US Dollar Weakens after US Data Disappoints

The US Dollar Index - a widely-watched measure of broader Dollar performance - dipped at the start of the new month following the release of manufacturing and inflation data which undershot expectations.

The ISM manufacturing report is an important business survey conducted by the Institute of Supply Management which is considered a useful bell weather for the economy.

The EUR/USD rose to 1.0917 after the release of the data led to a weakening of the Dollar versus the Euro.

The same could not be said the GBP/USD, however, which faltered due to a weaker Pound.

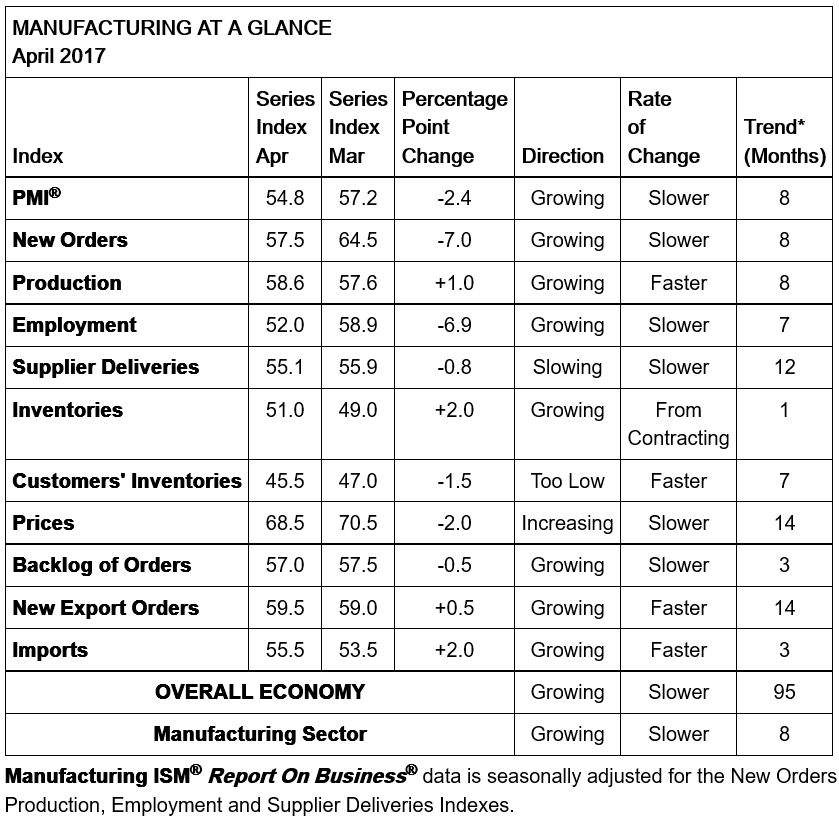

The ISM showed a marked drop of -2.4% from the previous month of March and a dramatic fall in the key subcomponents of New Orders and Employment.

The ISM fell to 54.8% in April from 57.2 in March, which though still in the expansion territory above 50 was nevertheless still a result below the 56.4 expected.

Arguably of more concern than the pull-back in the headline figure was the 7.0% drop registered in the New Orders component of the survey, which is forward looking, and which went from 64.5 to 57.5 in April.

The Employment subcomponent also showed a substantial fall of 6.9% from 58.9 to 52.0.

The largest growing subcomponents were Inventories (which is a negative sign) and Imports, both of which grew by 2.0% in April.

Respondents were not as negative as the data suggested.

“Comments from the panel generally reflect stable to growing business conditions; with new orders, production, employment and inventories of raw materials all growing in April over March,” said the ISM.

The data was indicative of “healthy growth” commented one analyst after the release, but it was important that current levels are “held”.

“The current level of the ISM Manufacturing Index is still indicative of healthy growth in the sector, but it will be important to see that level hold. Overall, this was a slightly worse outcome than expected and has seen the dollar weaken and yields fall,” said CIBC’s Royce Mendes.

Other Data showing slowing inflation also weighed on the Dollar.

The Fed’s preferred inflation gauge Personal Consumption Expenditure (PCE) contracted in March, falling by -0.2% and -0.1% for Core.

Year-on-year, however, it continued to show growth, rising by 1.8% from March 2016 and 1.6% Core.

The falling inflation data may arguably be as a result of a seasonal slowdown the US experienced in Q1, reflected in the under par GDP data for the period.

Analysts at Nordea think the poor Q1 data is unrepresentative and due mainly to seasonal disruptions.

They think the US economy still has strong underlying growth.

Nordea continue to expect a June rate rise of 0.25% as probable despite the recent string of poor results.