Pound / Dollar Rate Boosted by Fed Bet Unwind

- Written by: Gary Howes

Image © Adobe Images

Some unhelpful comments by the boss of Moderna have sparked another market decline and the U.S. Dollar is amongst the losers.

The Euro, Franc and Yen are all trading higher on Tuesday, Nov. 30 after Stéphane Bancel, head of Moderna, said he foresees a "material drop" in the effectiveness of existing vaccines.

“There is no world, I think, where [the effectiveness] is the same level ... we had with Delta," Bancel told the Financial Times in an interview at the company’s headquarters in Cambridge, Massachusetts.

Oil and stock markets were all sharply lower on the comments, betraying investor fears that the pandemic is far from over and with inflation already running high there might be little central banks can do to provide generous support.

The Dollar - typically described as a 'safe haven' - has been unable to benefit from a flight to risk, a sign that investors are pushing back expectations for a Federal Reserve rate hike.

Regarding the effectiveness of existing vaccines, Bancel said he thinks "it’s going to be a material drop. I just don’t know how much because we need to wait for the data. But all the scientists I’ve talked to . . . are like, 'This is not going to be good'".

"His comments shouldn’t have been very surprising considering that the entire scientific community has been saying this for days now, but nervous traders still took the opportunity to liquidate riskier bets," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

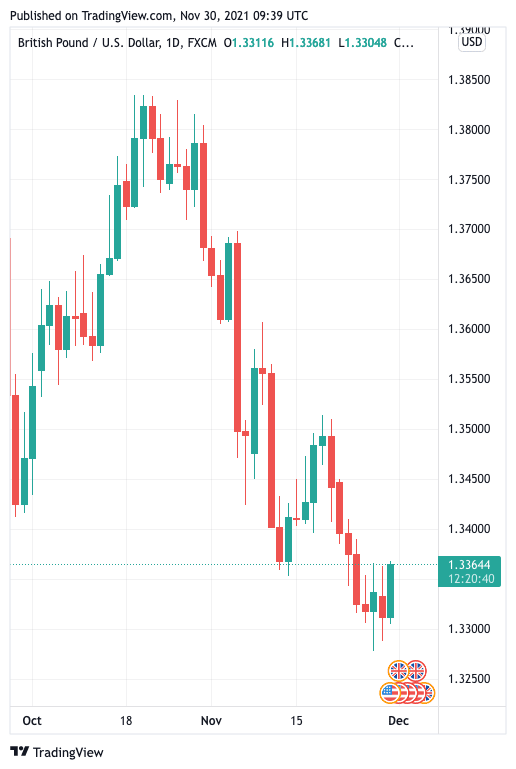

The Pound to Dollar exchange rate rose a third of a percent to 1.3360 while the Euro to Dollar exchange rate rose by two-thirds of a percent to quote at 1.1362.

Above: GBP/USD is consolidating after recent falls as shown on the daily chart.

- GBP/USD reference rates at publication:

Spot: 1.3365 - High street bank rates (indicative band): 1.2997-1.3091

- Payment specialist rates (indicative band): 1.3245-1.3298

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

"Safe haven currencies like JPY and CHF are strengthening. The dollar is mixed but the euro is largely stronger – possibly because carry trades are being unwound," says George Vessey, a strategist with Western Union Business Solutions.

A carry trade describes the investment process of borrowing in a low interest rate currency and investing in assets higher yielding assets denominated in another currency.

The Yen, Franc and Euro all have in common ultra-low interest rates with little prospect of a rate rise on the horizon.

The Dollar is meanwhile something of a 'higher yielder' in that expectations for higher rates at the Federal Reserve have meant foreign investors have bought Dollar-denominated assets to seek higher returns.

Reversing these flows amidst a desire to lower exposure in uncertain market conditions and a belief the Fed will delay hiking rates is therefore acting as a headwind to the Dollar.

"The collapse in Fed rate expectations and yields all along the US yield curve are making the euro’s extremely low rates look “less bad”. Other crosses, like EURGBP and EURAUD, show that the euro will likely show relative stability if this storm of volatility persists," says Steen Jakobsen, Chief Investment Officer at Saxo Bank.

"The overnight reaction to the Moderna CEO Bancel’s FT interview perhaps says more about positioning than anything else," says Elsa Lignos, Head of FX Strategy at RBC Capital Markets.

RBC Capital polled their clients on Monday to gauge sentiment and found half still think the path of tapering by the Fed will not be affected by the Omicron variant news.

Under a quarter looking for the Fed to delay the path of tapering.

"Investors are evenly split between those looking for no change to hikes and those looking for a delayed start to hikes, with only 1% thinking this could bring hikes forward," says Lignos.

RBC Capital have made selling the Pound-Dollar exchange rate their 'trade of the week' and are still looking for a move to 1.31, although a rally to 1.3444 would mean they are stopped out of the trade.

RBC's findings that the Dollar is lower on repositioning suggests the 'sell the dollar' narrative might not be an enduring one and the currency could soon revert to its traditional 'safe haven' status.

"While the defensive tone may seem at odds with the greenback’s hitherto ‘safe haven’ status, it really must be gauged in terms of extant positions. Being ‘long USD’ has been the popular trade for months now, and market participants taking risk off means that those long USD positions are being closed," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

If this is indeed the case the Pound-Dollar exchange rate's multi-week downtrend could ultimately extend before long.

at the same time, if the market does refind its confidence on news the Omicron variant is not a severe threat then Dollar could benefit as investors rebuild bets on a fast tapering at the Fed and subsequent 2022 rate hikes.