U.S. Dollar Bid, Stocks Turn Red After U.S. Housing Data Triggers Fed Worries

Image © Adobe Images

A strong set of housing market statistics out of the U.S. on Wednesday helped trigger a sell-off in stocks and a rise in the value of the U.S. Dollar, at a time when investors are keeping a nervous eye on rising bond yields.

U.S. New Home Sales for January came in at 4.3% against a mere 1.7% expected by the market and well above the previous reading of 1.6%.

The market appears to be in a good news = bad news stage, a counterintuitive scenario that has its roots in the belief that the Federal Reserve will have to remove its supportive stimulus measures if the economy recovers strongly.

As such, stock indices fell deeper into the red and the Dollar rallied in the wake of the data.

The Pound-to-Dollar remains largely unfazed by the numbers given Sterling's propensity to rally into all forms of news at the current time.

But against the Euro the Dollar's strength is more notable, with the Euro-Dollar rate shedding a quarter of a percent to quote at 1.2132.

- GBP/USD spot at publication: 1.4114

- Bank transfer rates (indicative guide): 1.3720-1.3819

- Money transfer specialist rates (indicative): 1.3940-1.4015

- More information on securing specialist rates, here

The data and market reaction comes at a tricky moment for investors who have struggled in the face of rising bond yields, which are also an indication of investor expectations for a better economy and higher inflation levels in the future.

The yield paid on U.S. Treasuries with a maturity of ten years has risen sharply over recent days, a sign that investors are demanding a greater compensation for holding such long-term assets in the expectation of higher inflation in the future.

Since the beginning of the year, momentum has picked up and yields have broken upwards to almost 1.4%.

Therefore, the rise in bond yields and falling markets are a function of the market expecting higher inflation rates in the future, which is a natural reaction to the observation that huge amounts will be spent by the U.S. government in coming weeks and months.

Investors expect economic activity to recover strongly in 2021 as vaccines allow the U.S. and global economy to return to normality, but inflation expectations are growing in the U.S. given the rising budget deficit used to fund President Joe Biden's stimulus plans.

"The latest move is increasingly perceived as motivated by legitimate inflation fears in the wake of a US stimulus package that will propel the US economy above potential," says Yves Bonzon, Group Chief Investment Officer at Julius Baer.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Add to this the generous money supply created at the U.S. Federal Reserve, and you can start to understand why inflation is expected to make a return.

"The US economy will experience its strongest growth in more than 30 years and, base effect helping, inflation will rise above 2% during the course of 2021. However, the Fed will allow inflation to exceed its revised target of 2% over the cycle," says Bonzon.

Rising bond yields meanwhile impact on investor behaviour, with some encouraged to exit equity bets and reinvest in fixed income (bonds), given the increasing returns on offer, combined with their traditional safety status.

"Perhaps this is a sign that current real yield levels are at or rapidly approaching their current tipping point for the broader market," says Jonathan Cohn, Trading Strategist at Credit Suisse.

The U.S. technology sector has proven particularly sensitive to the rising yields, with the Nasdaq falling 1.64% last week and is down a further 2.80% this week.

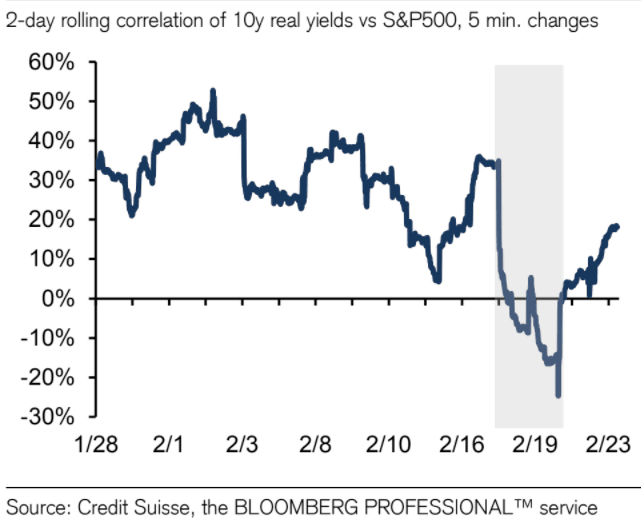

Cohn notes that the intraday correlation between real yields and equities turned negative late last week as the push higher in real yields gained momentum.

Above: Correlation between real yields and equities turned negative in last week's sharp sell-off.

"Our thesis has been that the Fed would tolerate higher yields if driven by inflation expectations or if a real yield-induced increase both reflected the “right” kind of reassessment (i.e., better growth outlook, less vaccine risk, etc.) and, crucially, did not elicit a significantly negative response in risk markets," says Cohn.

"The latter component has begun to show sensitivity," he adds.

As such, the decline in markets in reaction to rising yields could morph into a handbrake that slows the trend.

"While we retain our medium term bearish bias, we see the adverse price action in risk assets as a near term handbrake on another sharp real yield-driven leg higher in yields," says Cohn.

Federal Reserve Chairman Jerome Powell will be testifying before lawmakers for a second day on Wednesday, and investors will look to him to double-down on his message that the Fed will not withdraw support to the financial system in the near-future.

Comments made during day-one of his appearance pointed to no early Fed tightening of monetary policy or drawdown of asset purchases, even with a brighter economic outlook.

The comments steadied U.S. markets on Tuesday which had suffered sharp declines as investors tacked onto the rising yield story.

Chair Powell presents the semiannual Monetary Policy Report to the House Financial Services Committee via livestream: https://t.co/uX8mLT2CkY Watch live: https://t.co/fTApdnZ8s2

— Federal Reserve (@federalreserve) February 24, 2021

"In recent weeks, the number of new cases and hospitalisations has been falling, and ongoing vaccinations offer hope for a return to more normal conditions later this year. However, the economic recovery remains uneven and far from complete, and the path ahead is highly uncertain," Powell said in a prepared statement to the Senate banking committee.

Julius Baer tell clients that the market faces another consideration: peak liquidity. Analysts say from late March into the second quarter onwards, the base effect on the year-on-year growth of monetary aggregates will roll over.

Accordingly, the liquidity tailwind is slowly turning into a headwind which will potentially add further complications into the investment matrix.

"Debt levels have reached new records and highly financialised economies are very sensitive to negative wealth effects triggered by declining asset prices. Therefore, ensuring financial stability is the top priority of both the Fed and the European Central Bank. This will not be easy, as liquidity – the fuel supporting asset valuations – is about to reach its peak growth rate," says Bonzon.

Bonzon says the market will experience more volatility and less return as we lose the valuation expansion engine and fly on the earnings one only.