Budget 2017: British Pound Reactions & Analyst Viewpoints

- Pound-to-Euro exchange rate: 1 GBP = 1.1258 EUR, down 0.22%

- Pound-to-Dollar exchange rate: 1 GBP = 1.3280 USD, up 0.27%

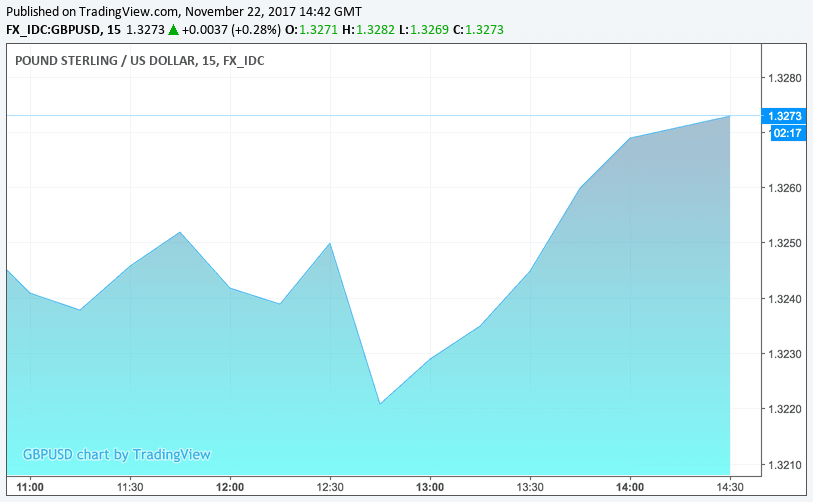

The British Pound experienced choppy trade as the 2017 budget was delivered with the currency ending the event close to where it started. See below for latest updates, reactions and explanations.

Chancellor of the Exchequer Philip Hammond delivered his 2017 budget statement to the U.K. Parliament, with credibility of what was delivered likely to have implications on the Pound.

In the aftermath of the Statement we observe Sterling to be largely unchanged having dipped minutes into the event, suggesting what was delivered was ultimately expected by markets.

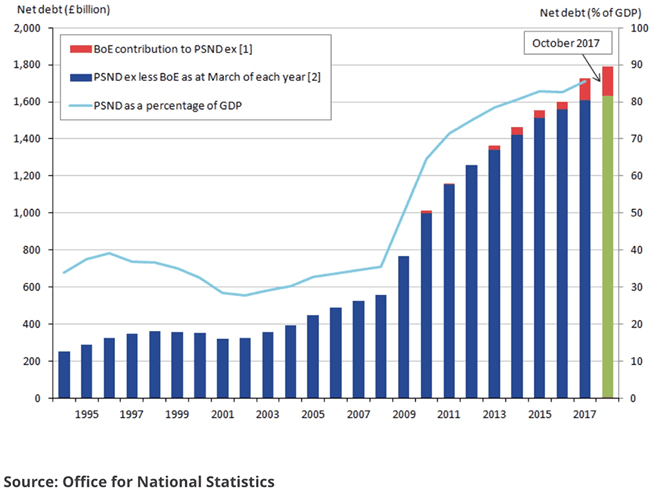

Kicking off proceedings was the presentation by the Chancellor of the latest economic and financial forecasts from the Office for Budget Responsibility that dictate just how much wiggle room the Chancellor has when it comes to spending and borrowing while ensuring the country's debt mountain stops and then starts falling.

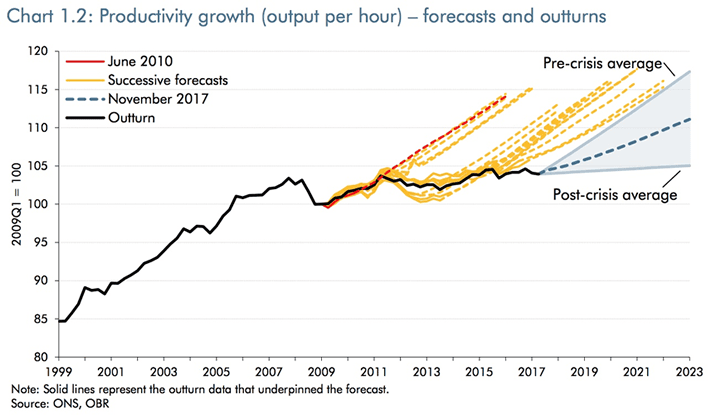

Productivity forecasts have been lowered, as was expected, which confirms the Chancellor's wiggle-room on spending will remain constrained if he is to bring the UK's debt burden down.

Above: Productivity continues to disappoint - when productivity increases pay packet increases will accelerate.

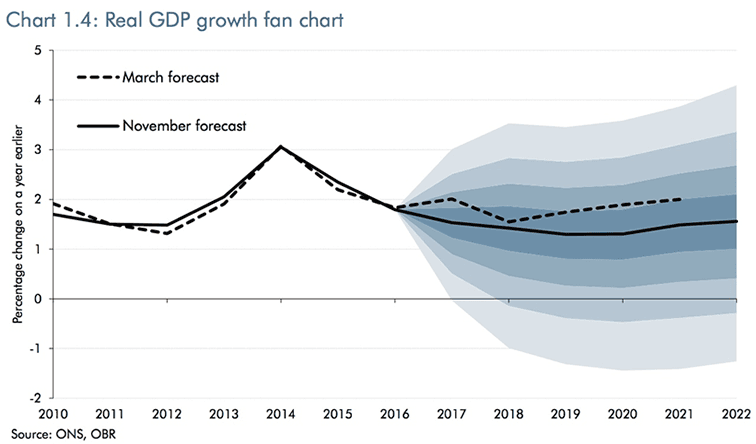

GDP forecasts are cut to 1.5% in 2017, 1.4% in 2018, 1.3% in 2019/2020, 1.5% in 2021 and 1.6% in 2022.

The decline in expected growth come as "public spending cuts intensify and Brexit-related uncertainty continues to bear down on activity," report the OBR. "The gentle improvement in underlying productivity growth and a small cyclical boost as spare capacity is brought back into use are expected to deliver slightly higher GDP growth in 2021 and 2022."

Above: UK economic growth forecasts are lowered, constricting the Government's ability to increase spending.

The OBR meanwhile expect CPI inflation to peak in the current quarter and then fall back to – and for a while slightly below – the Government’s 2 per cent target over the subsequent year and a half.

The Chancellor says borrowing is set to fall every year from now on, 86.5% will be the peak, reached in 2017, this represents "the first sustained decrease in debt in 17 years," says Hammond.

Above: The UK has a debt addiction problem.

Productivity Headache

As mentioned, productivity forecasts are lowered once more, and the Chancellor took steps to get the UK's workforce producing more.

Research & development allocations are increased; an attempt to raise productivity with £500MN going into artifical intelligence.

The Government is to increase the National Productivity Investment Fund from £25bn over five years to more than £31BN.

However, it appears the Pound took this to be a little lacklustre and fell as the breadth of Hammond's ambitions became clear.

Andrew Sentance, an economist with EY and former Bank of England Monetary Policy Committee member says it appears the Chancellor's attempts to boost UK productivity have proven lacklustre; this appears to be the obvious catalyst for the Sterling weakness witnessed mid-point.

Above: Sterling goes down as issues of productivity are considered in the first half of the budget, but then recovers on the view that this is a reasonably tidy budget from Hammond.

Finer Details

With regards to the politically contentious universal credit, a £1.5bn package to address concerns about the operation of the system has been announced, furthermore the seven-day waiting period at start of claim abandoned; new claimants will get housing benefit for a further two weeks.

If this is broadly well-received it will certainly help take some pressure off the Government.

The National Living Wage is meanwhile to increase to £7.83 from £7.50 in April 2018 - a move welcomed by the Federation for Small Business who believe this "more moderate increase takes into account the cost pressures on small firms, particularly those with tight margins."

This represents a 4.4% increase; higher than the increase in national wages, which should be inflationary.

The fuel duty rise has meanwhile been frozen, which is tipped to save commuters further money and potentially ensure inflation pressures are kept in check.

The NHS meanwhile gets an additional £10BN over the course of the current parliament; if this proves popular the Government could benefit, remember that if the budget is not well received questions will be asked of Hammond and May's future which will in turn undermine Sterling.

On housing, the Government will give local authorities the power to charge a 100% council tax premium on empty properties.

Next 5 years £44BN capital funding, loans and guarantees to boost skills and resources to deliver 300K net additional houses a year by the mid-2020s.

Best use of urban land will be targeted, and the green belt will be protected. High quality, high density homes in city centres and around transport hubs.

An urgent review has been commissioned to identify why so many housing projects are greenlighted, yet the equivalent amount of new building projects being started are lower suggesting land hoarding.

The Government will legislate to ensure that land is actually used.

And, a big move on stamp duty is announced, it is abolished for first time buyers on amounts of up to £300K.

What Does the Pound Think?

The market's verdict so far is that the budget is neutral for Sterling - the currency fell initially as it appeared not much had been done to boost productivity.

However, a recovery in the latter half of the budget suggests in its totality, the budget is neutral for the currency.

Initial reaction coming onto our desk is that the budget has been a sound one and is therefore likely to be well-received, this might provide some stability for the Government, and thus the Pound.

“Against a sombre economic backdrop, the Chancellor today gripped the steering wheel on the UK economy. This is a budget that balances support for people on squeezed incomes with vital action to help grow the UK out of austerity," says Carolyn Fairbairn, CBI Director-General. “Action on business rates, R&D tax credits, the National Productivity Investment Fund and Brexit planning will help firms to invest and grow today against an uncertain Brexit backdrop."

Overall, #hammond has done enough to stay in his job at the Treasury and the markets like it. #GBPUSD testing 1.3280 resistance...

— KATHLEENBROOKS (@KATHLEENBROOKS) November 22, 2017

Currency specialists reckon now markets can once again focus on what really matters for the Pound.

"In the wake of this Budget, any real movement from the Pound will be caused either by developments in the Brexit negotiations or the potential for a further interest rate rise. I would therefore advise any businesses that want to stay on top of turbulence in the currency markets to keep a close eye on inflation data,” says Owain Walters, CEO of Frontierpay.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Why Credibility is What Really Mattered for Sterling

As we have noted already, the Pound's reaction was always going to rest on two pivots: 1) Is the budget good enough to cement support for the Conservative party and 2) is it fiscally responsible?

Understandably, most currency analysts who offered directional viewpoints on the Pound ahead of the budget have done so from the angle of political stability - i.e. if the budget is not well-received the leadership of Theresa May will be questioned once more, opening the door to fresh uncertainty.

And Sterling dislikes uncertainty.

"If the budget is badly received, there will be intensified pressure on Prime Minister Theresa May particularly from hard Brexit supporters to appoint a new Chancellor. The Pound would likely prove sensitive to any further signs of political instability at the current crucial phase in the Brexit talks," says Lee Hardman at MUFG who notes that the details of the budget are unlikely to be important for movements in the currency.

Labour waits to see if any #Budget2017 missteps plunge Theresa May into another crisis https://t.co/efowta3jUI pic.twitter.com/ghHQuXfcyV

— Bloomberg Brexit (@Brexit) November 22, 2017

"Budget 2017 may arrest the latest rise in the British Pound," says Philip Wee, FX Strategist with DBS Group Research, "aimed at the millennials, the budget is said to focus on building 300,000 homes a year. Rating agencies will be paying close attention."

For Wee, what matters is how the budget sets the tone for the important Brexit negotiations that still lie ahead.

"The UK’s economic outlook is held hostage to poor leadership hurting Brexit negotiations. GBP/USD recovered to 1.3215 last Friday from its low of 1.3059 on 2 November. The currency pair is probably setting its sights at the floor rather than the ceiling of its 1.3050-1.3300 range set since early October," says Wee.

Tim Riddell at Westpac notes the budget is critical not only for the Government’s self-imposed fiscal goals (2% deficit by 2021, balanced by mid-2020s) "but the survival of May’s Government due to mounting political pressures domestically and around Brexit."

Viraj Patel, an analyst with ING Bank N.V. in London is however more optimistic and he is betting Sterling might rise.

"Long GBP/USD is our trade of the week and we eye 1.3400 on a well-received Budget," says Patel. "It's clear that the global investment community are in dire need of some Churchillian-like words of inspiration over the future of Britain."

Hamish Pepper, an analyst with Barclays is however concerned the Government might be forced to reduce spending further owing to expected downgrades to productivity.

The Government has promised to continue targeting a structural fiscal deficit below 2% in the 2020/2021 fiscal year even if economic circumstances change.

"This target, however, introduces a worrying scenario for GBP if the OBR delivers more sizeable downward revisions to its GDP growth forecasts and the government is forced to reduce spending in order for the target to be met," says Pepper.

Pepper warns fiscal austerity at a time when the BoE is encouraging market expectations of rate hikes "could leave the currency isolated and GBP depreciation the only release valve for the economy to stabilise."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.