EUR/USD Exchange Rate Outlook: Bounce Projected to be Limited

The EUR/USD conversion should see its post-Italian referendum rebound be a limited one.

Italy’s decision to vote ‘No’ to historic constitutional reforms saw the Euro exchange rate complex slip before recovering sharply.

Italian bonds and bank shares have bounced back after opening sharply lower following the referendum result.

Shares in Monte Dei Paschi bank are 0.5% higher, while Banca Popolare is 2.2% higher.

The Italian stock index, FTSE MIB, has pushed back into positive territory too.

"Markets outside Italy were apparently largely prepared for a ‘No outcome’ and didn’t see any big global consequences outside Italy. The market was even ripe for some kind of short-squeeze as the event risk was out of the way," says Austin Hughes at KBC Markets in Dublin.

In a few waves the Euro moved higher with EUR/USD recording a short-term correction top north of 1.07 around noon.

"Despite rising political uncertainty, a short squeeze pushed the euro higher as the market was positioned too short euro going into the risk event," says Hughes.

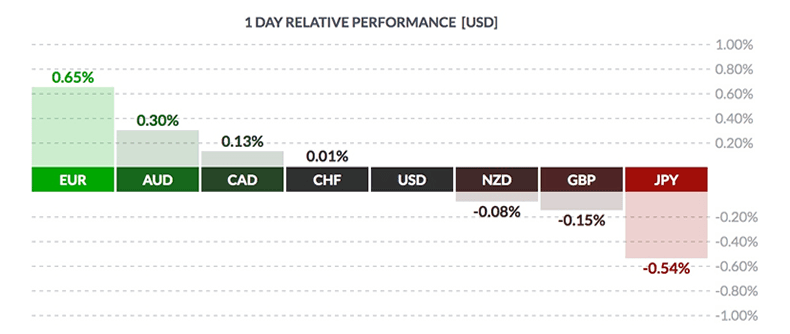

The Euro was actually the best-performing currency in G10 on the day:

With regards to the immediate outlook, keep an eye on Italy's banks where the situtation is hardly compelling of an all-out Euro rally.

"The immediate market focus will be on the struggling banking sector. Not least because the new resolution regime makes government support much harder, Italy has been desperate to find capital via the private sector," says Holger Sandte at Nordea Markets.

"The fate of the ongoing capital raising of Monde dei Paschi di Siena is first on the line, and its success or failure will have material consequences for the other banks," says Nordea Markets' Sandte.

The analyst believes the need for further government support, in one form or another, has increased with the clear No vote.

The outlook for the state being able to contribute to solving the problems of the Italian banks for good would require a strong government – something that looks unlikely for now.

"On the government bond markets, there were rumours that the ECB was willing to use the flexibility offered by its QE programme to prevent a sharper rise in Italian bond yields. A failure to do so could become self-fulfilling in the short-term, as it would dent confidence in the central bank’s ability to control the bond markets," says Sandte.

Yet, Sandte believes it would be premature to call for another crisis in financial markets, especially as the no vote was expected, even if the margin was surprisingly large.

The broader market reaction is thus likely to be contained, but the outlook for Italian markets continues to look uncertain.

The EUR/USD Recovery may be Fleeting

However, the Euro's strength against the Dollar is forecast to remain fleeting.

“Although the EURUSD rebounded in a short squeeze, it remain a sell the rally trade given the serious political problems in the region. In addition the volatile political climate may force the ECB to maintain its ultra-easy monetary policy longer than initially planned,” says Boris Schlossberg at BK Asset Management in New York.

Although there has been a modicum of improvement in Eurozone growth since the ECB instituted quantitative easing in the region, the rate of inflation is nowhere near the ECB's 2% target which suggests that the central bank can maintain its dovish stance for quite a while longer.

"Our long term bearish outlook on the EUR/USD has not changed. But in the near term, there is an increased risk for a larger counter-trend move before the bearish trend probably resumes," says Fawad Razaqzada at Forex.com.

The EUR/USD will probably make its next big move on Thursday in reaction to the ECB’s policy meeting and press conference and then next Wednesday when the US Federal Reserve will mostly likely hike interest rates.

Investors will want to know whether the ECB will extend its QE programme beyond the intended end date of March 2017, and how aggressive or otherwise the Fed will be in tightening US monetary policy.

"If these fundamental events still point to widening disparity between policy stances in the Eurozone and the US then the EUR/USD will most likely start its descend towards parity, after all," says Razaqzada.

ECB is Euro's Next Risk

This week will be dominated by the European Central Bank’s Interest Rate Decision on Thursday, December 8 at 12.45 (GMT).

As far as the ECB rate meeting goes consensus expectations are for it to extend its QE programme for another 6 months.

If this not forthcoming, however, that will send the Euro higher. Likewise if any hint of tapering next year is mentioned the Euro will strengthen.

What Matters for the US Dollar this Week

Data out on Monday, December 5 at 15.00 (GMT), includes ISM Non-Manufacturing PMI which is forecast to rise to 55.3 in November.

Services PMI for November is also out on Monday at 14.45.

On Wednesday, December 7 at 15.00, JOLTS Job Openings are released for October