UK On Cusp of a Deflation Problem: Capital Economics

- Written by: Gary Howes

Image © Adobe Images

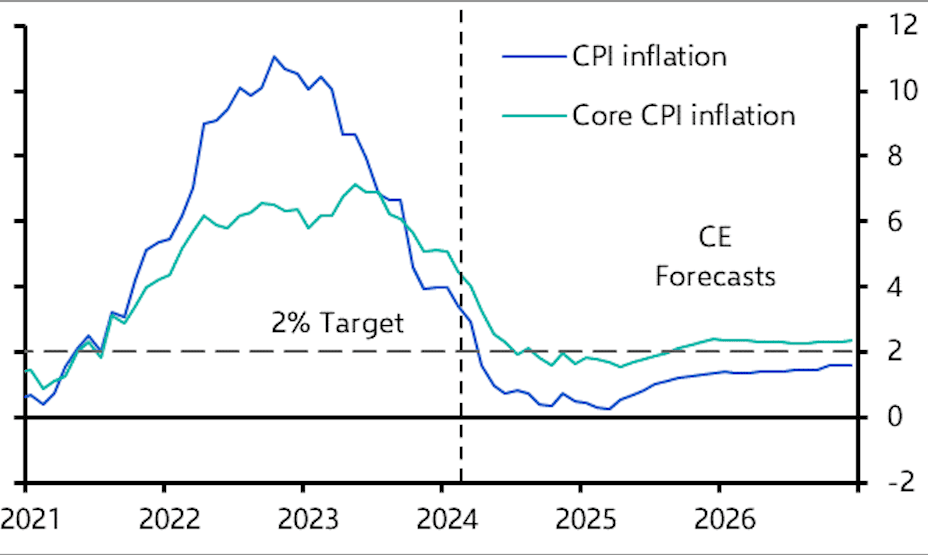

New analysis shows that CPI inflation will fall below 1.0% and remain below the Bank of England's 2.0% target through 2025, raising the risk of deflation in the UK.

Capital Economics - an independent research provider - says the UK is on the cusp of switching from having a bigger high inflation problem than other major economies to having a bigger low inflation problem.

"We think CPI inflation will fall to just 0.5% later this year, and there is a risk of deflation," says Paul Dales, Chief UK Economist at Capital Economics.

The call comes after March's UK inflation report undershot expectations, putting the Bank of England on course to cut interest rates in the summer.

UK CPI inflation rose by 3.4% in the 12 months to February 2024, according to the ONS, down from 4.0% in January and below the 3.6% expected by the consensus.

Above image courtesy of Capital Economics.

"We’ve been forecasting for a year that CPI inflation would drop below 2.0% this April, from 3.4% in February, and most other forecasters now agree. That would leave inflation below the target for the first time in three years. But the consensus has yet to appreciate that inflation may fall to just 0.5% later this year," says Dales.

If these predictions are correct, the Bank of England will cut interest rates further than markets are currently expecting, with far-reaching consequences for UK lending rates, bond markets and the British Pound.

Markets are currently priced for about 75 basis points of cuts in 2024, but this would rise if the UK approaches a deflationary scenario.

The Pound, held up by expectations that the Bank would cut by less than major peers, would likely come under considerable pressure. (Of course, the Pound's direction will depend on whether this deflationary phenomenon is repeated elsewhere).

Capital Economics explains inflation's decline will partly be because further falls in wholesale gas prices will mean that utility prices continue to subtract up to 1.0 percentage point from CPI inflation.

In response to the falls in global agricultural commodity prices over the past two years, Capital Economics expects food price inflation won’t add anything to inflation, and it may even turn negative later this year for the first time since July 2021.

"But most of the decline will be due to further falls in core inflation (i.e. excluding energy, food, alcohol and tobacco). A further easing in price pressures from overseas is on the cards. The recent stagnation in manufacturing selling core prices suggests that core goods CPI inflation will soon fall from 1.9% to zero," says Dales.

The all-important services inflation component - which the Bank of England watches closely - is expected to rise at a slower-than-expected rate as the economy slows.

"In other words, not only will overall CPI inflation be a long way below the 2% target in the second half of this year, but a substantial fall in services inflation, from 6.1% in February to perhaps 3.0% later this year, will show that inflation has become less persistent," says Dales.

Capital Economics expects overall CPI inflation to remain below the 2.0% target for all of 2025 and 2026. "This would leave inflation in the UK below the rates in the US and the euro-zone," says Dales.

This would open the door to more cuts at the Bank of England than at the ECB and Fed, potentially weighing on the Pound against the Euro and Dollar over this period.