GBP/USD Forays Above 1.25 Remain Difficult, Despite Positive Data Flow

- Written by: Gary Howes

Image © Adobe Images

The Dollar is finding itself bid in midweek trade amidst a broader turn lower in global equity markets, highlighting the currency's enduring safe-haven appeal.

This source of support is keeping a lid on the Pound to Dollar exchange rate (GBP/USD) which would likely be higher in the wake of the release of UK inflation numbers that proved stronger than economists were expecting.

UK headline inflation read at 10.1%, defying expectations for a fall to 9.8% and casting doubts on the Bank of England's forecasts for a rapid decline in inflation to 3.0% by the first quarter of 2023.

Even if GBP/USD is struggling for upside traction, the Pound is in fact the day's top-performing major currency as investors bet on further Bank of England interest rate hikes.

"GBP-USD remains above 1.24, supported by still high UK CPI data for March, with USD dynamics across the board also playing a key role in driving sterling at present," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

UK core CPI inflation increased 6.2% year-on-year in March, unchanged on February, which was stronger than the 6.0% the market was looking for. The month-on-month change in core stood at 0.9%, which exceeded the estimate of 0.6%.

"Headline inflation coming in 0.9ppts above the BoE's latest forecast and with strong core momentum, makes another 25bps hike from the MPC at its May meeting even more likely," says a note from strategists at TD Securities.

In fact, the Bank of England's favoured measure of domestically-generated inflation, core services CPI excluding airfares, package holidays and education, was unchanged at 6.4% year-on-year.

"The stronger than expected UK inflation figures provided some support for the pound," says Hann-Ju Ho, an economist at Lloyds Bank.

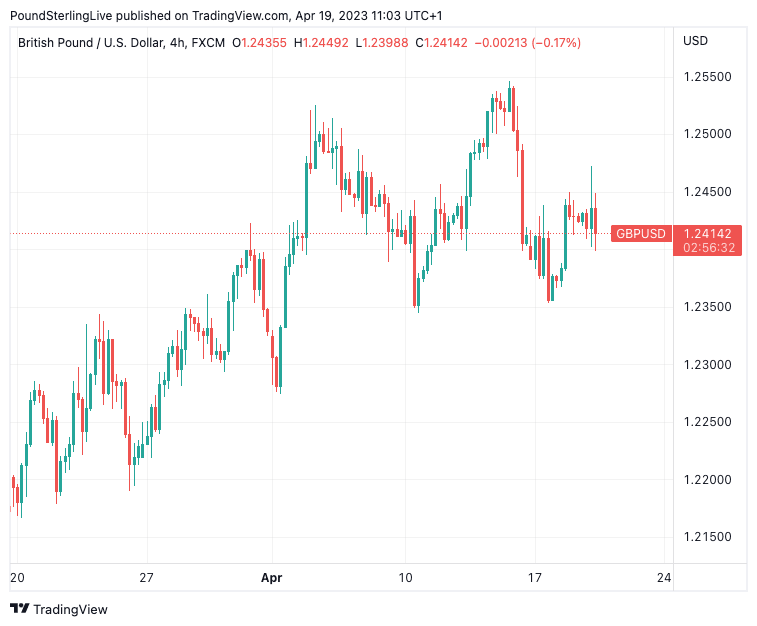

Above: GBP/USD at four-hour intervals, showing an uptrend, but also a struggle to hold 1.25.

But recent FX market dynamics suggest rallies in GBP/USD above 1.25 might remain difficult to sustain in the near term, unless we see another capitulation in the Dollar complex.

Ho also reminds us the Pound's recent performance has been more mixed following a positive first quarter and the outlook could be more challenging as markets have almost fully priced in a Bank of England 25bp hike in May with conviction levels having risen after recent data.

Derek Halpenny, who heads FX research at MUFG agrees; "the market is fully priced for this now and with the Fed expected to hike in May and the ECB to hike by more over the coming months, the positive impetus from this data for the pound will likely be contained."

This would suggest the Pound-Dollar exchange rate could struggle to make any forays above 1.25 over the near term, even if technical signals remain broadly supportive.

"GBP/USD is trading above all of its key daily moving averages and is supported by an upward-sloping trendline developed since early March. GBP/USD is now circa 3% higher year-to-date and nearly 4% above its 1-year average rate. The big question is whether $1.30 trades this year or whether $1.25 is the new ceiling?" asks George Vessey, FX and Macro Strategist at Convera.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Vessey also makes the point that, ultimately, the inflation reading isn't good news for the UK economy.

"Raising rates will only aggravate the current cost-of-living crisis," he says.

For much of 2022, the Pound showed little appetite for appreciation in the wake of hotter-than-expected inflation data given its negative implications for the economy.

To be fair, this was also a time of political uncertainty as Prime Ministers changed and the market baulked at newcomer Liz Truss's big spend-and-cut-taxes plans.

Improving confidence in the UK leadership has helped steady investor sentiment and allowed the traditional relationship of 'higher inflation and interest rates = stronger exchange rate' to establish itself again.

But there remains a risk of a 2022 redux if inflation remains stubbornly high.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks