Dollar Woe Grows as ISM Services Beat Not Enough to Keep Bears at Bay

- Written by: James Skinner

Image © Federal Reserve Bank of New York

- GBP/USD spot rate at time of writing: 1.3151

- Bank transfer rate (indicative guide): 1.2791-1.2883

- FX specialist providers (indicative guide): 1.2954-1.3033

- More information on FX specialist rates here

The Dollar Index hit fresh two-year lows Wednesday as the greenback ceded further ground to major rivals after a better-than-expected Institute for Supply Management (ISM) PMI was unable to stem an exodus from the U.S. currency.

The ISM non-manufacturing PMI index confounded market expectations on Wednesday by rising from 57.1 to 58.1 for July, when the consensus among economists was for a fall to 55.0.

This ISM PMI attempts to gauge the relative monthly change in activity within the services industry, which is the engine of the U.S. economy.

"The ISM's non-manufacturing index suggested that the US economy could have remained on an upward trajectory in July, in contrast to other high frequency indicators received lately," says Katherine Judge, an economist at CIBC Capital Markets. "It is important to keep in mind that this survey could have reflected responses submitted earlier in the month, and therefore the business activity reading wouldn't have reflected the increasing deterioration seen throughout the month. The disappointing employment sub-index reading is another piece of evidence that the recovery is on shakier ground."

There had been fears that the services industry suffered as rising coronavirus infections stymied efforts to reopen the economy in some parts of the country, although economists have suggested handling the data with caution while the beat itself did little to slow an ongoing rout in U.S. exchange rates.

Dollar rates have fallen deeper into the red this week amid Federal Reserve policymakers' calls for fresh fiscal support that would inevitably draw further monetary policy expansion too, and favourable coronavirus developments including indications the disease may again be losing momentum in the U.S.

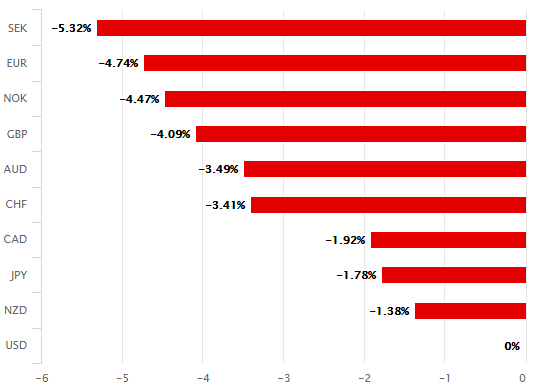

Above: U.S. Dollar performance against major rivals in 20 trading days to Wednesday. Source: Pound Sterling Live.

New infection numbers are coming in lower and lower each day of late and enough so for some analysts to conclude that declines are not simply the result of reduced testing. These are favourable developments for the U.S. economic outlook but seemingly, and for the time being at least, not the U.S. Dollar.

President Donald Trump has also continued to speculate about a possible large U.S. payrolls gain this Friday, further aiding investor sentiment that had also been lifted earlier in the session by Eurozone data suggesting that retail sales returned to pre-coronavirus levels in June.

The data is a very positive development for the Eurozone economy as well as the Euro-to-Dollar rate that was heading back toward last week's two-year highs on Wednesday. Euro gains helped send the Dollar Index fall to its lowest level since May 2018.

"Overnight, San Francisco Fed President, Mary Daly, said that the US economy will need longer support. That has seen Fed Funds futures contracts nudge up and progressively price a negative Fed Funds rate from summer 2021 through summer 2022," says Chris Turner, global head of markets and regional head of research at ING. "US-Chinese officials meet on 15 August to review the Phase-One trade deal and a modicum of Renminbi strength may soften discussions. DXY may well be entering a 92.50-94.00 trading range but expect participants to maintain a sell dollar rally mind-set."

Above: Dollar Index shown at weekly intervals with relative-strength-index measure of momentum in lower pane.

Dollar losses and the resulting gains for other currencies came concurrent with rising stock markets and increases in major economy bond yields, but also new highs for precious metals like gold and silver. Precious metals are safe-haven assets that require a lower U.S. Dollar in order to perform.

"Although the USD's decline has been at the center of the recent storm gripping the FX world (let's face it, the US has devalued the greenback), there is potentially a much bigger story brewing in precious metals. In this regard, no fiat currency has been safe," says Greg Anderson CFA, global head of FX strategy at BMO Capital Markets. "What the pandemic has done is made people think long and hard about the forces which held goods price inflation down for the last decade or two, and consider how the world might be very different in the months and years ahead. One of the most important topics of discussion in this regard is the changing nature of the globalized economy."

Central bankers are flooding economies with new currency to support their governments as they seek to satisfy simulataneous, extraordinary funding requirements in bond markets that had grown flighty before policymakers stepped up in earnest back in March.

Above: Gold CFD at weekly intervals with Dollar Index (orange) andrelative-strength-index measure of momentum.

As necessary as their actions may have been, central banks have revived previously dormant fears about what such expansionary monetary policies might mean for inflation and the value of currencies over time.

Precious metals have long been viewed as a safe-haven currency of last resort although less appreciated is often the protection offered by stock markets, which reflect the perceived future value of corporate cash flows that can adjust along with product prices in response to future inflation.

Such qualities may explain at least a part of the speed and scale of the rallies seen by stock markets across the world in recent months and which mostly all also began in March when central bankers turned the money taps on.

"The above rationale doesn't necessarily explain why EM central banks and sovereign wealth funds have also started to boost their gold allocations in recent months. Looking ahead, these investors probably see major challenges facing their own local currencies in the context of subdued growth in global foreign exchange reserves. Precious metals are providing these institutions with stores of value that could be reliable future sources of hard currency liquidity when the time is right," Anderson says.