UK's Trade Woes Lower Pound Sterling's Equilibrium Level

Where does the British Pound's equilibrium level lie?

The question is absolutely central to where the UK currency is headed - if the level of fair-value is higher than current levels, the Pound should rise.

However, should the level be lower, then Sterling might be en route to lower levels from where there would be no justification for a sustainable recovery.

The equilibrium level ultimately rests with the UK's trade dynamics with the exchange rate typically being reliant on whether the UK attracts foreign currency via exports or whether it exports foreign exchange via imports.

The UK imports more than it exports, therefore we would expect the currency to be in persistent freefall were it not for the counterbalancing influence of foreign investor inflows. The Pound is supported by foreign investors sending capital to the UK to take advantage of investment opportunities.

It goes without saying, should the UK be deemed a less-attractive investment destination than it once was, the Pound would be in trouble.

And the outlook on this front is not good. UK Government Bonds - or Gilts as they are known - make up a significant proportion of the assets soughts out by foreigners.

They could be 'left on the shelf' next year by the combined impact of European Central Bank (ECB) policy and Brexit insecurity, according to a report by US investment bank Jefferies International.

Why the ECB Matters for the Pound

The result could lead to a fall in Sterling and a rise in the cost of borrowing, according to Jefferies' Chief European Economist, David Owen.

Currently, ECB buying of UK Gilts helps finance the current account deficit - the hole in the country's accounts left from spending more on foreign goods, services and investments than it earns from selling British goods, services and investments.

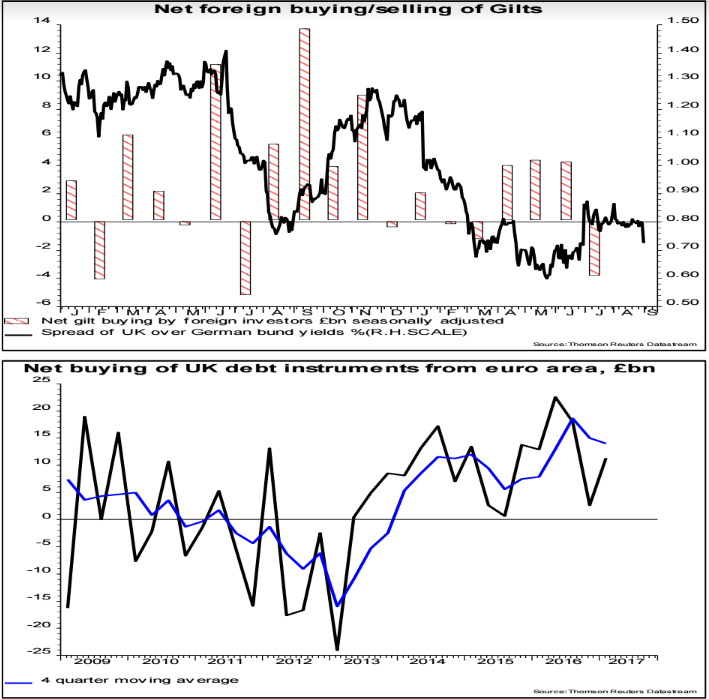

ECB buying totaled 35.2bn Gilt purchases in the year up until July which is equivalent to half the UK's current account deficit.

Yet this source of demand may soon disappear as the ECB is widely reported as preparing to wind down its program of asset purchases, or QE as it is more commonly known, because of the strong recovery in the Eurozone economy as well as financial stability concerns.

Indeed, data from July already appears to show demand for Gilts tailing off:

"In a world where the ECB moves to taper in 2018 and Brexit discussions stall, will the UK continue to see significant net foreign buying of Gilts? One’s month data is too early to determine a trend, but foreigners were net £4bn sellers of Gilts in July," said Owen.

Unless the UK's financing needs can be met from alternative sources the Pound will devalue as a result, and UK government borrowing costs will probably rise.

To make matters worse, the UK's plans to leave the European Union (EU) mean that the country's economic outlook suffers from a great deal of uncertainty, making UK Gilts an even less attractive punt.

If Brexit results in a cliff-edge fall to WTO tariffs, for example, as is widely feared, this is likely to reduce the attractiveness of Government debt, leading to a fall in Gilt prices and an even sharper rise in borrowing costs - compounded further by a possible credit rating downgrade.

If foreign investor flows decrease, the Pound will have to fall to levels deemed fairer by the export, import dynamic.

The equilibrium level for Pound Sterling is therefore at risk of falling.

Friday's Trade Data Key

The UK current account deficit stands at a record low -4.4% of UK GDP and a large part of this is due to the deficit in traded goods which is one of the largest components of the current account.

Economists have been left bewildered by the lack of change in the trade deficit after the referendum.

They were expecting it to shrink as a result of the weaker Pound which made UK exports more price competitive.

However, in the end, both exports and imports increased at the same rate, leaving the deficit intact.

The latest Trade Balance data for July, out on Friday, September 8, is forecast by economists to show a slightly reduced deficit of -11.95bn Pounds from -12.72bn in the previous month.

Given the precarious outlook for the continued financing of the UK's current account deficit, trade data may come to play a more significant role in Pound valuations moving forward, making Friday's release a potential 'heat-spot' for the currency.