GBP/EUR Predictions: Heads, Shoulders and Clues

- Written by: Gary Howes

Image © Adobe Images

An analyst at Société Générale says the Euro to Pound exchange rate's daily chart hints at a major reversal playing out.

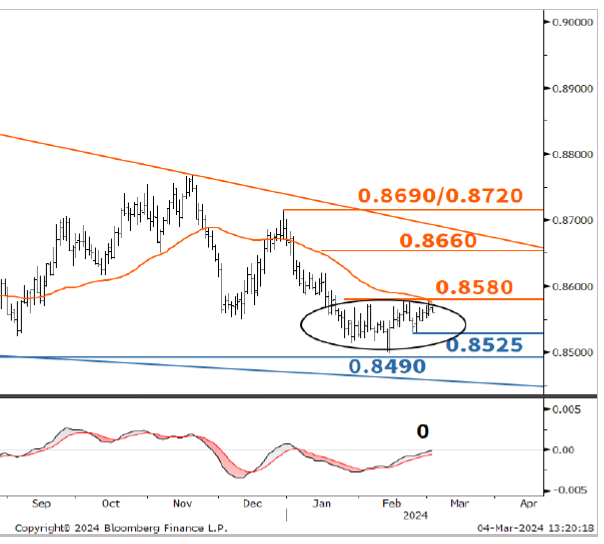

According to Soc Gen's technical analyst Tanmay Purohit, the EUR/GBP has successfully defended the low of last August near 0.8490 in the most recent period of decline. The exchange rate is now said to be evolving within an Inverse Head and Shoulders pattern.

"This points towards a potential upside, but a break above neckline at 0.8580 is essential for confirmation. Once this materialises, the pair could inch higher towards a target of the pattern at 0.8660," says Purohit.

Image: Société Générale

An inverse head and shoulders is a specific chart formation that technical analysts say can predict a reversal of a bearish trend. In this instance, it implies the Euro's decline against Pound Sterling since February 2022 could be about to reverse.

Purohit says the right shoulder level of the pattern, near 0.8525, is near-term support.

He warns an inability to defend 0.8490 "could mean risk of deeper downtrend".

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For those watching the exchange rate from the Pound to Euro angle, a Head and Shoulders pattern could mean a breakdown from recent highs.

Regular readers of this website will note the staunch resistance in GBP/EUR at around 1.1760, which the exchange rate has failed to crack on numerous occasions.

According to Purohit's research, a break below the neckline at 1.1655 "is essential for confirmation".

The right shoulder support near 0.8525 translates into resistance at 1.1730, and a breakthrough at 1.1778 opens the door to a run higher into fresh multi-month highs.

Track GBP/EUR with your own custom rate alerts. Set Up Here

Last week saw Pound Sterling endure its biggest weekly decline against the Euro since mid-December (-0.30%), as it extended its retreat from the February 14 peak at 1.1767, a 25-week high.

Nevertheless, The market is static amidst the broader decline in volatility across the FX space. A potential trigger for bigger moves would be Wednesday's UK budget announcement and Thursday's European Central Bank (ECB) policy meeting, the only event worth speaking of on the Pound-Euro's calendar.

We reported recently that if Chancellor Jeremy Hunt gets the March 06 budget wrong, the Pound could fall by as much as 2%, but analysts say the Pound would find some positives if a credible fiscal easing is announced.