Dollar Forecast: HSBC Bullish, Citi & Technical Studies Advocate for Weakness

Image © Adobe Images

- USD to resume its bull trend say HSBC

- Citi see cause for caution

- Charts add to bearish flavour

Strategists at HSBC reiterate their bullish stance on the U.S. Dollar, but their rivals at Citibank as well as technical studies suggest investors should be cautious before diving into greenbacks.

One of the reasons for HSBC’s bullish stance is that it argues the U.S. Dollar has already absorbed a lot of bad news, and further downside is therefore limited.

‘Bad news’ from a U.S. Dollar perspective includes an improvement in U.S-China trade relations which reduces safe-haven flows, a breakthrough in Brexit, the Federal Reserve increasing Dollar-liquidity to cover overnight lending constraints, and high expectations of interest rate cuts which deter foreign capital inflows.

“We believe that much of the shift in news (“good” for global growth but unhelpful for the USD) is now in the price as the USD is at the weak end of its channel. We also do not believe these factors point to additional USD weakness from here, and the balance of risks points to some modest recovery in the USD,” says Daragh Maher, head of strategy at HSBC in New York.

Another reason HSBC is bullish the Dollar is that it believes the market is being too pessimistic about the future trajectory of the economy. The market is pricing in 3 more interest rate cuts in 2019 according to overnight index swap rates but Maher only sees one more rate cut on October 30.

This is because HSBC believes the U.S. economy will continue to show resilience.

The Fed’s emergency easing to provide liquidity to the overnight interbank market is also likely to fall over time, reducing bearish pressure from that source.

Citi is Bearish

It is not just technical bears who see the Dollar going lower but some fundamentalists are also turning more negative.

Citibank, for example, is bearish the Dollar for fundamental reasons.

They argue domestic data has not been very positive recently and suggests evidence the slowdown in manufacturing may be infecting the wider economy.

They cite recent falls in retail sales and existing home sales as evidence for a wider malaise gripping the economy.

Citibank also expects further interest rate cuts from the Fed, unlike HSBC.

What’s more, the Fed has more amplitude to cut interest rates than the ECB, where rates are already too low, and any further cuts could cause self-defeating damage to the banking system.

This should help EUR/USD higher and given the pair is the main component of the Dollar Index, pressure it lower.

Citi also notes how the IMF is pessimistic about the trajectory of the U.S. economy and if their prognostications come true this could weigh on the currency.

At the recent 2019 IMF-World Bank Annual Meeting “participants noted that USD outperformance is receding,” says Citibank.

There is even talk of the US “catching up with global weakness” as if its period of anti-cycle exceptionalism is fading.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Finally, recent discussions amongst world leaders and policymakers about the overreliance of the world financial system on the Dollar, due to its status as the global reserve currency, and its use in commodity trading, suggests impending global regulatory shifts.

This is especially likely as perennial Dollar over-appreciation tends to cause trade imbalances and the U.S’s historically high trade deficit which were factors that triggered the trade war.

Indeed, U.S. president Donal Trump has complained on more than one occasion about the overvalued Dollar.

One way to help would be to reduce the world’s reliance on the greenback.

“Discussion of reducing reliance on the US and USD in the international system now also appear commonplace with several highlighting that the desire to diversify could be difficult to reverse and could have more serious consequences in the long run,” concludes Citibank.

Technical Signals of Caution

Yet despite these fundamental arguments the technical picture - which analyses price action - has deteriorated significantly and is telling quite a different story.

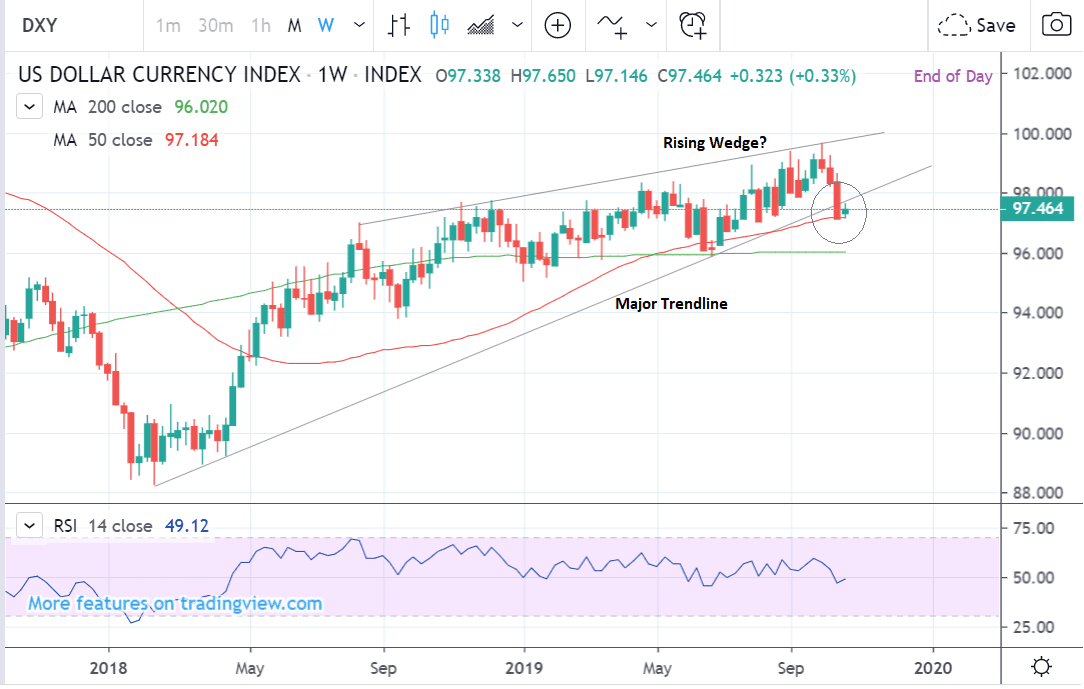

The graveness of the situation for USD is probably best expressed by the weekly price chart of the Dollar Index (DXY), which is an index that measures the performance of the broader Dollar via a basket of the major Dollar exchange rates.

The main point of interest is the break below the major trendline which has occurred last week (circled) which is an extremely bearish sign.

The main reason it is so important is that the trendline is old - it dates back to the start of 2018 - and that increases its significance.

Another reason is that the break represents a weekly close below the trendline.

A further reason is the possibility that DXY may be forming a rising wedge pattern which, if true, increases the potential for a bearish volatile break lower.

It is not all negative, though, one saving grace is that the 50-week moving average (MA) appears to have successfully broken DXY’s fall.

The 50-week is a major MA, which means it has strong chart support qualities. The fact it successfully stopped the market falling any lower at the recent break suggests the potential for it to hold out and prevent any further losses.

Whether or not it can prevent a deeper decline indefinitely and perhaps even provide the springboard for a reversal is open to debate, and the odds probably on balance favour the opposite.

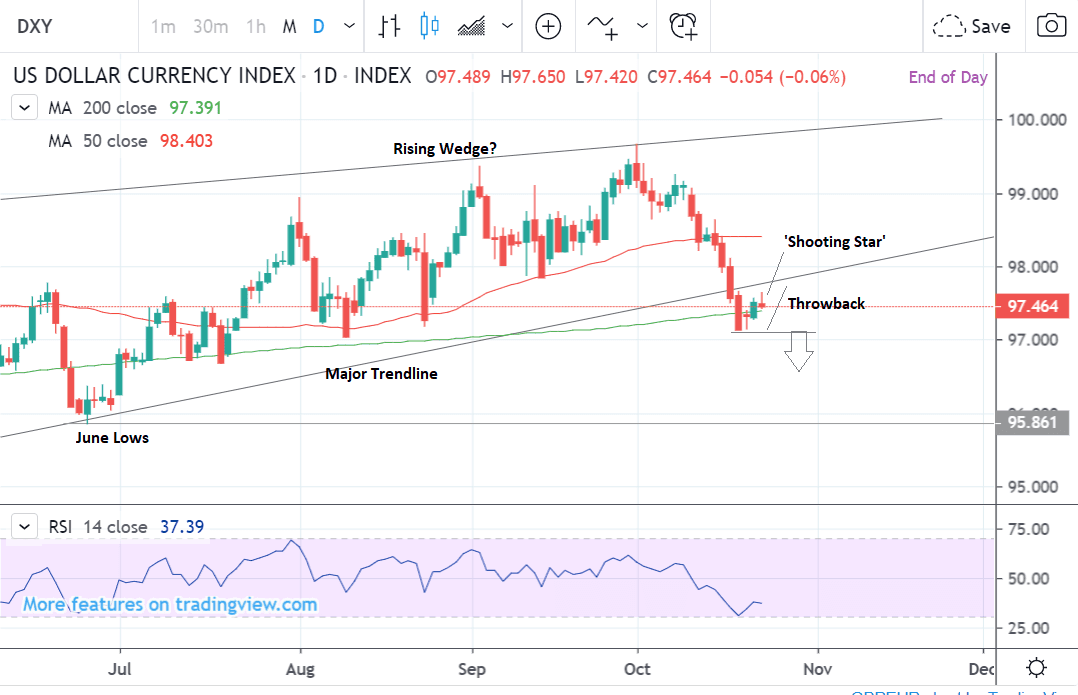

The daily chart is equally bearish. The main point to notice on this chart is how the pair is pulling back up into the trendline following the initial break.

Rather than mark a potential recovery, however, this is actually quite a common phenomenon known as a ‘throwback’.

Throwbacks are simply pauses which occur after major line breaks. They mark a short breather after which the market normally just resumes its downtrend. They also provide traders with the opportunity to enter a low-risk bearish bet at an optimal price.

The formation of a bearish ‘shooting star’ candlestick during the throwback is a sign price may be about to resume its downtrend. Confirmation would come from a break below the 18 October lows at 97.14.

A break back above 98.00 would negate the bearish stance and lead to a neutral outlook.

A downside target might be 95.90 at the June lows.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement