Pound-Dollar Rate a Coiling Spring Ahead of Fed & Bank of England Updates

- Written by: Gary Howes

- GBP/USD settles ahead of central bank updates

- Exchange rate has fallen into zone of support

- Fed dot plot update key for Dollar

- BoE's take on gas crisis key for Pound

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3660

- Bank transfers (indicative guide): 1.3280-1.3377

- Money transfer specialist rates (indicative): 1.3540-1.3590

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Volatility in the Pound-to-Dollar exchange rate has faded following the sharp falls seen on Monday with traders apparently reducing exposure ahead of updates from the Federal Reserve on Wednesday night and the Bank of England on Thursday.

Pound-Dollar fell by more than half a percent on Monday and holds ground in the vicinity of 1.3644 at the time of publication.

"Although risk aversion has abated for now, the continued safe-haven allure of the USD will limit it's setbacks while markets remain cautious, as will fears of a hawkish surprise from the U.S. Federal Reserve on Wednesday," says Richard Pace, a Reuters market analyst.

The question investors want answered is how the Fed intends to approach the ending of its quantitative easing programme, with many expecting some announcement on Wednesday with all roads pointing to a 'taper' commencing in December.

"Although domestic demand has slowed and COVID cases are rising, we think concerns about supply bottlenecks and uncertainty about the inflation outlook will keep the Fed inclined to taper sooner than later," says Juan Prada, an analyst with Barclays.

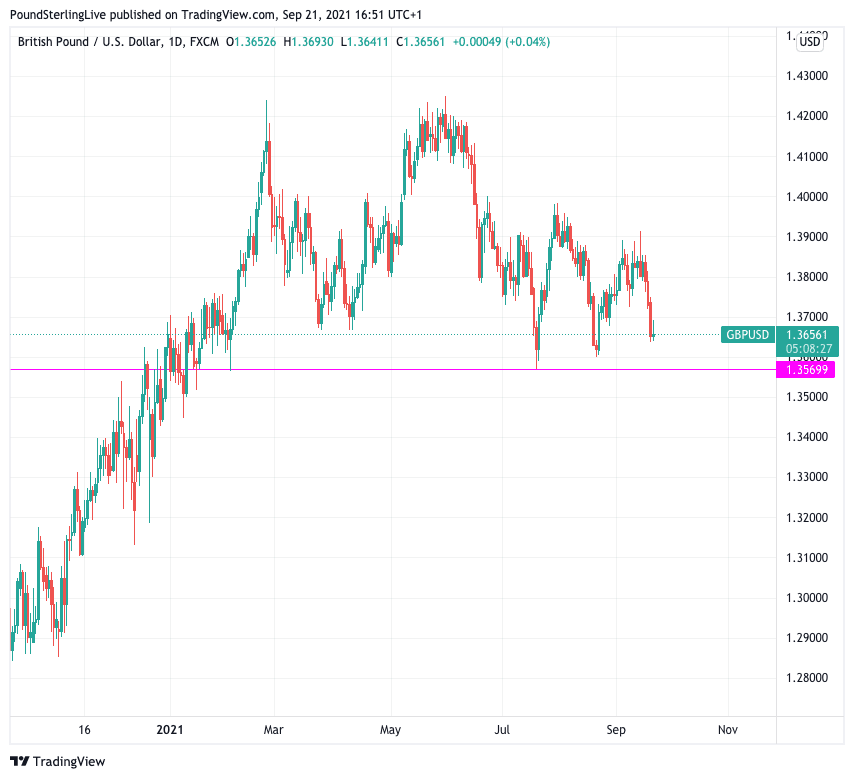

Above: GBP/USD has fallen back into a zone that has attracted support in the past.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Potentially more important to markets will be the issuance of updated forecasts from the Fed as to where members of the Committee see interest rates in coming years.

The answers to these questions ultimately rests with the Fed's assessment of a recent slowdown in economic growth.

"Investors still expect the Fed to signal their intention to taper this week, but that it won't start before the end of 2021, so the risk of a hawkish surprise and stronger USD is therefore tied to forward projections about interest rates from committee members – the dot plot," says Pace.

Consensus expects one hike in 2022 and two in 2023 and as such "it would take the dots to show two hikes in 2022, or four or more in 2023, to generate a hawkish reaction," says Pace.

There is a decent amount of uncertainty regarding the economic outlook given rising Covid-19 cases in the U.S., global equity market weakness and red hot inflation.

"However, while a hawkish surprise would be sure to reignite USD demand, its gains might be limited. The market isn't short of U.S. dollars – as it was before the June Fed meeting – and still faces the risk of a USD negative U.S. PPI miss on Thursday," says Pace.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound Sterling side of the GBP/USD equation is meanwhile likely to offer up some volatility on Thursday when the Bank of England delivers its latest assessment.

No changes to policy are expected but should more than one member of the Monetary Policy Committee (MPC) vote to end quantitative easing immediately the Pound could benefit.

In addition, a number of votes for a rate rise could also be interpreted by the market in a pro-Sterling fashion.

The Bank's September policy meeting comes amidst surging gas prices which not only threaten to push inflation higher than the Bank's current forecasts anticipated back in August but also slow economic growth.

On the one hand the Bank would want to ensure inflation expectations do not get carried away given the already elevated levels of inflation, but on the other any 'hawkish' signal on the matter might pose a headwind to growth.

"We retain our caution on GBP given the headwinds to growth from supply constraints, withdrawal of government support schemes and higher taxation. The market is already priced for two rate hikes in 2022 so the risk is that data ends up making 'tightening too frightening' as our economists like to say," says Daragh Maher, Head of Research, Americas, at HSBC.

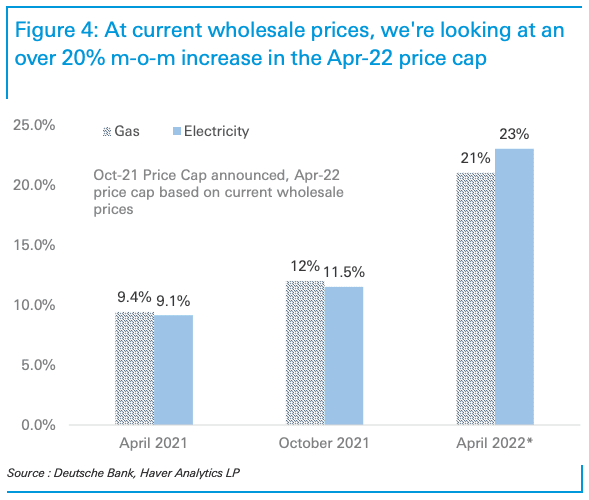

Economist Sanjay Raja at Barclays says the current gas spike could prompt a 20% uplift to Ofgem's retail gas price which could in turn result in a 60bps increase in headline inflation by April.

This would pose a decent lift to the Bank's existing inflation forecasts and question the sustainability of any argument that high inflation will prove transitory.

"The overwhelming public narrative on inflation is turning more hawkish, as inflation expectations remain set to move in one direction over the near-term: up," says Raja.

The foreign exchange market's assessment of the gas crisis is that it is a negative for economic growth, highlighted by the Pound's unquestionable underperformance over recent days.

The decline in GBP/USD and other GBP exchange rates is therefore symptomatic of a market preparing for a cautious tone to be sounded by the Bank.

The upside risk therefore is that Governor Andrew Bailey and other members of the MPC betray a growing unease about inflation and signal a rate hike in 2022 is warranted.

Any hawkish surprises could therefore help the Pound recover from recent lows against the Dollar.