Pound-to-Dollar Rate on Course for New Lows after Breaking the Back of its Uptrend

- Written by: James Skinner

© IRStone, Adobe Stock

- GBP cedes key trendline to USD, more losses ahead says Commerzbank.

- GBP on course for Dec 2018 low against USD but could go even lower.

- Price action comes with Boris Johnson in 1st place to succeed PM May.

- Uncertainty over Johnson's 'no deal' Brexit policy still weighing on GBP.

The Pound-to-Dollar rate is on course for a return to the flash-crash low set on New Year's Eve, according to analysts at Commerzbank, who say the exchange rate has now broken the back of a shallow uptrend marked out on the charts between January 2017 and the present day.

Sterling has ceded ground to a stronger Dollar this week and in the process, conceded a key threshold that stood between the Pound and lower levels that have rarely been seen in modern times. The British currency has now handed back to the Dollar what was, in February, a five percent gain for 2019.

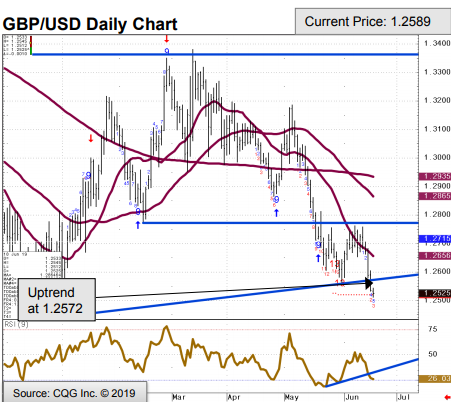

"GBP/USD has eroded the 2019 uptrend at 1.2570 and looks set for further losses to the 1.2444 December 2018 low. The market now stays directly offered below the 7 th June high at 1.2763," says Karen Jones, head of technical analysis at Commerzbank.

Above: Commerzbank Pound-to-Dollar rate chart showing technical indicators.

The Dollar has rebounded from an earlier trough over week as it gained support from 'safe-haven flows' associated with an escalation of tensions in the Middle East as well as a retail sales report that appeared to suggest the U.S. economy is in better shape than some analysts had thought.

But Sterling has not been without its own problems though, as the Conservative Party leadership election goes on and is increasingly seen as likely to install a Brexit-supporting Prime Minister in 10 Downing Street.

"It will need to regain the February low at 1.2772 on a closing basis in order to alleviate immediate downside pressure and avert further losses to the 1.2444 December 2018 low. This is the last defence for 1.2108, the 78.6% retracement of the move up from 2016," Jones warns, in a note to clients Tuesday.

Above: Pound-to-Dollar rate shown at daily intervals.

Jones has advocated that institutional clients of Commerzbank sell the Pound-to-Dollar rate at 1.2555 and bet on a continued fall over the coming days and weeks, although she's also suggested walking away from the trade if the market rises above 1.2635 in the interim.

She had been betting on an increase in the Pound-to-Dollar rate for a number of weeks until Tuesday, although she reduced the size of her bet when the market reached 1.2750 last week. Now, the outlook has turned sour.

Jones says Tuesday's fall below the 1.2570 level means Sterling will spend the next one-to-three weeks trending lower toward 1.2444, at which point the exchange rate would be in danger of a further slide to 1.2108 over the subsequent two months or so.

Above: Pound-to-Dollar rate shown at weekly intervals.

Tuesday's call from Jones comes just hours ahead of the second round of voting in the Conservative Party leadership election, which is intended to find a replacement for the outgoing Prime Minister Theresa May.

Boris Johnson, a former foreign secretary in Theresa May's cabinet, is running a country mile ahead of his nearest rivals in the parliamentary balloting process. There are seven candidates that will be whittled down to just two over the coming days, with the final choice taken by party members.

Johnson, who also led one of the Brexit-supporting referendum campaigns, has told other MPs he intends to renegotiate Theresa May's withdrawal agreement with a view to having the EU drop its insistence on the 'Northern Irish backstop', but has also said he'll take the UK out of the EU without any kind of agreement if it refuses.

The UK parliament has rejected the EU withdrawal agreement, which the EU says is the only deal available, on three occasions. If the EU won't compromise with a new Prime Minister and parliament continues to reject the new treaty, then there are few other options available to a government determined to deliver on the referendum result.

"We expect GBP to stay under pressure in the near term as Tory leadership favourite, Johnson, retains his stance of taking the UK out of the EU on 31 October – with or without a deal. This should be the story at least until he secures the keys to 10 Downing Street when Tory members return their ballots by 22 July," says Petr Krpata, a strategist at ING Group.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement