Norwegian Krone Under Pressure as Norge Bank Wavers on December Rate Hike

- Written by: Gary Howes

Image © Adobe Images

The Norwegian Krone was softer in the wake of a Norges Bank decision to keep interest rates on hold and update guidance that drew doubts on whether a December rate hike was now likely.

The decision to keep interest rates steady was never in doubt, and the Monetary Policy and Financial Stability Committee was unanimous on the decision.

But the guidance pertaining to future rate moves would be closely watched by financial markets, in particular the issue of a December rate hike.

After all, Norges Bank said in September:

"Whether additional tightening will be needed depends on economic developments. Based on the Committee's current assessment of the outlook and balance of risks, there will likely be one additional policy rate hike, most probably in December."

Now, the central bank states:

"Based on the Committee’s current assessment of the outlook, the policy rate will likely be raised in December. The Committee will have received more information about the inflation outlook ahead of its monetary policy meeting in December. If the Committee becomes more assured that underlying inflation is on the decline, the policy rate may be kept on hold."

The commitment to "may be kept on hold" opens the door to another pause.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Norges Bank is clearly having second thoughts on the guidance for December due to the drop in core inflation," says Kyrre Aamdal, an economist with Den norske Bank (DNB), Norway's largest bank.

"The market pricing of the policy rate fell a little after the announcement. Currently the markets price in roughly 50% probability for a rate hike in December, versus 60% before the meeting," adds Aamdal.

The developments ease pressure on Norway's bond yield outlook, which has, in turn, been reflected in a softer Norwegian Krone:

The Pound to Krone exchange rate has staged a recovery from today's lows at 13.5214 to 13.6050. The Euro to Krone has rallied from 11.78 to 11.865.

However, the broadly weaker Dollar post-FOMC ensures the Dollar to Krone is still in the red for the day at 11.15.

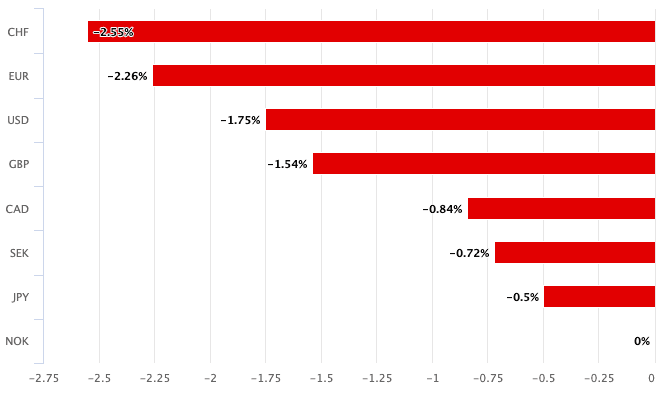

To be sure, the NOK is the worst-performing currency in the G10 currency basket for the past month, something the Norges Bank remains uncomfortable with.

DNB's Aamdal says the central bank could yet raise interest rates again in December simply in order to buffer the NOK against further losses.

Above: NOK performance over the past month.

"While the weakening of the NOK is unlikely to affect the next couple of inflation prints much, it will affect the central bank's assessment of whether inflation will remain on a downward trajectory," says Aamdal.

Norges Bank expects core inflation in October to remain close to the current level, keeping the distance to Norges Bank's forecast from September intact, but the weaker NOK could have Norges Bank opt for a hike in December.

"However, all in all, the threshold for a hike in December seems somewhat higher than we expected," says Aamdal.