GBP/USD Set to Slide into Mid-2018 as US Inflation Makes a Comeback say Julius Baer

Pound Sterling has this week broken decisively below the 1.30 marker against the US Dollar and is looking vulnerable to further losses amidst sanguine UK data releases and expectations that the US economy is likely to see a pick-up in activity into year-end.

Yesterday, GBP/USD dropped sharply to the six month support line at 1.2859 as technical conditions deterirorate.

The decline marks a shift in sentiment for the Pound to Dollar exchange rate which has been climbing for much of 2017 despite despite concerns pertaining to the UK economy derived from Brexit.

This confirms much of the lift in GBP/USD has been derived from US Dollar weakness; the risk for GBP/USD is that the Greenback finds its feet once more.

Indeed, the Dollar’s period of weakness might be coming to an end according to a noted Swiss investment bank.

“The most recent US inflation reading poses a risk to our bullish US dollar view and the expectation that the Fed will hike rates once more this year,” says David Kohl, Chief Currency Strategist with Julius Baer.

The Dollar has been on of the worst-performing global currencies in 2017 with declines coming on the realisation that President Donald Trump would likely fail in delivering his pro-USD campaign promises to slash taxes and raise infrastructure spending.

In addition this, markets believe the US Federal Reserve would ease back on the pace it raises interest rates. This is in part because markets have observed a sluggish trend in US inflation data.

But, for Kohl and the team at Julius Baer, it would be wrong to believe there are no inflationary pressures in the US economy - if anything they have simply been delayed.

“Strong pipeline pressure with an emphasis on wage dynamics suggests that inflation is just late and not dead in the current cycle,” says Kohl.

Dollar to Find Support as Inflation Returns

US inflation for July surprised with a weaker-than-forecast print when released in August. The Dollar predictably suffered as markets questioned the need to for the US Federal Reserve to raise interest rates at the coming FOMC meetings.

“The most recent reading for sure poses a risk to our bullish US Dollar view and the expectation that the Fed will hike rates once more this year,” says Kohl. “Encouraging, nevertheless, is the inflation assessment of the Federal Reserve itself, which according to the last press conference is prepared to lower inflation readings, attributing them largely to 'arithmetic' effects.”

Kohl believes there is good reason to stick with his bullish view on the Dollar as inflation is likely to pick up going forward.

The analyst argues the large swings in energy prices at the end of last year are still having their effect on today’s inflation figures, making it difficult to spot the true underlying inflation trend.

“We lean towards the assessment of the Federal Reserve and are highly sceptical that the general inflation dynamics has structurally changed in the current economic cycle,” says Kohl.

Julius Baer recognise that online shopping and the sharing economy put downward pressure on certain consumer price index (CPI) components but maintain the true CPI disappointment can be attributed, rather, to the lagging nature of inflation itself.

“Hence, the focus on pipeline pressure with an emphasis on wage dynamics is a more promising means of forecasting inflation than breaking down the inflation rate into its component parts,” says Kohl.

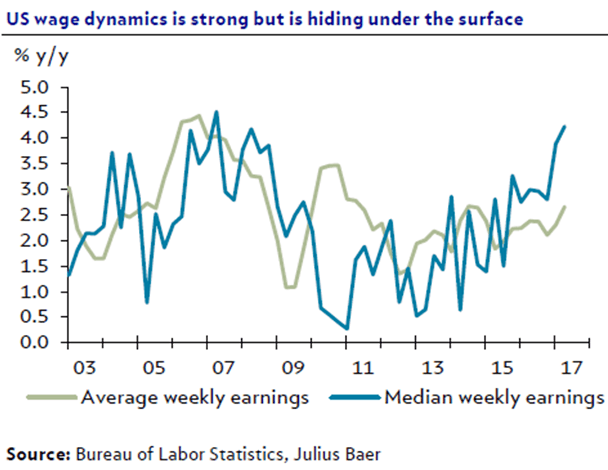

“Wage dynamics in the US is already strong, even if it is hiding under the surface. Quit rates are at 10-year highs and a record number of companies report problems with the quality of labour,” says Kohl.

In contrast to the average weekly earnings, median figures reveal the strong wage dynamics in the large pool of low-income workers.

“With such strong wage dynamics, and inflation not worrisomely low, we stick to our view that the Fed will hike rates in December, with the consequent strengthening of the US Dollar,” says Kohl.

GBP/USD Forecast to Slide into Mid-2018

Julius Baer are forecasting the GBP/USD exchange rate to trade at 1.25 by the end of 2017 ahead of a fall to 1.22 by March 2018.

However, the decline in the exchange rate will extend beyond here with 1.17 being forecast by mid-2018.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

GBP/USD’s Technical Outlook Look more Bearish than Bullish Again

From a technical perspective, Forex.com’s Fawad Razaqzada notes the GBP/USD’s struggle and the subsequent failure to hold above the psychological 1.30 handle is a bearish omen.

GBP/USD now faces resistance in the 1.2940-1.2955 area which as previously support.

A break above this region on a daily closing basis would be bullish again, ideally if the last high at 1.3030 is also taken out.

“Unless that happens, we may see further weakness going forward. A couple of support levels to watch include 1.2905 and then all the way down at 1.2760, levels which had been resistance in the past. There’s also a trend line which may offer some support at 1.2860/70 area. In short, the technical outlook looks more bearish than bullish as things stand,” says the analyst.