Pound Sterling's 'No Deal' Losses Likely Bigger than the Market Expects says Pantheon

- Written by: James Skinner

© Gage Skidmore, accessed Flickr, CC license.

- "No deal" losses likely larger than market expects say Pantheon.

- Odds of 'no deal' imply 30% probability, more downside for GBP.

- But Pantheon assumes orderly exit in October, GBP recovery.

- MUFG sees weak growth, BoE outlook hurting GBP in Autumn.

- Warns risk of a general election is mounting, could hurt GBP.

Pound Sterling's losses in the event of a 'no deal' Brexit are likely to be much more severe than the market currently anticipates, according to new analysis from Pantheon Macroeconomics, one of the UK's top forecasters.

A new Reuters poll of institutional analyst forecasts showed this week the market expects the Pound-to-Dollar rate to fall as low as 1.17 if the UK left the EU without an agreement on October 31, and that it would settle into a 1.17-to-1.25 range during the ensuing month.

"Such a downshift now looks easily within reach," says Samuel Tombs, chief UK economist at Pantheon. "Sterling already has dropped to $1.26, from $1.30 at the end of April, merely in response to perceptions that the likelihood of a no-deal Brexit has increased."

The Pound has fallen steeply since the beginning of May as the UK political backdrop turned from bad to worse for those hoping the country would make its exit from the European Union without hitch, with outgoing Prime Minister Theresa May's resignation marking a step-change in the pace of losses.

May resigned following repeated rejections of her exit agreement by MPs, two extensions of the Article 50 window and a hardening of positions on both sides of the Brexit divide in parliament as well as the country. The odds of a 'no deal' Brexit have since been slashed.

"Since April, the implied probability of a no-deal Brexit this year on betting exchange Betfair has doubled to 30%. This suggests that sterling would drop all the way to $1.05, if no-deal was 100% priced-in, or would rise to $1.34 if no-deal was no longer a risk," Tombs writes, in a research briefing.

Above: Pound-to-Dollar rate shown at monthly intervals.

Tombs has measured the pace of decline in the Pound alongside the increase in probability of a WTO exit to calculate fresh estimates of exactly where the British currency would end up if a negotiated exit is not ratified by October 31 and either the EU refuses a further extension of the negotiating window or one is not requested.

He says the Pound could fall all the way to 1.05 against the Dollar in that scenario, which would mark the lowest level for the Pound-to-Dollar rate since February 1985. The Pound-to-Euro rate is expected to fall to parity which, although a long-held and common forecast, would be a record low for Sterling.

However, the top forecaster actually says the Pound-Dollar rate will finish 2019 at 1.32, close to the level he says will prevail if 'no deal' risk is completely eliminated. That suggests Pantheon is banking on an orderly EU exit.

Above: Pound-to-Euro rate shown at monthly intervals.

Pantheon's forecasts are underwritten by an optimism about the outlook for the Brexit process, although that positive psychpology is not shared by the currency team at Japan's MUFG, which is the world's fifth largest bank and a significant foreign exchange dealer.

"Considerably weaker” than expected growth is increasing pressure on the BoE to shift to a more dovish policy stance following the lead of other major central banks," says Lee Hardman, an analyst at MUFG. "The darkening UK growth outlook and increasing likelihood of looser BoE policy is reinforcing our dovish outlook for the pound heading into the autumn period."

IHS Markit surveys of the manufacturing, construction and services sectors suggested this month that UK economic activity slowed sharply in June. Those figures follow monthly GDP data that showed the economy contracting by -0.4% in April, after a 0.5% expansion in the first quarter.

Many say this means the economy probably either stagnated or contracted in June, which is bad news for the Pound and Bank of England (BoE). BoE Governor Mark Carney acknowledged the recent slowdown in a speech this week, as well as the deteriorating condition of the global economy.

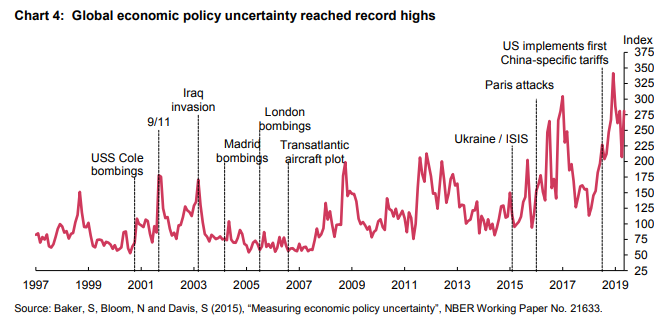

Above: BoE graph showing estimates of market uncertainty over interest rates, shown as an index.

"The steady deterioration in demand with exceptional weakness in construction and manufacturing following Brexit-related stockpiling in Q1, and an unusually thin majority of services companies reporting rising activity suggests that the slowdown is likely to prove more persistent," Hardman says.

Carney told his audience that a "strong labour market" and inflation at the 2% target means the Bank of England should focus on its medium-term inflation outlook rather than fretting too much about the current condition of the economy.

However, he was also left with little choice but to acknowledge the outlook for price pressures would itself be undermined by slowing growth in both the global and UK economies, which is undermining the BoE's long-held contention that UK interest rates will need to rise in the coming years.

It's impossible for analysts to reliably say exactly where Sterling will have stood this July if not for the BoE's mantra of steadily rising interest rates in the years ahead, but what is certain is that abandoning the narrative in the current environment would hardly be good for the British currency.

"With Brexit uncertainty set to remain elevated in the coming months as well, we expect the pound to weaken further. An FT report today entitled “”Conservative MPs ready themselves for snap autumn election” highlights why uncertainty is set to remain elevated," Hardman says. "If the polls remain at similar levels in the autumn it would be big gamble for the new PM to call a general election to strengthen their mandate, although they may have no choice if the parliament stands in the way of a No Deal Brexit."

MUFG forecasts the Pound-to-Dollar rate will end 2019 at 1.2750, which is only a short distance above Friday's 1.2550 level.

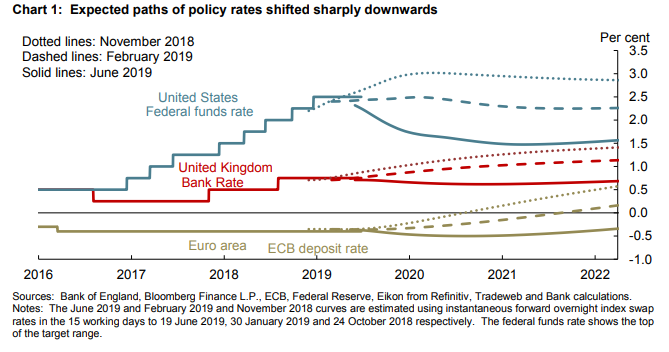

Above: Market expectations of UK, U.S. and ECB interest rates.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement