GBP/USD Rate Rises on U.S. Inflation Fall

- Written by: Gary Howes

Image © Adobe Images

Stocks rose and the Dollar retreated after U.S. inflation fell at a faster rate than investors were anticipating in March.

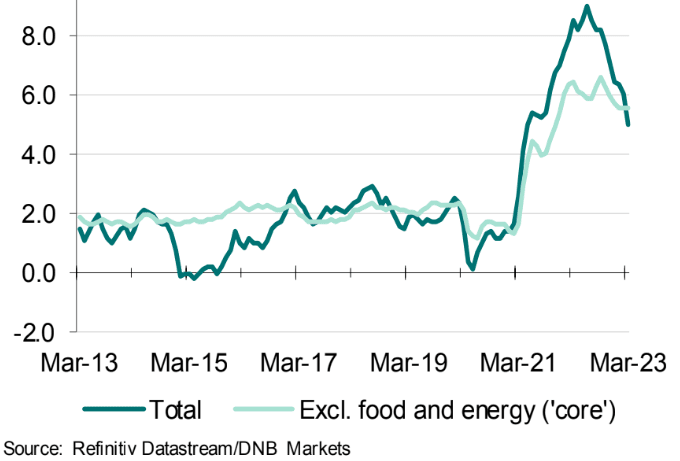

Headline CPI inflation rose by 0.1% month-on-month in March, which was half the 0.2% gain the market was expecting. This also represents a substantive slowdown from February's 0.4% rally.

This pulled the year-on-year growth down to 5.0% in March, which was less than February's 6.0% and the consensus expectation of 5.2%.

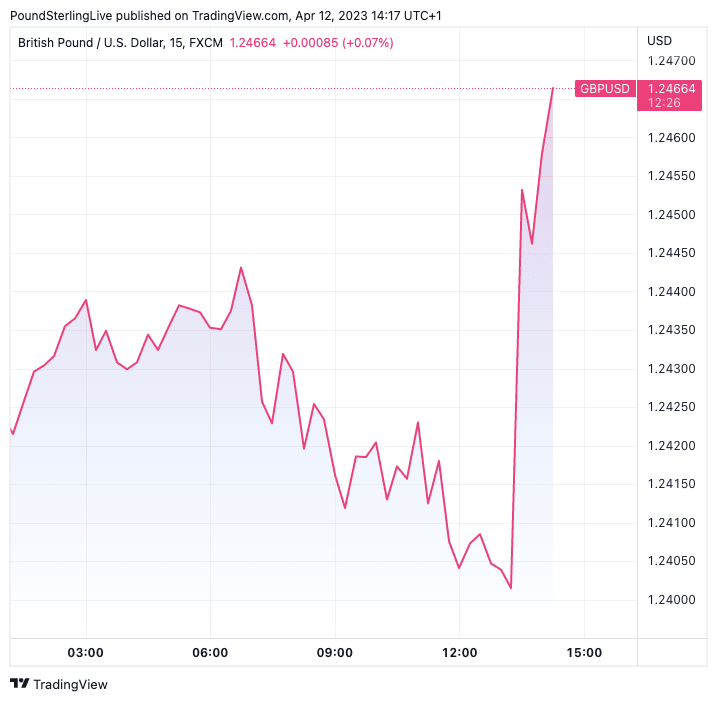

The Dollar was lower across the board in the wake of the figures: The Pound to Dollar exchange rate (GBP/USD) spiked half a per cent to 1.2464 in the 15-minute window following the release.

EUR/USD was up by a similar margin at 1.0977. "The U.S. dollar tumbled after a bigger than expected cooldown in American inflation backed the view that the Fed may only have one more quarter point rate hike on the table," says Joe Manimbo, Senior Currency Analyst at Convera.

Above: GBP/USD at 15-minute intervals. (Consider setting a free FX rate alert here to better time your payment requirements.)

Gains for EUR/USD and GBP/USD were perhaps tempered by the all-important core inflation data which offered no surprises and, on balance, keeps alive the prospect of another Federal Reserve interest rate hike.

Core rose 0.4% in the month of March, a touch lower than the 0.5% of February, but on target with consensus expectations.

The annual gain stood at 5.6%, again in line with expectations, but a touch higher than February's 5.5% reading.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Downward drivers of U.S. inflation include falling energy bills, used vehicles, restaurant bills and medical services.

Ryan Brandham, Head of Global Capital Markets for North America at Validus Risk Management says at the very least U.S. inflation is softening, even if not as quickly as the Fed would like.

"U.S. economic data has softened of late, which will please the Fed, and this latest release does nothing to dent that market theme," says Brandham.

The declines in inflation are in-line with Truflation's data, which shows the utilities, healthcare, education, and food and alcoholic beverages sectors all driving the rate downwards.

The Truflation index, which is compiled using millions of data points taken in real-time and quoted daily, already shows US inflation at 4.3% as of April 12.

"We expect next month's official US CPI number to fall in line with this level as the steady decline in house prices that has been reported by numerous independent data providers since July last year finally starts to feed through to BLS numbers," says Oliver Rust, head of product at Truflation.

Rust says now that the recent banking crisis appears to have passed the Fed might deliver another 25 basis point hike "to really make sure that inflation is dead".

"However, with a credit crunch already playing out, there may be enough drivers now to push inflation down without another hike," he adds.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Economists at ABN AMRO Bank expect U.S. core inflation to remain high over the coming months, prompting another rate hike from the Fed.

Core goods inflation is expected by ABN AMRO to continue picking up as higher wholesale used car prices pass through, while services inflation is expected to remain high as employers pass on higher unit labour costs, amid continued resilient services demand.

"Our base case is that the Fed hikes one last time, by 25bp at the May FOMC meeting," says economist Bill Diviney at ABN AMRO Bank.