Traders Still Selling Japanese Yen Strength

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The Dollar-Yen exchange rate has rallied for six days in succession now, underpinning a mildly constructive view of the pair held by analyst Richard Perry at Hantec Markets who says 105.70 will now act as a point of resistance.

For about a week now we have been speaking about the consistent theme of buying into intraday weakness on Dollar/Yen.

This was in evidence once more yesterday as another positive reaction to early selling pressure came through into the close.

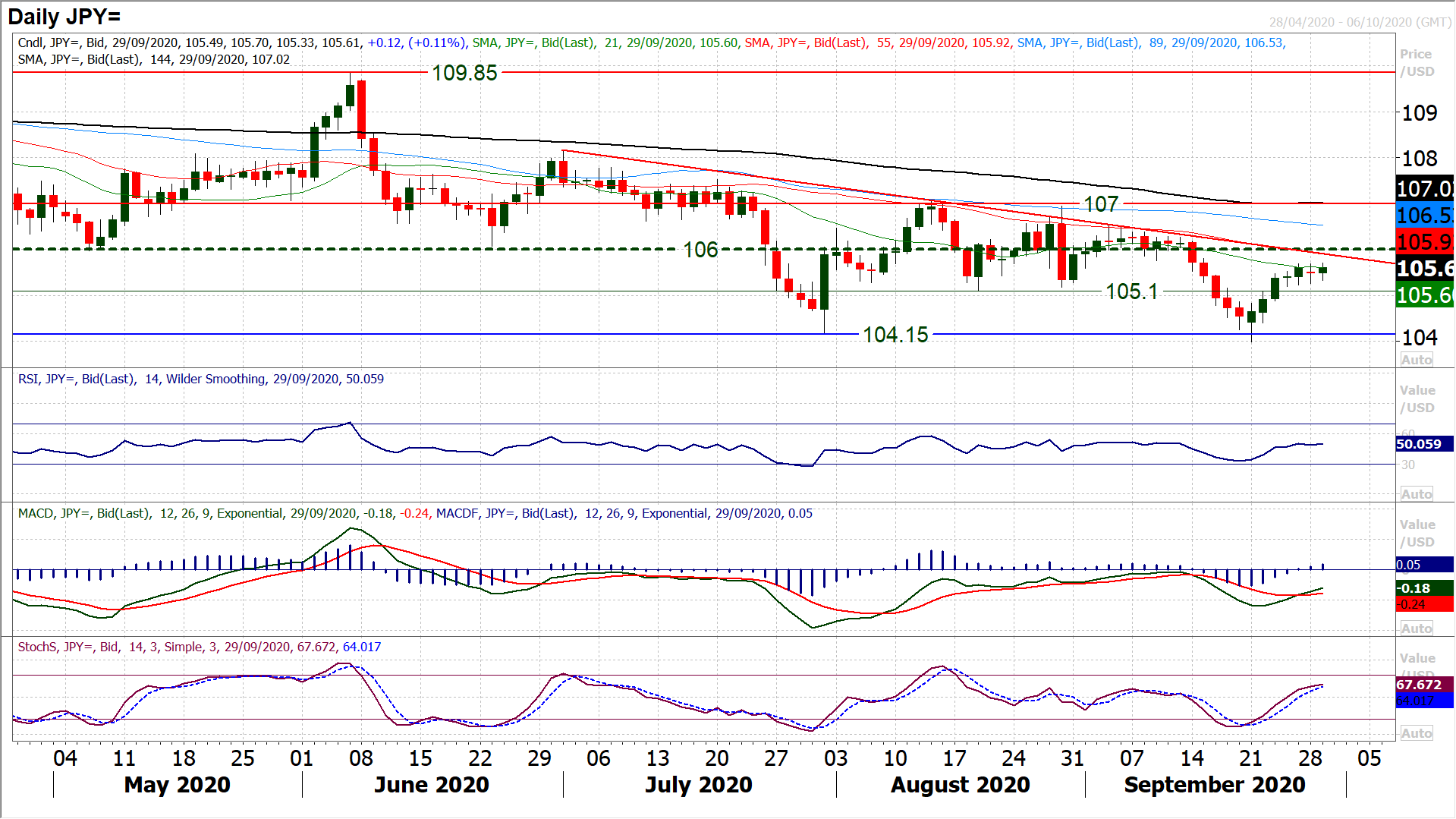

However, there is a slight loss of momentum as two of the past three sessions have consolidated and “doji” candlesticks (open and close at the same level) have formed.

This has seen RSI and Stochastics begin to tail off.

The market is ticking mildly higher this morning and there is still a positive bias to the recovery, albeit only slight now.

It could be that the closer the recovery gets to the three month downtrend and 55 day moving average (both at 105.90) and the medium term pivot at 106.00, the less downside potential there is and the move loses steam.

Additionally, the RSI is now around 50, where previous rallies of the past few months have begun to dissipate.

Initial resistance at 105.70, whilst support is still in place between 105.10/105.30.

A risk positive start to the week has just begun to lose a little steam this morning.

Markets have been able to respond to some good newsflow for a change, as the steps towards a $2.2 trillion package of US fiscal support edges closer and hints of positive steps emanate from Brexit trade negotiations.

This is leaves markets at an intriguing inflection point.

The dollar has been strengthening in recent weeks as risk appetite has faltered amidst rising second wave COVID fears.

This is still a key factor for traders to price for, but if Congress can get a new fiscal support package over the line, it would be a very welcome boost in the coming days.

After a couple of sessions of reacting to the initial news, this morning, markets are looking more circumspect.

Previously, we have seen hope of agreement in Congress dissipate quickly. It seems that markets need further traction in Congress (but also the EU/UK Brexit trade negotiations) in order to take a view.

The dollar has drifted off, but only marginally and so far there has been little sustainable damage to its multi-week recovery. Equities have rebounded, but the move is stalling slightly today.

Gold has bounced after a recent phase of selling pressure, but is also stalling. The one decisive mover today seems to be sterling, but again, the politics can change quickly, leaving sterling as a volatile play right now.

The economic calendar is a bit busier today as we approach the end of the month. German inflation is due at 1300BST and is expected to show German HICP falling by -0.1% in the month of September (after falling by -0.2% in August) and also falling by -0.1% on the year (-0.1% in August).

The US Trade Balance is at 1330BST and is expected to show a slight increase in the deficit to -$81.8bn in August (from $-$80.1bn in July). The S&P Case Shiller House Price Index is at 1400BST and is expected to improve to +3.8% in July (from +3.5% in June).

The main data point of the day is the Conference Board’s Consumer Confidence at 1500BST which is expected to improve well to 89.5 in September (from 84.8 in August).

There is an abundance of Fed speakers to watch out for today, with four on the docket. FOMC’s John Williams (voter, centrist) speaks twice at 1415BST and 1800BST, whilst FOMC’s Patrick Harker (voter, leans slightly hawkish) speaks at 1430BST.

Vice Fed chair Richard Clarida (voter, can lean slightly dovish) speaks at 1640BST, whilst FOMC’s Randall Quarles speaks first at 1800BST and then again at 2000BST. With an array of comments this could show some elevated volatility for the dollar today.