GBP Outlook Brightens as Productivity Growth Hits Six Year High, Sterling Seen as a 'Buy on Dips' vs. Euro and Dollar

Higher productivity should lead to higher wages which should in turn allow the Bank of England to confidently raise interest rates. And higher interest rates make for a stronger Pound.

Data from the ONS shows labour productivity grew by 0.9% in the third quarter of 2017, which represents the largest growth since the second quarter of 2011.

Labour productivity grew in both the services and manufacturing industries; services productivity grew by 1.0% on the previous quarter, and manufacturing productivity also grew by 1.0%.

The data raises hopes that wage growth will soon start accelerating as wages are seen as a function of the productivity of the labour force.

The news is good for those hoping for a stronger Sterling in 2018.

The Pound rose in 2017 as the Bank of England raised interest rates 0.25% and indicated that further rate rises were in the pipeline but the Bank of England has made the raising of interest rates over coming months and years contingent on wage growth.

Wage growth tends to push inflation higher and the Bank responds by raising rates; and when studying wage growth the Bank tends to mull over expectations for productivity growth which has disappointed over recent years.

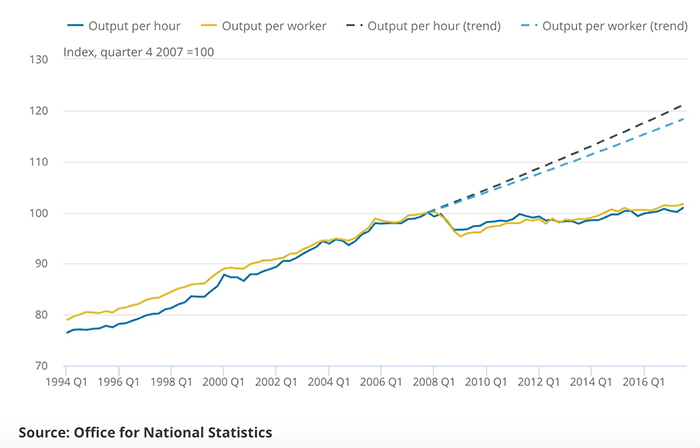

“Productivity has been a major challenge for the UK economy since the financial crisis in 2008. Quarter after quarter, we have experienced sluggish growth, but hopefully today’s figures mark a turning point for the economy," says Tom Purvis, Political and Economic Adviser at IPSE, The Association of Independent Professionals and the Self Employed.

Above: The financial crisis of 2008 triggered a flat-lining in productivity growth.

“As a result of slow productivity growth, living standards have taken a major hit with earnings not expected to reach their pre-crisis levels until the next decade. Our survey of freelancers' confidence found that day rates were under pressure, but productivity growth could ease these concerns," adds Purvis.

Evidence that productivity growth could now be accelerating are therefore encouraging for the wider economy and Sterling specifically.

"There are signs of growth within the economy and this in conjunction with rising inflation, should put the BOE in a position to be thinking about a slightly more accelerated normalisation than the one the market is currently pricing," says Joel Kruger, an analyst with LMAX Exchange.

Kruger is optimistic on Sterling's prospects in 2017 and advocates buying the currency on weakness:

"2017 was a pivotal year for the Pound, with the currency stabilizing post EU referendum, pricing out worst case Brexit scenarios. While there are still plenty of uncertainties associated with the negotiation process, we believe the path forward is one that now favors a buy on dips approach."

New figures from the @ONS show largest quarterly rise in productivity since Q2 2011. We’re investing in skills, housing and transport to improve productivity, which is vital for raising wages and making our economy fit for the future. pic.twitter.com/fknlPJqASI

— Philip Hammond (@PhilipHammondUK) January 5, 2018

Looking at the data, the service sector drove the bulk of the productivity growth and IPSE believe the ever-increasing number of self-employed people deserve credit for the important role that they play in the UK economy.

The service sector has provided many opportunities for self-employment – from cleaning positions to business consultants.

“The UK is now reaping the rewards of a flexible labour market and we hope that the Government takes note of the contribution the self-employed make to the economy – all £255 billion of it. Now is the time to get behind the self-employed workforce and continue to support them so that the UK can benefit from consistent productivity growth,” says Purvis.

The impact on Sterling is relatively muted at this juncture and we believe that markets will want to see evidence that this improvement is the start of a trend before they start buying Sterling.

Following the data we see the Pound-to-Euro exchange rate higher at 1.1247.

The Pound-to-Dollar exchange rate is at 1.3551.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.