Hong Kong Dollar Slips but Downside Limited as USD Peg Tipped to Hold

- Written by: James Skinner

Image © Adobe Images

- USD/HKD avdvances Monday as sepculators eye USD peg.

- HKD nears 7.85 floor amid protests and U.S.-China trade war.

- Market eyes break above 7.85 but analysts say it won't happen.

- HKMA has the resources to keep USD/HKD in line with peg.

- GBP/HKD a Sterling story so long as USD/HKD near peg limit.

The Hong Kong Dollar was weaker against the U.S. greenback and Pound Monday as ongoing protests in the City after another weekend of protests in the city stoked fears for the future of the financial centre, although some analysts say that further losses from current levels should be limited.

Protesters brought the Hong Kong airport to a standstill Monday, with increased numbers reported to have joined a 'sit in' that has been ongoing since Friday, leading to hundreds of cancelled flights from what is one of the world's busiest airports. The sit in follows immediately on the heels of a tenth weekend of mass protests on the streets of Hong Kong, which saw demonstrators clash with armoured police and prompted claims by the local administration that it's witnessing "the first signs of terrorism".

Uproar at an attempt by the government of the 'Special Administrative Region' to pass a bill that would allow criminal suspects to be extradited to mainland China to face trial continues to drive the protests. Critics claim it defies a treaty agreement that was supposed to guarantee the British system of governance remains in place for 50 years after the 1997 post-imperial handover of the province back to the Chinese authorities.

Unrest in the semi-autonomous Chinese city is now stoking fears for the economy, not to mention the long-term future of its place in the world as a financial hub that connects the eastern and western hemispheres, which has put downward pressure on the currency.

The USD/HKD rate was quoted at 7.8460 Monday, close to the 7.85 ceiling imposed by the Hong Kong Monetary Authority (HKMA), a level the exchange rate has stalked repeatedly in the last 18 months.

"HKMA appears to be using a combination of spot intervention and HKD liquidity management to keep "market pressures" from forcing a breach of the band's upper 7.85 bound. Lower USD rates over the course of 2019 have also done their part. But what intrigues us the most is the tendency for USDHKD to keep bouncing back up towards the top of the band, despite HKMA's efforts," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: USD/HKD rate shown at daily intervals.

Hong Hong maintains a "linked exchange rate system" that has been in operation since 1983 and requires the USD/HKD rate to remain below 7.85 at all times and above the 7.75 threshold, with the gap between the two know as the "convertability range".

After 36 years the system is the most succesful example of a currency peg, although the upper bound of the permissible range has been tested repeatedly since the beginning of 2018 and some have questioned whether that level is sustainable, escpecially in light of growing economic pressure on China.

"You could argue that, due to trade and economic links, the natural path for the HKD is to track the RMB lower. There is some truth to this. But by and large, the main tensions facing the peg are geopolitical in nature," says BMO's Gallo. "Hong Kong's currency board arrangement with the USD is not being rocked by the traditional sort of "peg pressure".

China's Renminbi has ceded ground to the Dollar this year, pushing the USD/CNH rate up 3.3% and auguring suspicions among analysts that the world's second largest economy could be contemplating allowing its currency to depreciate in order to offset U.S. trade tariffs, which are as high as 25% on some products.

Meanwhile, the U.S. Dollar has pushed on to new multi-year highs in 2019 as the Federal Reserve's high interest rate acts like a magnet for yield-hungry investors and the greenback's safe-haven quality draws those who're simply seeking a safe harbour to moor up in

Many say this should mean depreciation for the Hong Kong Dollar too, even without the protests that risk damaging international perceptions of business-friendly stability and relative freedom from the overbearing hand of Beijing.

BMO's Gallo says the HKMA has the necessary resources to ensure the USD/HKD rate doesn't go any higher than Monday's level, while economists at BNP Paribas have said speculators betting on a further rise in the exchange rate are bound to "get burned".

"Hong Kong's current account surplus is huge, and HKMA's USD reserves are more than 200% of the monetary base," says BMO's Gallo. "If (a big if) Hong Kong does eventually abandon the currency board arrangement with the USD, the geopolitical factor for doing so will probably outweigh the economic factor."

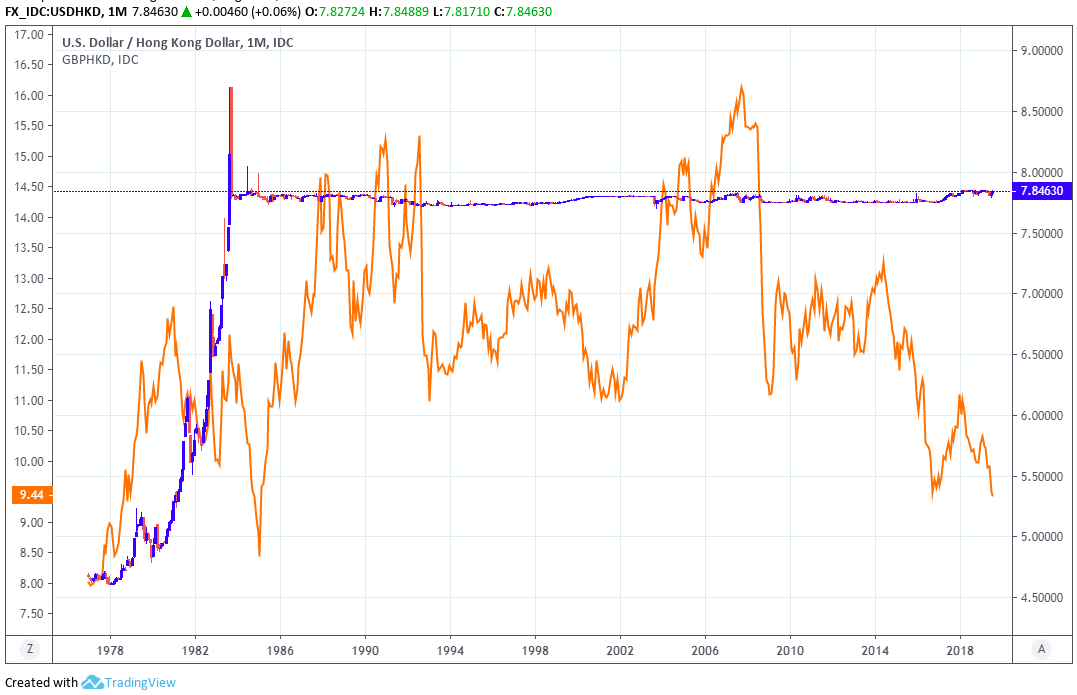

Above: USD/HKD rate shown at daily intervals, alongside GBP/HKD rate (orange line, left axis).

The HKMA said last week that it had $448.5 bn in foreign exchange reserves, which are equal to more than seven times the entire amount of currency in circulation in Hong Kong. Those reserves are greater than the size of the Hong Kong economy and are equal to around 47% of so-called M3.

M3 is the broadest measure of money because it includes not only notes and coins, but also the short and long term balances of the banking sector which serves not only Hong Kong, but also many international companies doing business in China.

As a result, the HKMA has significant amounts of U.S. Dollars that can be sold in order to keep the USD/HKD rate below 7.85. This should mean there's very little upside left in exchange rate, and only downside. The same cannot be said for the GBP/HKD rate however.

There is no peg to the Pound for the Hong Kong Dollar. This means the future path of that exchange rate will be dictated mostly by Sterling for as long as the USD/HKD rate remains near to Monday's levels, because the former is effectively the GBP/USD rate divided by the HKD/USD rate.

"Speculators have been selling the HKD since last year, pushing the HKD-USD exchange rate to the weak side of the convertibility range. Such situations have occurred many times over the peg’s 36-year life and have always ended the same way – the HKD peg holds firm and the speculators get burned," says Chi Lo, an economist at BNP Paribas. "It’s a mystery to me why speculators would want to pick a fight with a currency backed by persistent capital inflows."

Lo says the Hong Kong Dollar has been backed by a "twin surplus" since 2003, which is comprised of a budget surplus for the government and a current account surplus, which arises from the combination of a budget surplus and a trade in goods and services surplus among other things.

That means the tide of capital flows is constantly moving against the speculators who might be betting the USD/HKD peg breaks, even before the HKMA gets to using its foreign exchange reserves in order to defend the peg.

"The HKMA will not cede in the face of selling pressure but speculators seem to have no clue about this," says BNP Paribas' Lo.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement