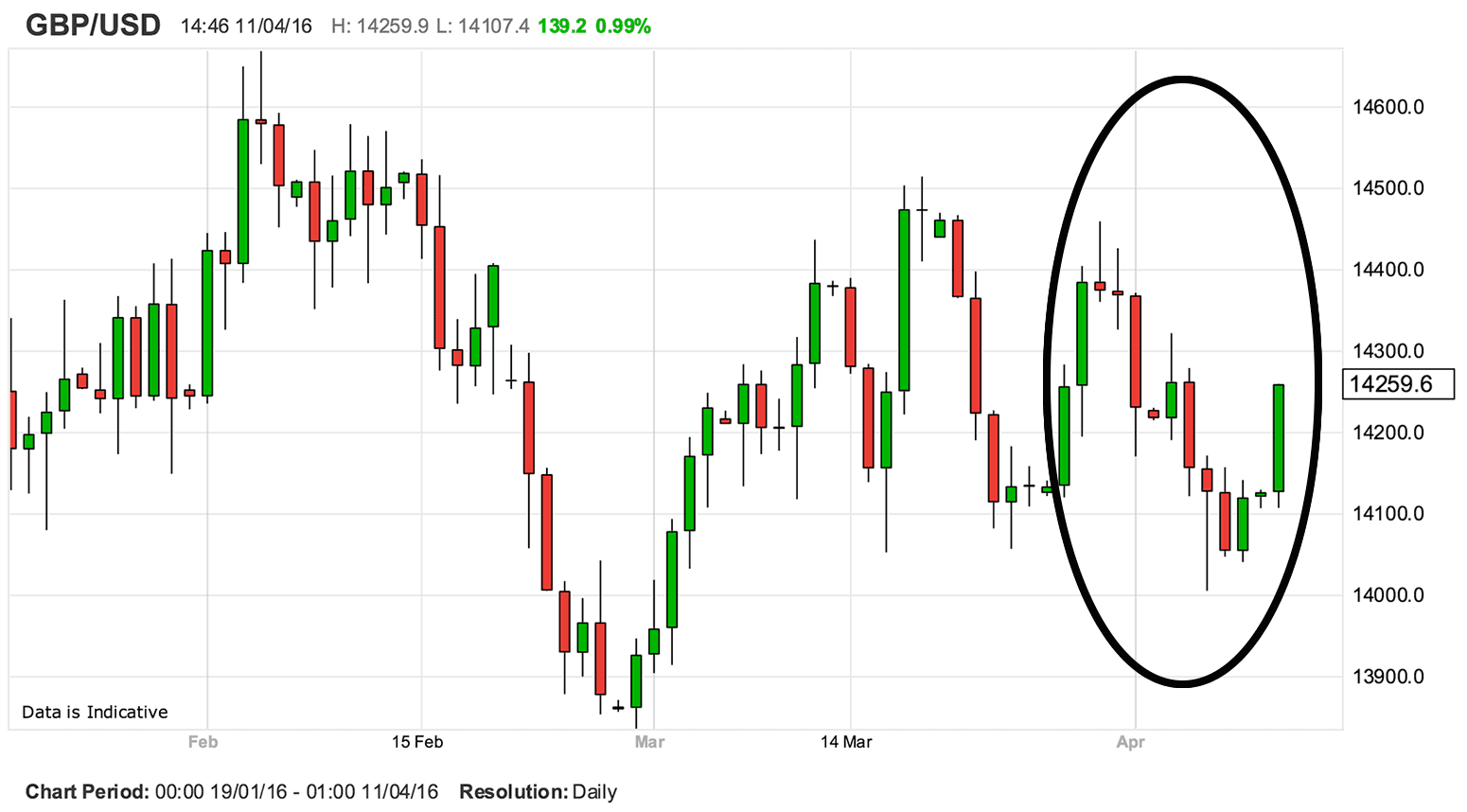

The Pound / Dollar Rate is Tracking the German DAX this Month

The British pound appears to be taking its cue from the German DAX this April.

We have uncovered a new and interesting relationship that could explain the pound’s recent behaviour against the dollar.

Yes, Brexit is the main culprit cited by most financial scribes but we have been sceptical as to whether it is the only driver of sterling strength and weakness.

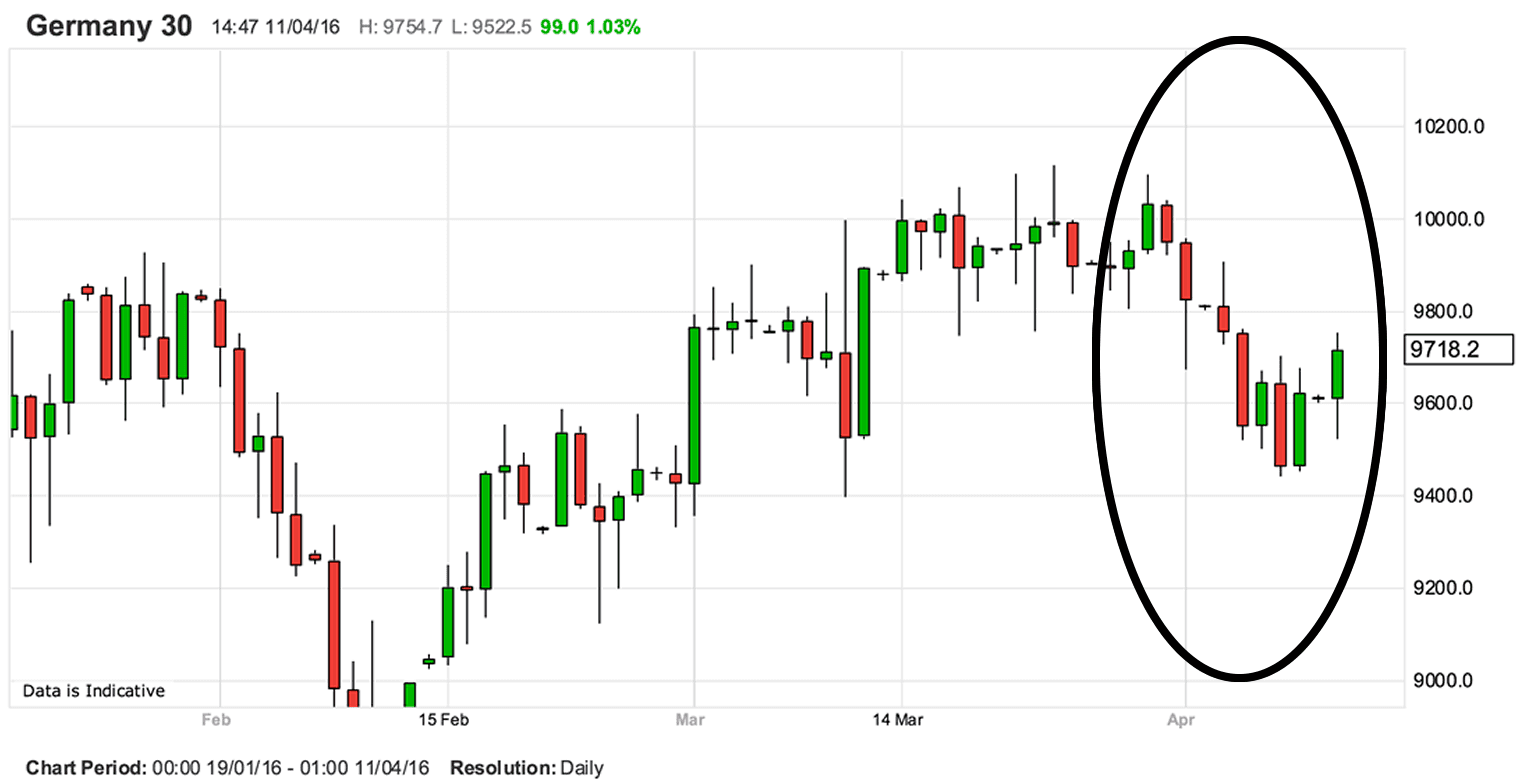

I look at the pound’s stellar 1.0% gains against the Greenback on my dashboard today, and noted that another gain of equal magnitude was to be found on the German DAX.

Looking at the charts revealed more - the GBP/USD and German 30 have been tracking each other for much of April.

In fact, when the DAX has a down day so does the GBP/USD, and today’s strong up day is echoed across both:

The relationship has only really been relevant since the end of March / April to-to-date period so we will not get too carried away by this.

But why?

My best guess on this matter concerns the euro’s status as a funding currency; the euro is dirt cheap to borrow and as a result is being borrowed in epic proportions and exported to international markets that offer high yield.

This ‘carry trade’ dynamic is nothing new.

When international markets sell-off the euro is repatriated; this bids the value of the euro higher as borrowed euros must be settled in returned euros.

When markets are rallying, as they are today, the euro is sold off as money is exported. When the euro is selling it appears the broader pound sterling complex is bid higher.

Now, I will concede I am unclear as to the exact dynamics involved that would explain that when the DAX rallies so does the pound, but my guess is that it lies with the interplay of global bond markets and risk relationships that I have described.

Perhaps a simpler observation is that the British pound is taking its cue from the general risk environment, as is the German stock market.

This is understandable in that sterling is considered one of the more risky assets to hold onto at present and will likely be so until the results of the June referendum are known.

Therefore we should continue putting focus on general risk sentiment when analysing sterling over coming weeks.