Federal Reserve to Address Delta Variant, Could Threaten the Dollar's Strong Run

- Written by: Gary Howes

- Fed to address Delta-driven case rises in U.S.

- Could trigger some USD softness

- But unlikely to waver from 'tapering' plans

- USD risks skewed higher says Bank of America

Above: File image of Jerome Powell. Source: Federal Reserve.

- GBP/USD reference rates at publication:

- Spot: 1.3793

- Bank transfers (indicative guide): 1.3410-1.3507

- Money transfer specialist rates (indicative): 1.3670-1.3696

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The highlight of the week for the U.S. Dollar and global markets approaches in the form of Wednesday's Federal Reserve policy update where Chair Jerome Powell will deliver updated guidance on plans to reduce the extraordinary crisis-era monetary support for the economy.

The Federal Reserve (Fed) is tipped by analysts to confirm they intend to taper their quantitative easing programme in coming months, a necessary precursor to higher interest rates, steps that are proving supportive of the Dollar.

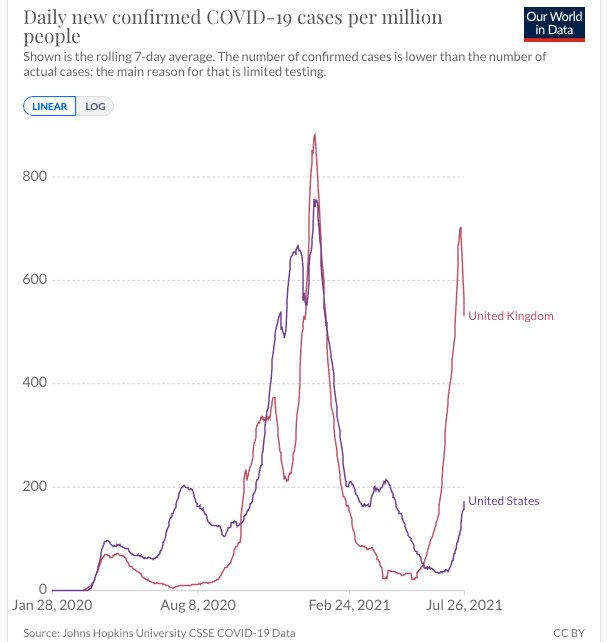

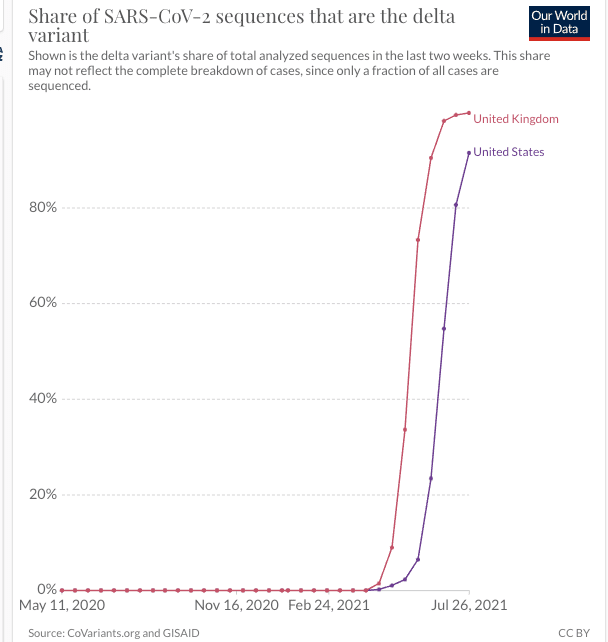

However, there are new downside risks for the currency as the Fed could be forced to address rising U.S. covid cases which come courtesy of the Covid Delta variant gaining a foothold in the country.

The Fed was responsible for a notable rise in the value of the Dollar in June and into July after striking a more optimistic tone on the U.S. economic outlook and any softening in this optimism would be pounced on by markets.

"The USD strengthened on the back of the hawkish Fed policy surprise at the June FOMC meeting. The policy announcement created an adverse market reaction by bringing forward Fed rate hike expectations thereby lifting short-term US rates and encouraging a stronger USD," says Derek Halpenny, Head of Research Global Markets EMEA at MUFG.

The July meeting coincides with the sharp rise in Covid cases across the world which has in turn stoked investor fears about global growth trends, which has proven supportive of the Dollar to date as the currency has benefited as investors sought safe-haven assets.

But, these win-win dynamics (a hawkish Fed + global safe haven demand) for the Dollar could weaken if the variant starts pushing up cases in the U.S., which it appears to now be doing.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

If the Fed were to turn more cautious on the economy's outlook due to the variant investors would likely push back their timing on the first interest rate hike, which would in turn weigh on the Dollar.

"The focus of the July FOMC meeting will be on risks from the Delta variant, inflation, and upcoming plans for taper," says Michelle Meyer, U.S. Economist at Bank of America.

Dr. Anthony Fauci, Chief Medical Advisor to the President, has said the U.S. is heading "in the wrong direction" on the coronavirus pandemic as infections surge among the unvaccinated.

Recently Mary Daly, a voting member of the Federal Reserve Open Market Committee (FOMC), addressed Delta variant concerns saying:

"Right now we want to do the following: we need to get through the fall — the delta variant being so contagious and spreading throughout the globe and actually spreading in the U.S. - that’s a risk. We just need to open the economy fully."

"While the incoming data continue to show a strengthening economy, he will likely highlight the rising downside risks from Covid in the US and globally due to the Delta variant," says Meyer. "Even a modest pullback in the willingness to engage in leisure activities could serve as a drag to the economy which has recently been spurred by reopening activity."

"Discussions around Covid risks should be viewed as dovish by the rates market," she adds.

However, analysts at TD Securities view the 'delta threat' as unlikely to cause the Fed to waiver.

"We expect Chair Powell to acknowledge ongoing Committee discussions about tapering plans, but that reaching the standard of "substantial further progress" still remains a "ways off". Powell is likely to reiterate that the recovery remains on track despite the rising Delta threat, and continue to judge the surge in inflation as "largely" transitory," says Jim O'Sullivan, Chief U.S. Macro Strategist at TD Securities.

The July meeting comes ahead of Powell's speech at the annual Jackson Hole event scheduled for the end of August, which is where significant changes to policy have been announced in the past.

The market is expecting the Fed to on Wednesday to signal that a more significant guidance on the 'tapering' of its quantitative easing programme is coming.

"The FOMC would likely also discuss potential plans for reducing asset purchases. The language in the statement could be tweaked to state something like: The Federal Reserve will be providing additional guidance about the plan for reducing the pace of asset purchases at the upcoming meeting. This lays out the roadmap for taper, stating that more details are forthcoming, as has been suggested in recent speeches from Fed officials," says Meyer.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The Fed is expected to lay out in more detail their plans to begin tapering QE. A decision to begin tapering earlier than expected in September would again encourage market participants to bring forward rate hike expectations and reinforce the USD’s recent bullish trend," says MUFG's Halpenny.

But, Halpenny warns the adverse market reaction to the June policy update though suggests that the Fed should tread more carefully when signalling tighter policy ahead.

"We expect the USD to stay bid over the summer as support from global growth and Fed policy tightening concerns remain in focus. However, we expect both concerns to ease later this year resulting in a reversal of USD strength," says Halpenny.

TD Securities expect a formal tapering announcement at the December 2021 meeting, with the announcement signalled well in advance.

While Bank of America warn that the Fed might strike a cautious tone regarding the outlook over the Delta variant, they are strategically positioned for a stronger U.S. Dollar.

"USD risks look skewed to the upside through Wednesday's Fed meeting, in our view," says Ben Randol, G10 FX and Rates Strategist at Bank of America.

For Randol it is the Fed's commitment to tapering quantitative easing that will ultimately trump any concerns related to the Delta variant.

"We expect the Fed to lay the groundwork for an upcoming taper announcement at this meeting, serving to confirm the reality of US monetary policy divergence," he says.

Bank of America continues to expect U.S. Dollar strength in the second half of 2021, predicated on monetary policy divergence, an inevitable result of US economic decoupling driven by aggressive fiscal stimulus.

"We continue to expect that USD strength will extend against lower beta FX, and in particular EUR, as central banks in these areas are likely to be constrained in their ability to normalize monetary policy," says Randol.