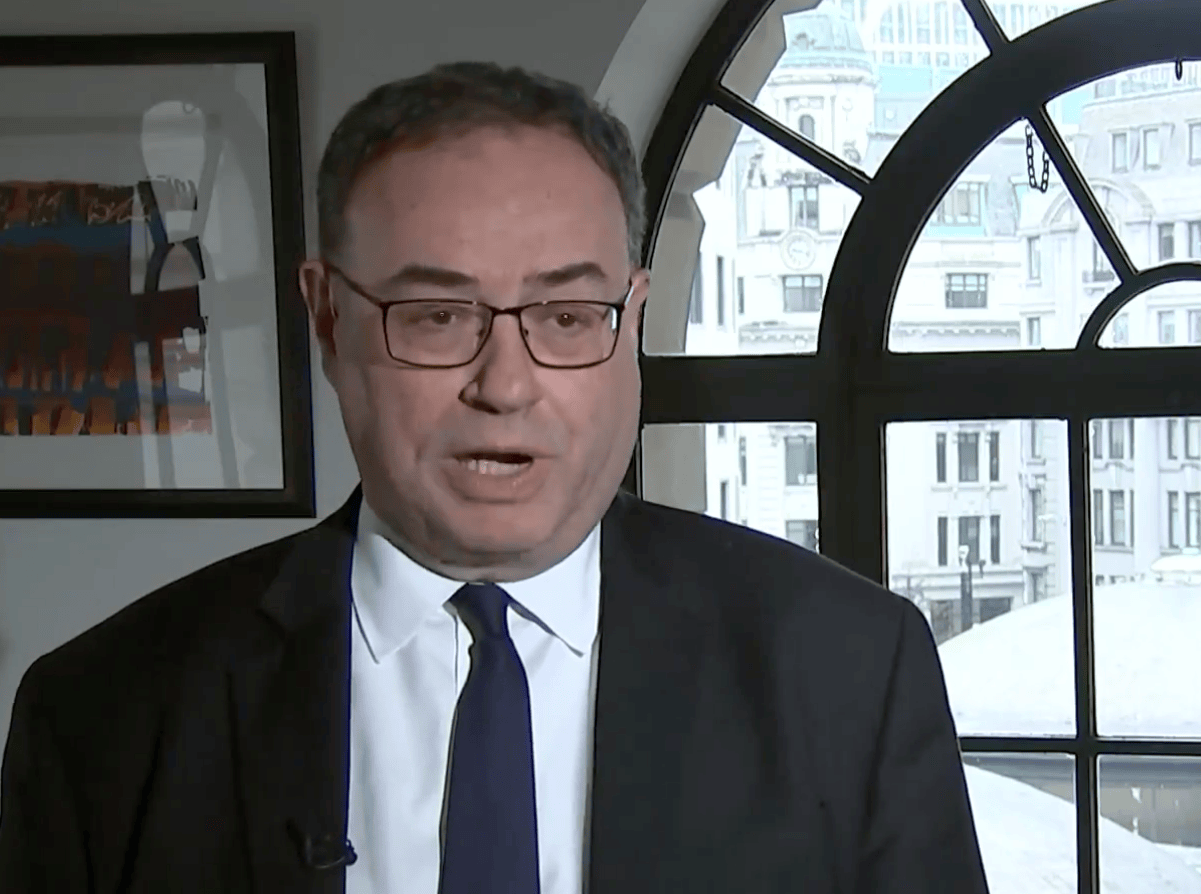

Above: Bank of England Governor Bailey speaks to the media following Thursday's decision announcement. Image © Pound Sterling Live

The British Pound rose against the Euro and Dollar after the Bank of England made it clear it was in no mood to entertain thoughts of interest rate cuts.

As expected, Bank Rate was maintained at 5.25% at the December policy meeting, and the Monetary Policy Committee (MPC) signalled it is ready to raise interest rates again if needed.

In an interview following the decision announcement, Governor Andrew Bailey said he "can't say definitively that interest rates have peaked."

The MPC voted 6-3 to maintain interest rates, with the three dissenters wanting to see rates lifted to 5.5%.

"GBP is reacting positively to the unchanged Bank of England rate decision," says Dominic Bunning, Head of European FX Research at HSBC. "For now it sees the balances of risks as skewed to the upside for inflation. This may keep the short term balance of risks similarly skewed for GBP."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The vote composition provides an initial signal as to which way the MPC is leaning, and economists considered the 6-3 vote split to be a 'hawkish' outcome that gives weight to the Bank's 'higher for longer' narrative on the interest rate outlook.

Indeed, the Bank's statement maintained previous guidance that "monetary policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with the Committee’s remit."

"Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures," it added.

This contrasts the U.S. Federal Reserve, which effectively condoned market expectations for up to 150 basis points of rate cuts to fall in 2024, a development that weighed on the Dollar.

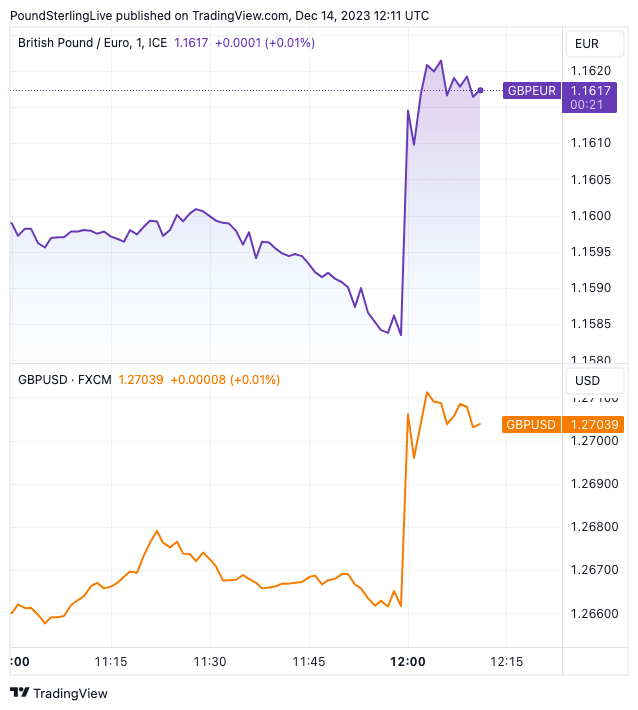

The Pound to Dollar exchange rate has lifted back to 1.27 on the divergent guidance coming from the Bank of England and the Federal Reserve: the Bank is clearly keen to keep talk of rate cuts at bay, whereas the Fed is more sanguine.

The Pound to Euro exchange rate lifted above 1.16 following the Bank's decision.

Above: GBPEUR (top) and GBPUSD at one-minute intervals. Track GBP with your own custom rate alerts. Set Up Here.

A look at the money market's pricing reveals why the Pound has risen in the wake of December's guidance, as investors have shifted expectations in a 'hawkish' direction by pushing back the expected start time of the cutting cycle.

The first cut is pushed back to June from May beforehand, and the odds of a March cut falling to less than 30% implied vs 40%.

A total of 107 basis points of cuts are now priced across 2024 from 114 ahead of the meeting.

This will be welcomed by Governor Andrew Bailey, who, in a press conference following the decision's release, said he "can't say definitively that interest rates have peaked."

When asked why the Bank isn't following the Fed's pivot (condoning of rate cut expectations), he responds, "there are differences between our position and the US".

"It's too early to start speculating about cutting interest rates," said Bailey.

However, Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says he expects the first cut to come in May.

"We continue to think the MPC won’t alter its language, to mimic the more dovish tone adopted by the U.S. FOMC earlier this week, until its meeting on March 21," says Tombs.

The Federal Reserve's 'pivot' saw it condone market bets for rate cuts in 2024 for the first time, saying there were risks with maintaining interest rates at restrictive levels for too long.

The Dollar fell sharply across the board in response.

But inflation in the UK is higher than in the U.S., which is reflected in the Bank of England's ongoing caution over upside risks to interest rates.

The UK labour market continues to loosen as there are now more workers seeking jobs as the number of vacancies available continues to fall. This is expected to weigh on wages, and cool inflation further.

"The meeting on May 9 is realistically the earliest time for the first Bank Rate cut, though by then we think the case for making monetary policy less "restrictive" will

be very persuasive," says Tombs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes