The Pound-to-US Dollar Rate in the Week Ahead: Bulls Hold Marginal Advantage

Image © Andrey Popov, Adobe Stock

- GBP/USD uptrend remains intact on balance despite recent weakness

- Break above 50-day MA required to signal continuation higher

- Main event for Pound is Bank of England meeting and for the Dollar inflation data

The Pound-to-Dollar exchange rate ended the week marginally lower amidst a strong recovery in the Dollar ahead of the weekend courtesy of some sizzling labour market data.

As we enter the new week the Pound hangs by a threat to its uptrend but a lot of work needs to be done for it to give a green-light to bulls again.

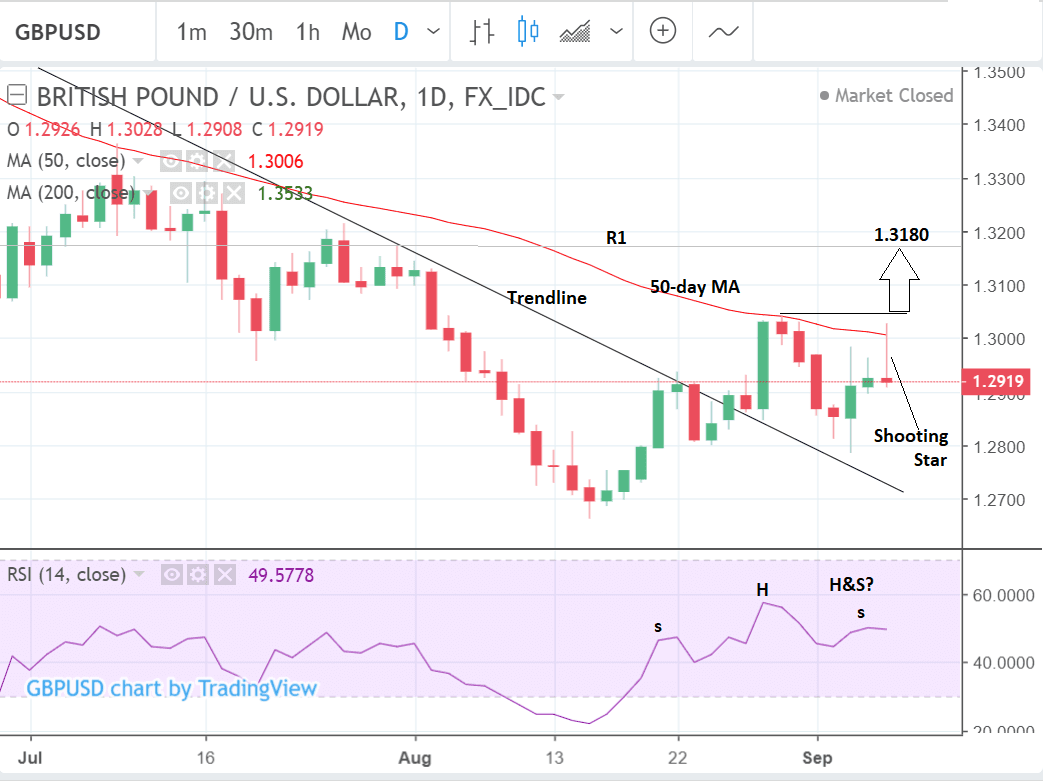

The pair ended the week on a very bearish-note after forming a shooting-star Japanese candlestick pattern and this has muddied the direction of the short-term trend - is it still up, or down now?

We think overall the bulls have a marginal advantage due to the break of the trendline on August 27 and the subsequent consolidation above it. Yes, there has been weakness since then, but this was mainly due to the rebuttal by the 50-day MA at 1.3000, a fairly common occurrence due to short-term technical traders using the MA as a place to fade the trend. It is not necessarily a sign of a deeper change, however, at least not yet.

As such, we still see risks as tending towards further upside, on balance, and a break above the 50-day and the 1.3043 highs would provide the necessary confirmation for such a continuation higher.

We see the next upside target as situated at 1.3180 where the R1 monthly pivot is situated. As its name suggests it is a level where prices often rotate and thus poses a risk to the uptrend extending, which is why we have selected it as our target.

Momentum is sluggish and has formed what is beginning to look like a head and shoulders top pattern warning of further reductions. This is a bearish indicator for the exchange rate and is the reason for us seeking a high threshold of confirmation (plus 1.3043) for expecting the uptrend to continue.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Dollar: What to Watch

Trade war related safe-haven flows are expected to be the main driver of the US Dollar in the week ahead.

The US government has still not decided whether it is going to raise anymore tariffs on Chinese imports but an announcement on the issue is imminent.

If it decides to raise tariffs on more goods, as is feared could happen, it could benefit the Dollar which should rise on increased safe-haven demand.

The China-US trade conflict is not the only external driver that could send more inflows into the US - a further factor could be more general emerging market (EM) risk as currency stresses simmer in the likes of Brazil, South Africa, Turkey and Argentina.

If these stresses extend, the US Dollar will likely benefit from increased safe-haven flows.

More strong data will only likely add to demand for dollars - investors are increasingly looking to the west in their search for a combination of reliability and yield and the US now offers both ever since growth started to motor ahead in Q2.

Further strong data in the week ahead will only tip the balance more in the US's favour leading to more EM into US flows, and increasing demand for the US Dollar in the process.

Inflation data on Thursday is expected to be a key metric in the week ahead as it shapes Federal reserve policy response and a higher reading makes it more likely the Fed will continue to aggressively hike rates. Current mean forecasts are for broad inflation to dip to 2.8% in August from 2.9% in July and core to remain unchanged at 2.4%, when results are released at 13.30 B.S.T.

Friday is likely to see the biggest Dollar movers, however, as retail sales numbers, industrial production and Michigan sentiment data are released.

Retail sales are forecast to show a 0.4% rise in August compared to July when it is released at 13.30, and core retail sales a 0.5% rise.

Industrial production is expected to show a 0.3% increase when it comes out at 14.15, and Michigan sentiment to increase to 96.6 when it comes out at 15.00.

The Pound: What to Watch

It is a busy week for UK data with several key data releases, and the Bank of England (BOE) meeting scheduled to finish on Thursday at 12.00 B.S.T.

The BOE raised interest rates by 0.25% at their August meeting but they are not expected to continue raising them in September.

Brexit uncertainty remains a key risk factor preventing them from going ahead - unless a deal is struck by Thursday, which seems a little unlikely even under the most optimistic scenarios.

"As for the BoE, which is scheduled to announce policy on Thursday of next week, we do not expect many new developments. The BoE raised its Bank Rate 25 bps to 0.75% at its August meeting, and further increases seem unlikely to be considered unless or until Brexit uncertainty is resolved," say analysts at global investment bank Wells Fargo in a recent client briefing.

The September meeting does not include a press conference or quarterly inflation report further reducing the chances they will use it to announce any changes in policy.

"The BoE last raised interest rates in August, lifting them above 0.50% for the first time since 2009. It is widely anticipated to hold rates unchanged at 0.75% next week. With no press conference and quarterly inflation report at the September meeting, the Pound may struggle to get much reaction from the BoE’s decision," say brokers XM in a preview of the event.

Another key event for the Pound in the week ahead is wage data which is scheduled for release at 9.30 B.S.T. on Tuesday, September 11.

Wages are leading indicator of growth and inflation pressures and a higher-than-expected increase would probably result in a rise in the Pound as it would increase the probability of the BOE raising interest rates.

Consensus expectations are for wages to rise by 2.5% in July from 2.4% previously (plus bonus). The Unemployment rate is forecast to remain unchanged at 4.0%.

Industrial and manufacturing production figures for July are out at 9.30 on Monday and are both forecast to show 0.2% growth from the previous month.

"Among the key releases will be industrial output figures, which will likely be closely watched for any clues that Brexit uncertainty is affecting manufacturing sentiment," say Wells Fargo.

Trade data is also out in the week ahead with the trade balance forecast to show a marginal widening to 11.75bn July, and Non-EU balance to show an increase to -3.30bn from -2.94bn previously, when the data is released at 9.30 on Monday.

Monthly GDP data at 9.30 and The National Institute of Economic and Social Research (NIESR) GDP mates at 14.00 are also out on Monday and could impact on the Pound if they present a negative outlook for growth.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here