Oil Prices Forecast Above $60/Barrel in 2017 by Bank of America Merrill Lynch

Brent Crude prices will average 61 dollars per barrel in 2017 as demand continues to creep higher.

To those who argue that demand for oil is set to decline in years to come, a rethink is required.

India alone will prove to be an engine capable of sucking up the world's supply of crude it is suggested.

India has car ownership of only 18 cars per 1000 capita (compared to China’s 128 and the UK’s 519), the economy is growing at 7.5% per year and people are straining at the leash to own a car.

The resultant rate of increase in ownership is 11% per year.

In addition, India is ramping up its manufacturing base, taking over from China as the workshop of the world, and this is generally energy intensive.

This emerging market (EM) demand potential, combined with OPEC’s recent supply cap has driven up forecasts for oil prices at Bank of America Merrill Lynch.

Bank of America Merrill Lynch’s Commodity and Derivatives Strategist, Francisco Blanch, sees Brent Crude rising to a peak of $70 per barrel in 2017 from a current price of $56.49.

According to Blanch, global demand for oil is increasing at around 1.2 million barrels per day.

Before OPEC’s historic supply cap agreed recently in Vienna, global oil supply was also rising at around 1.2 million barrels a day, balancing the increase in demand and resulting in stable prices within the $40-50 per barrel range.

However, since the supply cap, which roughly equates to 1.2 million barrels per day, demand will outstrip supply and lead to a rise in the price.

On top of that, Blanch sees oil prices potentially riding higher on a new era of global growth in a continuation of the reflationary themes which followed the election of Donald Trump.

For the BOFAML analyst, inflation is a good thing for commodities when it is accompanied by a Fed which is reluctant to increase interest rates.

“A goldilocks scenario for the commodities asset class would involve modestly stronger US and global growth, muted US wage pressures, a dovish Fed, and limited new trade restrictions.

“This tide could lift all boats, leading to a virtuous cycle of higher commodity prices, stronger EM growth, and rising global inflation.”

The Fed Could Be the Biggest Enemy to Oil Prices

One of the biggest risks to the BOFAML oil price forecast, however, is the Fed.

Blanch says research suggests there is a link between US interest rates and Oil prices, such that a rise in interest rates leads to a decline in oil (and other commodity) prices.

“So, should the Fed turn to a more hawkish language and signal the possibility of several US rate hikes next year, commodity prices may suffer.”

US Interest Rates and Impact on EMs

The reason behind the link between higher interest rates and lower commodity prices is that higher interest rates put pressure on emerging market economies which then consume less oil.

The first reason is that if interest rates rise in the US there is likely to be increased flight of capital out of EM’s and into the US since investors will want to take advantage of rising rates of return there.

Also, many EM companies use US financing, so higher interest rates in the US mean higher loan repayments.

More hikes from the Fed mean a stronger US Dollar, which in turn increases the cost of commodities for EMs and makes US Dollar-denominated loans more expensive to repay.

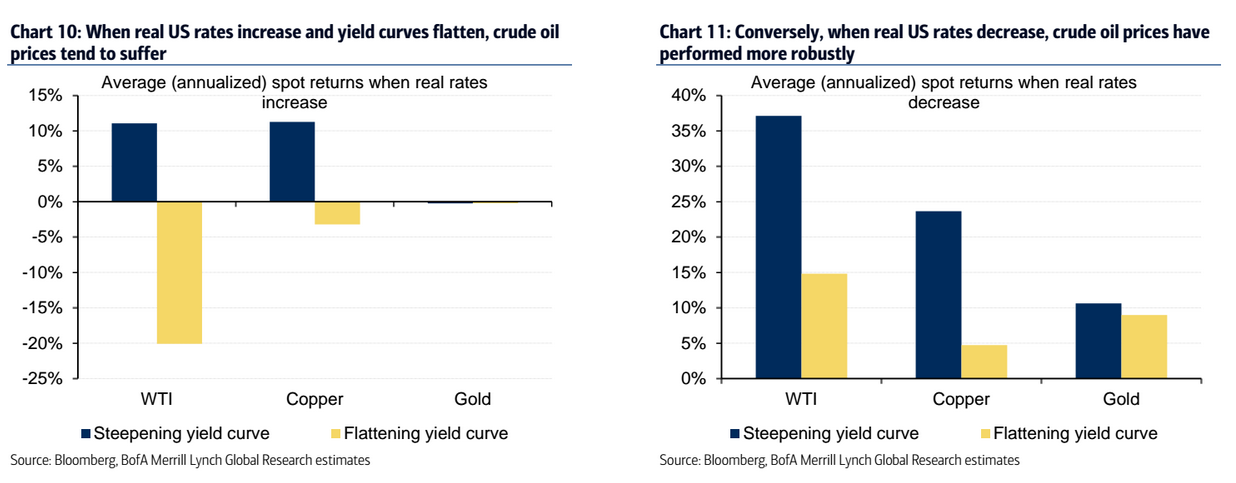

According to Blanch the worst possible combination for commodities would be an environment in which the Fed was raising interest rates and yet inflation expectations – especially medium and long-term expectations - remained relatively subdued (which results in a flat yield curve).

The Right Combination for Commodities

Whilst high interest rates tend to act as a drag commodity prices, they thrive best in a climate of rising infation expectations, especially longer-term ( a steep yield curve) and relatively low interest rates.

This may indicate that this week’s Fed interest rate meeting could have more riding on it then meets the eye.

Oil traders might not just be watching wat happens with interest rates, which are almost certain to rise, but also what the Fed’s longer-term expectations are for inflation, as this could impact on the global commodity market.

The left chart shows worst case scenario for commodities in which interest rates rise and inflation expectations don't; the right chart shows the best case of rising inflation and low interest rates.

OPEC Infighting

The other major risk to the BOFAML forecast for higher oil prices is that the OPEC deal will fall apart.

"Outside the noise created by the US election, we believe commodity prices face two key downside risks over the next few months: OPEC discord and an EM demand slowdown.

"Clearly, a dysfunctional cartel is perhaps the biggest concern that market participants have at the moment (Chart 6).

"Contradictory statements by different actors have created the appearance of discord within the cartel prior to the supply cut deal announced in Vienna, and there are reasons to be skeptical that cuts will be implemented in full," said BOFAML's Blanch.

Clearly whilst Oil is on the up - some risks still present obstacles for the commodity.