Pound-to-Dollar Rate Week Ahead: Correction Lower Possible, but Outlook Heavily Reliant on Brexit Negotiations

Image © Adobe Stock

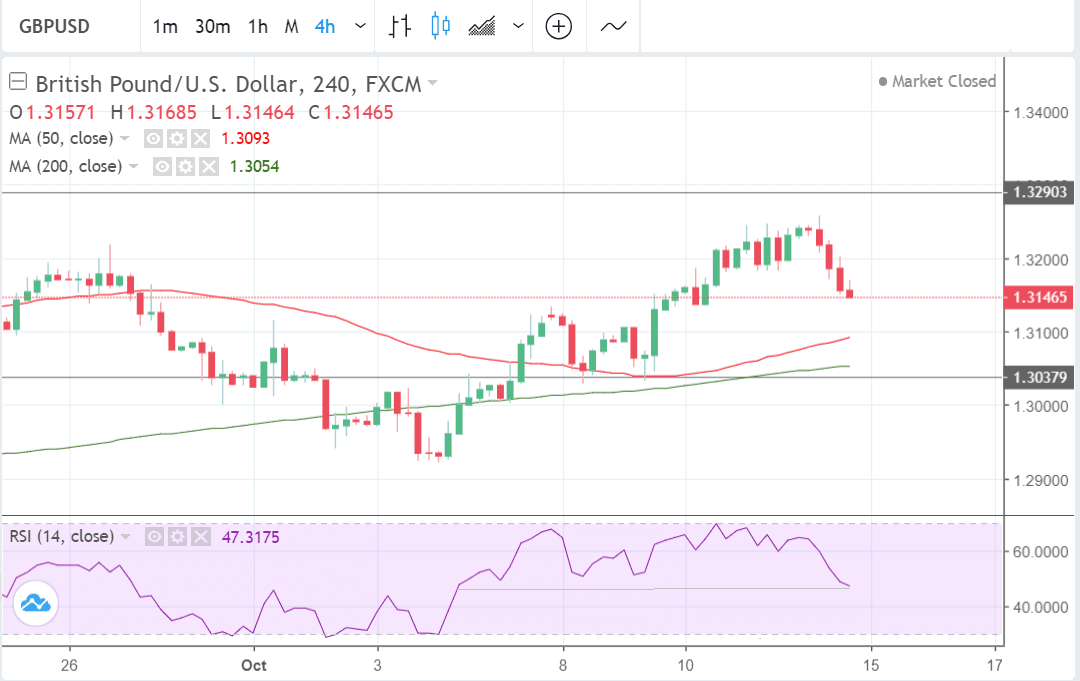

- GBP/USD correcting back within its uptrend

- Likely to resume higher after pull-back hits support zone in 1.29/30s

- The Pound will take its cue from Brexit news and the US Dollar from retail sales data

The Pound rose marginally against the U.S. Dollar last week after Brexit uncertainty eased following reassurances that the U.K. and E.U. were close to formalising a withdrawal agreement.

The pair was also helped higher by U.S. Dollar weakness as stock markets around the world sold off on fears rising interest rates in the U.S. could stymie growth.

The pair ended the week only 24 points higher than it started, however, as disappointment on Brexit set in later in the week amidst no solid news being released.

Overall the pair had a volatile roller-coaster ride within a 2-cent range between 1.3028 to 1.3258.

The daily chart below shows how the pair weakened steeply on Friday, in what looks like a potential threat to the short-term uptrend.

It is still too early to say if the pair has reversed trend. The 4hr chart shows four long red down-bars in a row, and the down move is steeper than the preceding up move. It certainly looks like it could continue falling in the week ahead but the broader trend since the August lows is bullish and intact so the odds still favour an eventual recovery and extension to the upside.

We, therefore, expect any weakness to be short-lived and to be followed eventually by a resumption of the uptrend.

The charts are showing a major support zone in the 1.2980 - 1.3040 area and this could be where the exchange rate reverses and starts moving higher again.

A move down, possibly to the support zone, followed by a rebound back up to the 1.3290 level where the R1 monthly pivot is located is forecast initially, and then after that a possible break higher in new territory above.

A rise above the previous September highs at 1.3299 would probably signal a continuation higher to a target at 1.3500.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The U.S. Dollar in the Week Ahead

The most important data release for the Dollar in the week ahead is probably retail sales data which is expected to show a 0.6% rise in September - up from the -0.1% in August.

Although some "interest-rate sensitive" portions of the economy appear to have slowed down recently, such as auto-sales which accounts for one-fifth of all retail sales, the majority of sectors have continued to grow.

There may also be increased spending following the aftermath of Hurricane Florence as well.

"The balance of data still suggests that consumer spending will be supportive of above-trend GDP growth in Q3. Consumer confidence and small business optimism remain a shade off of all-time highs. With interest rates rising, consumers still see no time like the present to spend, and we expect retail sales to rise 0.6% in September," says a note from Wells Fargo detailing their expectations for the coming week.

If the data is strong it may help dismiss growth fears linked to the recent sell-off in the US stock market and lead to an appreciation in the Dollar.

Industrial production data for September is out on Tuesday at 14.15 B.S.T. Growth was particularly strong in August the question now is can the trend continue in September?

"On Tuesday attention will shift to the industrial sector, where production was up a solid 0.4% in August. More impressive was the 4.9% year-over-year gain, which marked the strongest pace since 2010," say Wells Fargo. The consensus estimate is for a 0.2% rise month-on-month.

The main releases on Wednesday is housing data. Also out is the minutes from the Federal Reserve (Fed) meeting.

Building Permits are expected to show a 1.28m rise in September from 1.25m previously when released at 13.30; and housing starts are forecast to fall -4.5% after rising 9.2% in the previous month.

Wells Fargo sees signs the housing market may be slowing down but are overall optimistic about the sector's longer-term trajectory.

"We still expect homebuilding to improve over coming quarters but have taken down the degree of improvement in our forecast. Still, the remainder of the fall could see a rebound in starts. Lumber prices have fallen significantly from recent highs, and inventories of units authorised but not yet started continue to climb," says Wells Fargo.

The other major release is the minutes from the Fed's September meeting which are expected to reiterate the same hawkish message (hawkish meaning in favour of raising rates) as the statement from the actual meeting.

Yet, interestingly, this time around it may not have the same effect on the US Dollar which may be changing its relationship to rising interest rates.

"The U.S. dollar may not necessarily strengthen this time around as the hawkish outlook could lead to further losses on Wall Street and that would drag on the currency," say brokers XM.

Other key releases which could affect the Dollar in the week ahead include the New York Empire State manufacturing index in October (Exp 19, Prev 19); the Philadelphia Fed manufacturing index (Exp 20.5, Prev 22.9); and commentary from Fed's Bostic, Kaplan (Friday) and Bullard (Thursday).

The Pound: What to Watch

Brexit headlines will continue to drive the Pound in the week ahead.

U.K. Brexit minister Dominic Raab will travel to Brussels on Monday for a meeting with E.U. chief negotiator Michel Barnier, probably to agree on the final proposals to put before E.U. leaders at their crunch summit on Wednesday, October 17-18.

The outcome of the summit is expected to be a key driver for the Pound in the week ahead. If there is concrete progress on a withdrawal deal Sterling is likely to surge higher; if, on the other hand, there is no progress the Pound will fall.

Analysts at FX broker XM are rather pessimistic about the possibility of a major breakthrough:

"As it is standard for all E.U. negotiations to last into the last minute, the remaining issues are unlikely to be resolved at the E.U. heads of government summit on October 17-18 and the talks will probably continue into November when a special summit is being planned."

XM adds that "a worst-case scenario would be for Prime Minister May to secure a deal that has little chance of getting approved by the British parliament."

Indeed, weekend headlines have been troubling for the Prime Minister with reports that the cabinet are being urged to stage a mutiny on May's plans.

The big problem lies with a backstop clause that would trigger if the E.U. and U.K. fail to reach a trade deal during the two year transition period. There is talk that the backstop could apply to the whole U.K. and not just Northern Ireland, as had been the original proposal.

It is believed that Prime Minister May is willing to allow this transition to last indefinitely; something fiercely opposed by Brexit supporting MPs in the Conservative party. Should a time limit be agreed the opposition to May might fade and she will be able to push legislation through parliament.

There are several major releases in the week ahead but probably the most important is broad inflation data in September, which is forecast to show a 2.6% rise compared to a year ago and a 0.2% rise compared to a month ago, when it is released on Wednesday at 9.30 B.S.T.

Core inflation, meanwhile, is forecast to show a 2.0% rise compared to a year ago.

Inflation informs central bank policy and, crucially for FX, whether they put up interest rates; these in turn impact on exchange rates. A higher-than-expected rise in inflation would increase pressure on the Bank of England to raise interest rates and support the Pound.

The other major release in the week ahead for the Pound is employment and wage data, out on Tuesday at 9.30.

The unemployment rate is expected to remain at 4.0% in August. Average pay excluding bonuses is expected to have climbed by 2.9%, and pay including bonuses to have increased by 2.6%.

Market participants will be particularly focused on whether pay has increased more than expected - if it has the Pound could rise - as this will raise the outlook for inflation.

The third major release for Sterling in the week ahead is retail sales out at 9.30 on Thursday.

Retail sales have been fairly resilient but in September they are forecast to show a -0.3% drop (from 0.3% in August) but, nevertheless, a 3.7% rise compared to September last year. A higher-than-expected result would probably support the Pound as it suggests greater growth, inflation, and higher interest rates which are usually favourable for a currency.

Finally the weekends with a speech by the governor of the Bank of England (BOE) Mark Carney on Friday, at 16.30, which has been earmarked by some as a possible time for the Uk authorities to announce progress on securing trade deal with the EU.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here