Turkish Lira Could Benefit from Short-covering if CBRT Holds Rates

- Written by: James Skinner

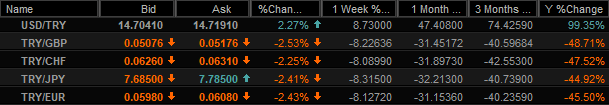

- TRY bidding for worst year on record in 2021

- USD/TRY closes in on 100% increase for year

- Reaches 14.70 as GBP/TRY looks above 19.50

- Markets eye CBRT cut, hold offers relief to TRY

Image © Adobe Images

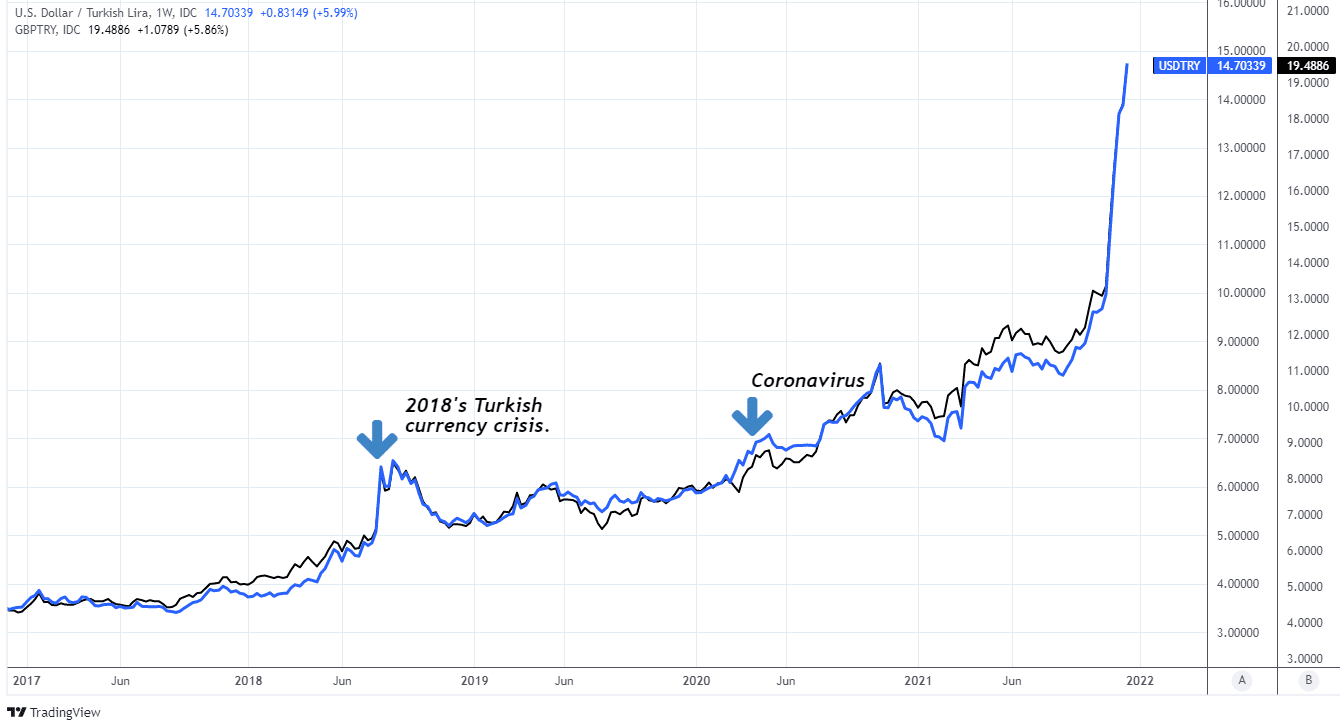

The Lira had almost halved in value against the Dollar, Pound and Euro for 2021 this week but would likely benefit if the Central Bank of the Republic of Turkey (CBRT) leaves interest rates steady on Thursday, some analysts say.

Turkish Lira losses had lifted the USD/TRY rate by 100% for 2021 on Wednesday as the lira’s losses surpassed 50% in what could be one of the Turkish currency’s worst years on record, with declines of almost five percent against many major currencies this week alone.

"The real culprit for the latest round of selling though can probably be attributed to Treasury & Finance Minister Nureddin Nebati's statement in the Haberturk newspaper that the government remains determined to not raise rates," says Kenneth Broux, a strategist at Societe Generale.

"Another 100bp rate cut is fully priced in for Thursday. A smaller cut or a surprise hold would bring the propensity of short covering gains," Broux and colleagues wrote in a Tuesday research briefing.

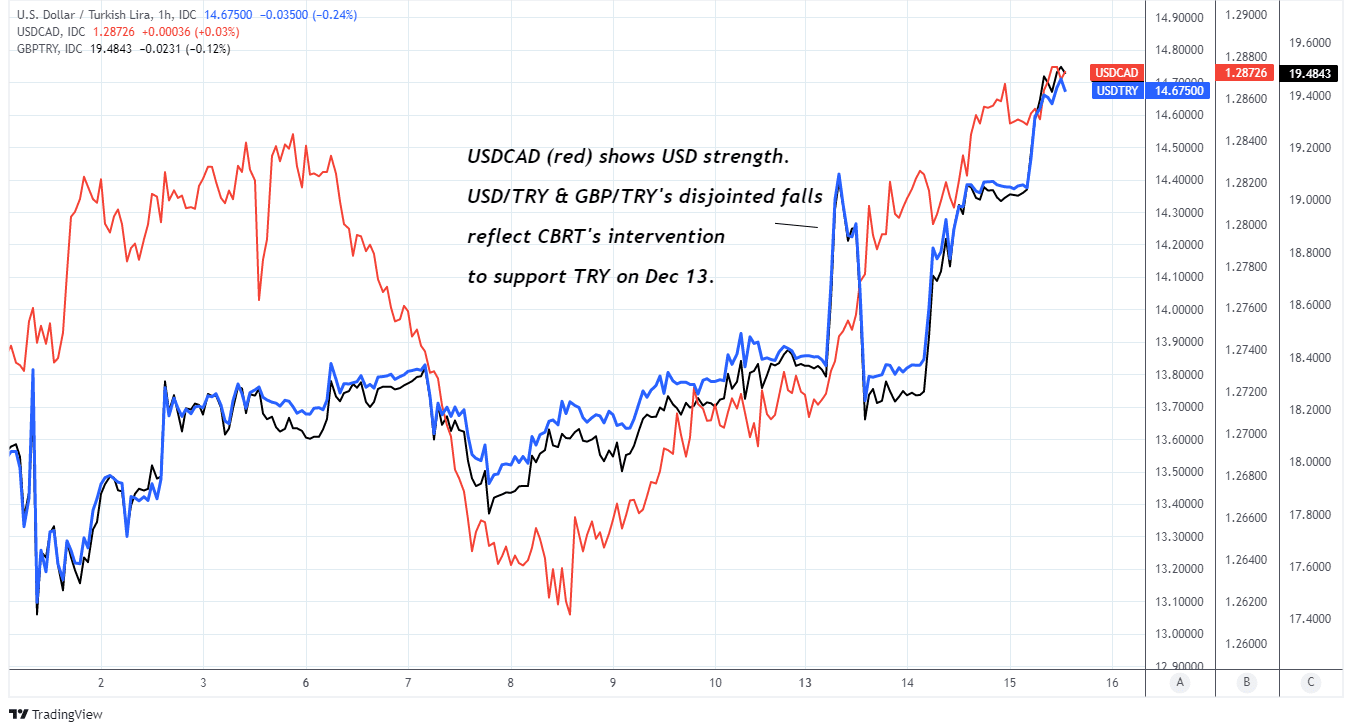

This week’s losses were immediate and elicited December’s third attempt by the CBRT to stem the decline in the currency through direct intervention in the foreign exchange market, which appeared to keep USD/TRY from a move above 14.40 for a time.

Above: Quotes and performances over various horizons for selected Turkish exchange rates. Source: Netdania Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Spot printed 14.99 high in thin liquidity – only 3 trades were done above the 14.50 level. Light volumes have gone through the market since open," says Yuliya Kryzhanovska, a trader at Credit Suisse, referring to Monday’s price action.

"Fitch stated that Turkey inflation would hit 25% in December. Bloomberg consensus stands for a 100bps rate cut while the range of outcomes ranges between 0-200bps of easing," Kryzhanovska wrote in a trading desk commentary.

S&P also lowered Turkey’s credit rating outlook from stable to negative this week although to the extent that Finance Minister Nebati’s reported remarks were the driving force behind the Lira’s losses it could be relevant that they stopped short of suggesting that a further rate cut is incoming this week.

"You will see. The economy will recover very quickly. As long as you trust us. There were also bankers at the meeting yesterday. "Trust us, believe us," I said. We will not raise interest rates. You will see that we can do this without increasing interest," Nebati told Haberturk’s Sevilay Yılman in an interview.

Nebati’s comments indicated only that the government is loath to raise borrowing costs again going forward whereas the CBRT has indicated in November, and financial markets have subsequently assumed that a further -100 basis point cut in the cash rate will be announced this Thursday.

Above: USD/TRY and GBP/TRY shown at hourly intervals alongside USD/CAD.

- GBP/TRY rates at publication:

Spot: 19.50 - High street bank rates (indicative band): 18.82-18.96

- Payment specialist rates (indicative band): 19.33-19.41

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

“Market assigned higher probabilities to unchanged rates following the recent CBRT investor call. However, we are sceptical about it. We maintain a long $ bias. On the franchise front we have seen $ buying from locals and hedge funds on this spike,” Credit Suisse’s Kryzhanovska says.

"Our APAC office saw further liquidation of TRY/JPY carry trade exposure," Kryzhanovska also said, before warning of fading interest among Japanese retail investors for buying dips in the Lira.

Analysts, investors and traders have long warned of the kinds of losses sustained by the Lira since the CBRT began to cut its cash rate from 19% in September and still widely expected this week that the bank would cut the benchmark to 14% on Thursday.

Because of that the Lira could benefit from any surprise decision by the CBRT to leave the cash rate unchanged, although it would likely take a sharp and sustained increase in interest rates to shift market thinking about the medium-term outlook for the Lira in a meaningful way.

"The USD/TRY has closed in on the 15.00 handle, as the lira slumped to a fresh record low this morning. The latest moves come ahead of the Fed and CBRT policy decisions,” says Fawad Razaqzada, an analyst at ThinkMarkets.

Above: USD/TRY and GBP/TRY shown at weekly intervals.

“Two central banks going in the opposite direction, one willingly, even if reluctantly; the other forcefully. No prizes for guessing which one is which,” Razaqzada said in a Wednesday market commentary.

The rub for the Lira is that President Recep Tayyip Erdogan effectively told the market to go and take a hike of its own when saying in a December interview with state news agency TRT Haber that Turkey would abandon the practice of courting “hot money” through high interest rates.

President Erdogan is widely perceived as being behind the CBRT’s recent interest rate cuts and is pushing Turkey into pursuit of what is billed as a new economic strategy that involves development of the economy’s export sector using low interest rates among other things.

But coming amid high and rising rates of inflation, the speculative market has been emboldened to bet heavily against the Lira, leading to heavy declines in Turkish exchange rates that merely add to the problematic levels of inflation seen in the country.

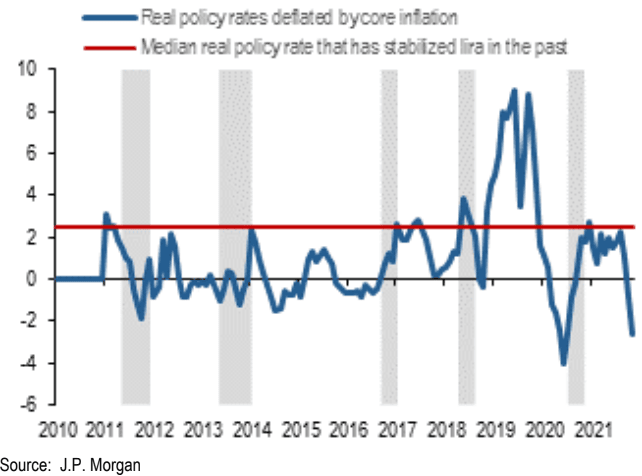

“A too easy policy against rising inflation risks was also the key concern in the late 2016/early 2017 episode. Similar to then, Fed tightening was also a key contributing factor. However, the starting point of diminished policy credibility is now worse,” says Anezka Christovova, an analyst at J.P. Morgan.

“Real rates screen much too low in comparison to the previous levels which were consistent with stabilizing the currency (Exhibit 5). A consistent feature of previous episodes of currency weakness has been that real rates had to rise meaningfully to stabilize the lira,” Christovova also said.

Source: J.P. Morgan