Bank of England in Emergency Rate Cut, and Pound Sterling Actually Rises vs. Euro and Dollar

- Bank of England cuts rates to 0.25%

- GBP/EUR goes below 1.14

- Budget is main focus today

- Bank of England coronavirus response possible

Above: Governor Mark Carney at a press conference following the announcement of a surprise interest rate cut. Still courtesy of the Bank of England

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The Bank of England has announced an emergency cut in interest rates to shore up the economy in the wake of the coronavirus outbreak, with markets judging that the effort forms part of a unified response between the Bank and government.

The Monetary Policy Committee cut the basic interest rate from 0.75% to 0.25%, taking borrowing costs back down to the lowest level in history.

The initial response of Sterling was to fall in reaction to the surprise rate cut: this is a text book foreign exchange reaction.

However, Sterling has since risen against the Euro, Dollar and other major currencies and we feel the market believes that the coordinated action of the Bank of England and the government is one of the more competent and potentially most effective when compared to other developed economies.

The Pound-to-Euro exchange rate went as low as 1.1316 before recovering to 1.1462, the Pound-to-Dollar exchange rate went from a daily low of 1.2842 to recover back to 1.2957.

"The synchronisation between the Bank and No 11 Downing St has encouraged the markets to expect a significant fiscal response from the budget which will be presented at 12:30 GMT today. The reassurance that the UK authorities have prepared a comprehensive package to counter the economic impact of the coronavirus should also provide support for the Pound," says Jane Foley, Senior FX Strategist at Rabobank.

In addition to the rate cut the Bank said it would also free up billions of pounds of extra lending power to help banks support firms. "The reduction in Bank Rate will help to support business and consumer confidence at a difficult time, to bolster the cash flows of businesses and households, and to reduce the cost, and to improve the availability, of finance," said the Bank in a statement.

"The Bank’s three policy committees are today announcing a comprehensive and timely package of measures to help UK businesses and households bridge across the economic disruption that is likely to be associated with Covid-19. These measures will help to keep firms in business and people in jobs and help prevent a temporary disruption from causing longer-lasting economic harm," added the statement.

In a press conference following the decision outgoing Governor Mark Carney says the Bank stands ready to act again to deliver further support, if need be. Incoming Governor Andrew Bailey told reporters that the Bank today used about 50% of the arsenal it had at its disposal, adding that the March 26 meeting will see business conducted as normal.

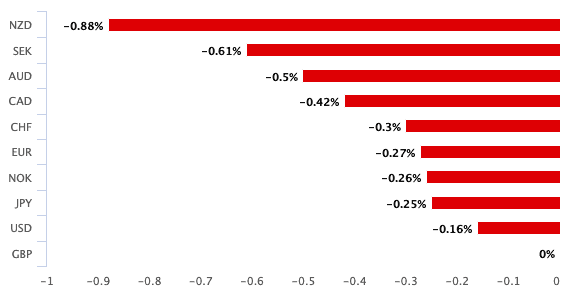

Above: GBP in the red following Bank of England emergency rate cut

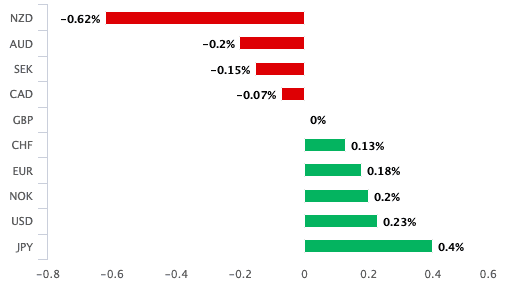

Above: GBP performance an hour after the cut as markets fully digest the implications of the Bank's support

The Bank of England has also announced a new Term Funding Scheme estimated at be around £100 billion which is designed to provide assistance for small and medium enterprises that might find their cashflow squeezed by the coronavirus-linked slowdown, a move that appears to be coordinated with further announcements to be made by the government in the upcoming budget.

The Bank also cut the Counter Cyclical Capital Buffer from 2.0% to 0%.

The buffer is the reserve capital regulators require banks to hold, akin to a build up of fat in good times.

Cutting the buffer requirement will free up as much as £190bn that banks can lend to businesses.

"No doubt this is co-ordinated with fiscal easing in March budget today. Pound initially weaker on 'surprise' of emergency cut. But expect GBP/USD to hold. The rest of the world will ease, rate differentials won't matter," says Viraj Patel, FX and Global Macro Strategist at Arkera. "If there are sufficient short-term growth support measures in today's Budget - then UK would be first major economy to have proper coordinated fiscal & monetary support in response to COVID-19 as most have been calling for. Can't imagine that being bad relatively for UK assets."

Patel picks up on a theme that is becoming more widespread and helps explain why the Pound is rising in the wake of the rate cut.

The UK is uniquely placed amongst many of its peers in that it is the only country where both the central bank and government can effectively act in tandem to provide a unified response to a crisis.

The government's majority allows it to take bold and swift decisions, while the Bank of England continues to show a readiness to coordinate with the Treasury.

By contrast, the U.S. is hampered by a divided Congress and a central bank that does not seek to actively engage with the government when coming up with decisions. Eurozone nations have meanwhile ceded their independent central banking functions to the European Central Bank, while fiscal rules set at the EU hamper the ability of governments to borrowing and increase spending. While the EU rules on spending can be bent in times of a crisis, the process remains clunky and beset by bureaucracy.

"GBP/USD has reversed its initial rate cut-induced weakness in a sign that FX markets are likely to reward currencies where the authorities are willing and able to act to counter the macro risks presented by the viral outbreak. This puts today's UK budget announcement into clear view as the next major directional driver for GBP," says Ned Rumpeltin, European head of FX strategy at TD Securities.

"Cable (GBP/USD) is currently trading at levels above where it was prior to this morning’s rate cut. This is a highly unusual reaction to a surprise 50 bps rate cut and reflects the reassurance that investors feel that the UK authorities are committed and prepared to present an aggressive package of policy measures aimed at countering the economic consequences of the crisis," says Foley.

The UK therefore has the opportunity to deliver a strong response to any crisis; and with this in mind all eyes now turn to Chancellor Rishi Sunak. We would expect the post-BoE bounce in Sterling to reverse should the Chancellor disappoint.

"Now that the market’s expectations for a fiscal response from the budget have been elevated even higher, the Chancellor may have his work cut to avoid disappointment," adds Foley.

Budget Up Next

Above: File image of Chancellor Rishi Sunak, Home Secretary Priti Patel, Chief Whip Mark Spencer. Picture by Andrew Parsons / No10 Downing Street.

The British Pound will take direction today from the evolving market sentiment to the global coronavirus outbreak, while the domestic point of interest will be the long-awaited release of the government's spending and taxation plans.

Chancellor of the Exchequer Rishi Sunak will unveil the government's Budget 2020, with expectations high that an increase in government spending will be announced. The currency market playbook currently suggests that the Pound will respond positively to a substantial increase in spending as this will help boost economic activity.

Of course this is a very nuanced event and we must immediately clarify that the Pound would likely react positively if the increase in spending is 1) greater than markets had anticipated 2) is credible i.e. the nation won't be bankrupt and 3) money is spent on areas of the economy that will boost consumption and productivity in real terms.

"The government has said that it will allow net investment to rise to 3% GDP, which based on current levels of investment implies c. GBP20bn in extra borrowing per year. Lower growth forecasts and already announced day-to-day spending increases leave our economists overall estimate of borrowing (PSNB ex-banks) some GBP40bn higher than previously forecast at around at around GBP 80bn. In the near-term, this is probably the headline number that FX markets will focus on and GBP is likely to follow the simple rule of thumb that more easing, and a larger deficit, is positive for growth and the currency," says Adam Cole, Chief Currency Strategist at RBC Capital.

The budget will address a myriad of issues and therefore the foreign exchange market will be attempting to make sense of many moving parts, therefore we could see some volatility around the event and would give markets some time before arriving at an ultimate conclusion, which should allow Sterling to settle.

"When it was announced Sunak would be taking the role Sterling rallied as it was hoped an inflationary boosting spending splurge could be on the cards, as part of Boris Johnson’s efforts to stave off a potential economic slowdown in the face of the December 31st UK / EU trade deal deadline," says Jake Trask, FX Research Director at OFX.

However, since Sunak took over the coronavirus outbreak erupted and has fast spread around the globe, with some medical analysts suggesting the UK is two weeks away from experiencing the outbreak's peak. There are concerns that the outbreak will evolve in an exponential manner, as was seen in Italy where a nationwide curfew has now been enforced.

The economic impact of such a development would be substantial: the new Chancellor might find that the money he had to spend on boosting productivity and 'levelling up' the country's regions has to instead be diverted to emergency coronavirus mitigation measures.

For instance, funding increased levels of sick pay and the emergency roll out of new hospital places would suck substantial amounts of money out of the Treasury.

We are likely to see a significant fiscal and monetary stimulus in UK, eurozone and US in coming few days - lots more spending (eg tomorrow’s UK budget) and probably significant easing by Bank of England, ECB and Fed (presumably largely measures to increase flow of cheap...

— Robert Peston (@Peston) March 10, 2020

Many coronavirus response initiatives will however rely on assistance from the Bank of England, which could provide finance for businesses that will face a financial impact from the breakdown of the global supply chain. T

A competent response to the coronavirus outbreak could however be supportive of Sterling, as this is a foreign exchange market that is incredibly focussed on the matter.

"It's worth noting that across G10 economies, the UK is perhaps the best-placed to coordinate its action between monetary and fiscal policy. Boris Johnson's government, with a strong and stable majority, is perhaps the most durable in the developed world. And the Bank of England's broad policy remit allows it to coordinate policy measures across monetary policy, financial stability, and regulatory pillars. Prior to Brexit, the UK was known for taking strong, clear policy decisions, and this could be an opportunity for officials here to demonstrate this once again," says James Rossiter, Head of Global Macro Strategy at TD Securities.

Rossiter tells clients that predicting the movement in Sterling - in the wake of the budget and an expected interest rate cut at the Bank of England - is incredibly difficult as there are multiple drivers pulling in opposite directions.

However, Rossiter will adopt the view that a rate cut at the Bank of England should be a negative for Sterling, while any public spending boost will act in the opposite direction.

"The demonstration of the UK authorities' resolve to combat the economic damage in a comprehensive and coordinated way is likely to lift sentiment toward the UK economy overall. That should ultimately work to Sterling's benefit," says Rossiter.

However, Jordan Rochester, FX Strategist at Nomura, says the outlook for the Pound is unconstructive for a host of reasons, including an expected disappointment at today's budget:

"Lower yields will make GBP less attractive for European investors, with a current account deficit to be funded. Coupled with the possibility of the budget disappointing high expectations and hard Brexit not being priced in at all. It’s why we are currently long EUR/GBP."

Being 'long' EUR/GBP is trader parlance for positioning for a rise in the Euro against the Pound.

The Pound-to-Euro exchange rate has declined in value since late February when a sharp sell-off in global stock markets saw billions of euros worth of investments return home to the Eurozone.

Further support for the Euro came as thousands of contracts betting against the Euro began to unwind, with traders having to close out bets which boosted demand for the single currency further.

"Investors will probably further close their net positions in currencies. "We think that they are still net-long dollar and sterling and net-short euro and yen," says Georgette Boele, FX Strategist with ABN AMRO.

"Therefore, we expect the weakness in the dollar and sterling in the near-term and strength in the yen and the euro. Emerging market currencies will probably decline as weaker global growth and the riskoff environment is negative for these currencies," adds Boele.