GBP/USD Rate Extends Below 1.20 in Wake of Jobless Claims Figures

- Written by: Gary Howes

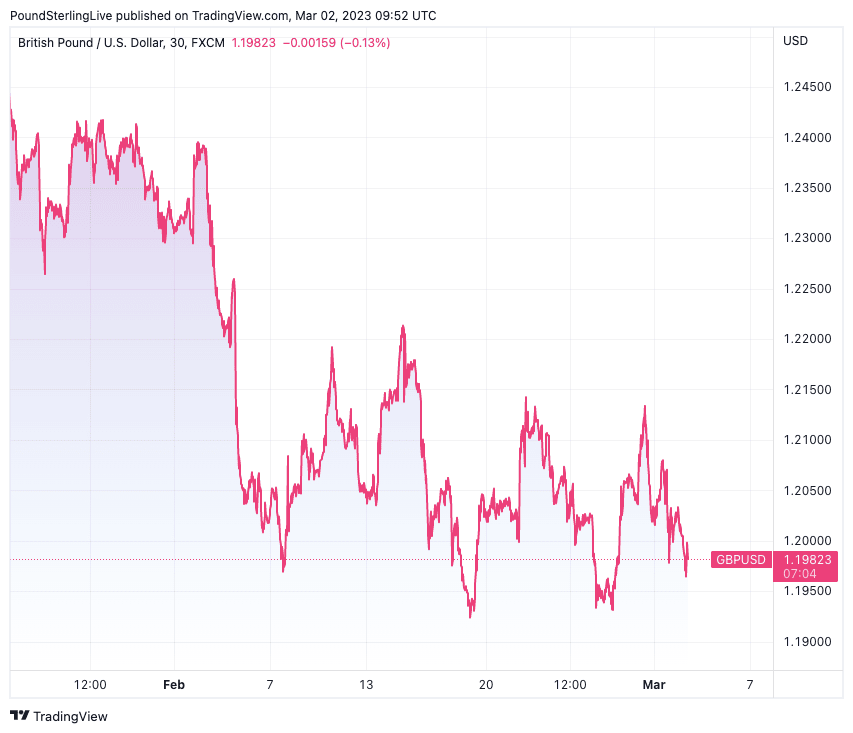

Above: GBP/USD at 30-minute intervals, showing the heavy feel to trade since the start of February. Analysts say now is not the time to fight this trend.

The Dollar's rally gained fresh impetus Thursday following the release of a labour market report showing the U.S. economy saw fewer people apply for out-of-work benefits than initially expected

Initial Jobless Claims read at 190K said the U.S. Department of Labor, less than the previous week's 192K (also revised down) and undershooting a consensus expectation amongst investors for 195K.

The result is the latest in a series of data outturns that paint a picture of a resilient U.S. economy that remains capable of churning out uncomfortably high inflation rates.

It is for this reason that investors are pricing in a 'higher for longer' peak in U.S. interest rates, which tends to aid the Dollar and penalise stocks.

The Pound to Dollar exchange rate (GBP/USD) retreated below the 1.20 level to 1.1933. The move means bank account transfer rates have now fallen into the region of 1.15-1.1690, competitive holiday and cash rates to around 1.1780 and competitive money transfer rates to around 1.1890.

The Dollar - considered a safe haven amongst currencies - is on the advance as global equity markets lose value amidst ongoing signs of stubborn inflation that would prompt central banks to raise interest rates further.

Thursday's labour market data comes ahead of Friday's key non-farm payrolls release and follows on from the release of ISM's Manufacturing PMI on Wednesday, which rose to 47.7 in February, up from 47.4 in January.

This is the first increase since August, but the headline was not market-moving.

What was market-moving, however, was the prices paid component of the survey which read at 51.3 against 44.5 in January, suggesting a sharp uptick in price pressures.

"This reflects an end to price declines for some products, especially those that have already returned to pre-pandemic levels, and is in line with the official data on producer prices for goods," says Brian Rose, Senior US Economist, at UBS.

The Dollar index appreciated and cut short an attempted rebound in the Euro above $1.07 in the wake of the release. Meanwhile, the GBP/USD exchange rate retreated back below 1.20.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar's rally comes alongside a rise in U.S. bond yields and raised expectations for further Federal Reserve rate hikes.

"This month, the manufacturing ISM's prices paid index proved to be a catalyst for a further rise in Treasury yields, up through 4%, and a further repricing of peak Fed Funds, with the market now pricing 90bp of hikes by September, about 70bp more than it did a month ago," says Kit Juckes, Global Head of Foreign Exchange Strategy at Société Générale.

Higher U.S. bond yields are both symptomatic of, and a cause of, the rising cost of money.

In short, they imply higher lending rates which are seen as a headwind to stock valuations and future growth. This boosts demand for the safe-haven U.S. Dollar.

But higher interest rates in the U.S. also attract foreign capital as investors seek out greater returns, offering another boost to the Dollar.

"The dollar index is back on the offensive this morning, dragging GBP/USD lower below the $1.20 handle, with the weekly chart formation turning bearish. A deeper drop to 2023 lows of $1.18ish is still on the cards," says George Vessey, FX and Macro Strategist at Convera.

GBP/USD peaked at 1.2447 on January 23 before succumbing to losses through February as investors realised U.S. inflation was proving resistant to falling further amidst a resilient economy.

"GBP/USD has failed multiple times to close above its 50- and 10-day moving averages over the past four weeks now, and although the currency pair seems primed to lift into the higher $1.20s at some point this year, the path of least resistance appears to the downside in the short term," Vessey.