British Pound Receives a Reality Check from the Bank of England

- Pound to Euro exchange rate (3-2-2016 A.M): 1.1640

- Pound to Dollar exchange rate: 1.2526

- Pound to Australian Dollar: 1.6370

Foreign exchange markets appear to have got it very wrong by bidding Pound Sterling higher ahead of the release of the Bank of England's February Inflation Report.

The currency tumbled sharply after the Bank maintained a neutral bias and confirming that, "montary policy can respond, in either direction."

Analysts expected this neutrality yet Sterling's reaction shows traders did not.

Our initial assessment is that traders were bidding the Pound higher in anticipation of some kind of indication that the Bank was leaning towards raising rates towards the end of the year.

However, there was no such indication and a technical profit-taking move has ensued.

A good explanation for the reaction is provided by Kathleen Brooks at City Index who warned us ahead of the event that Sterling was looking overvalued based on its relationship with money markets.

Any shyness from the Bank would likely see Sterling fall back to fair-value implied by the money markets:

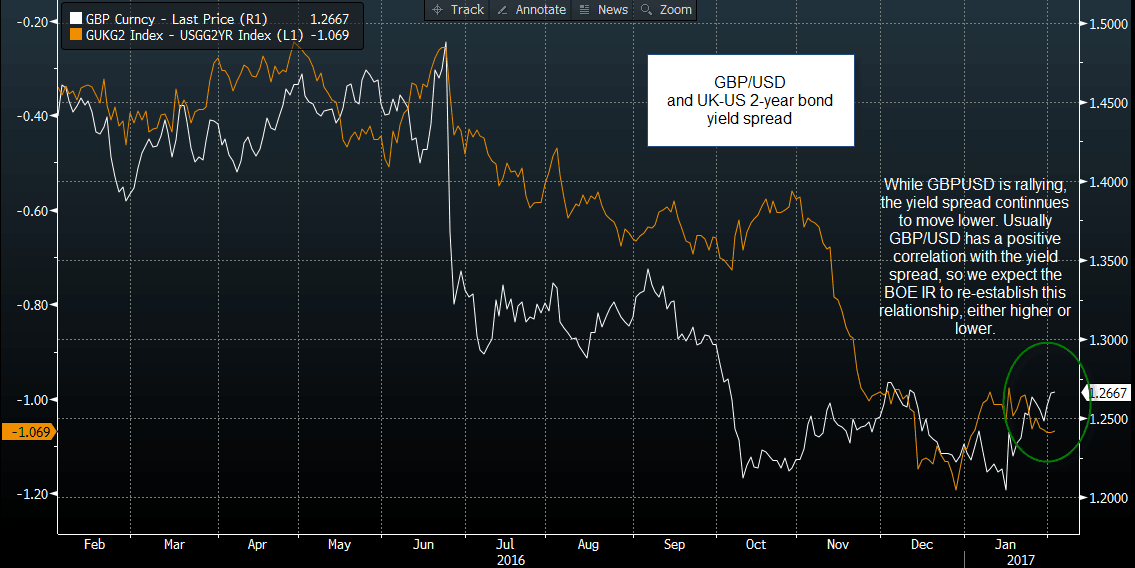

"A surprise dovish tone from the BoE could trigger a sharp fall in GBP/USD, especially since the recent rally is not supported by the yield spread."

The UK-US 2-year yield spread is the difference between the returns offered on US sovereign bonds and UK sovereign bonds.

The advantage currently lies with the US which offers higher interest rates, the direction of travel of the spread is unlikely to turn higher until such a time as the Bank of England indicates it is willing to rise interest rates.

Also calling it right were Credit Suisse who warned the BoE would likely try to avoid sounding hawkish, given its fears that consumer spending will suffer in real terms in 2017.

Indeed, the tone adopted by Governor Mark Carney is one similar to the tone adopted at his old workplace the Bank of Canada where Governor Poloz this month tried hard to take a dovish stance with an eye on structural risks. The move worked and sent CAD lower.

Markets were also guilty of expecting too much from the Bank and the Pound has further to fall as a result.

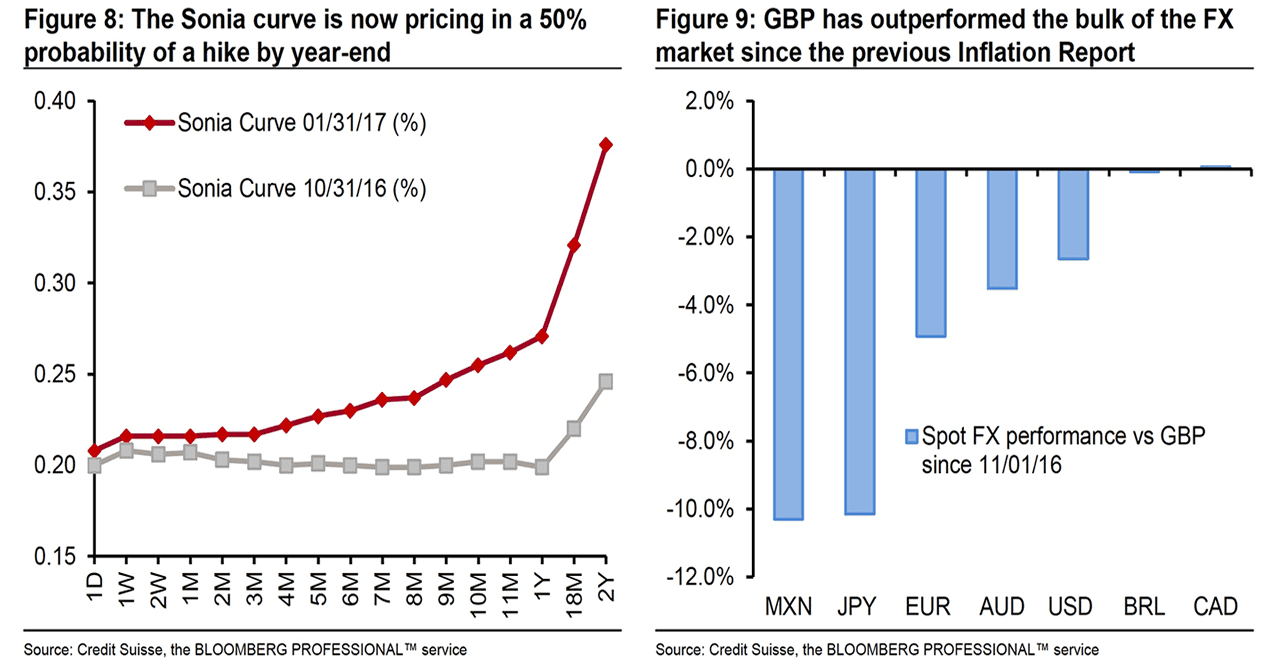

"Given the rates pricing in the Sonia curve already, this could lead to a setback for GBP that takes it 1-2% lower on a trade-weighted basis over the week that follows. But we doubt it would be a terminal blow," says Alvise Marino at Credit Suisse..

The below shows that markets were, quite incredibly, actually betting with a 50% certainty that the Bank would raise rates in 2017:

The move lower in GBP reflects the more sober repricing across the money and foreign exchange marketplace.

The move appears counterintuitive to many observerrs as the standout of the event is contained in the Inflation Report where the Bank's forecasters pushed their growth forecasts to 2% for the year 2017, from the 1.4% figure made in their November forecast.

The forecasts for 2018 are revised higher to 1.6%.

"The Brexit-defying UK economy will expand by 2% this year – up from 1.4% predicted in November. No more sharp slowdown to growth from Brexit," says Neil Wilson at ETX Capital.

In the press conference following the release Carney says the Bank's initial forecasts were way off target largely becaue of the strength of UK consumer confidence.

He says there was no way for the Bank to foresee the lack of concern given by the UK population to Brexit.

The Sting to the Pound from the Inflation Forecast

Inflation forecasts were however left largely unchanged - and this is what got Sterling falling.

Inflation is forecast to hit 2.70% in 2017 and 2.6% in 2018.

"While the Bank of England spent most of the afternoon revising things higher, one figure was taken lower; by the start of 2018 the central bank now expects inflation to be at 2.7%, not 2.8%. Combine this with comments from Carney suggesting he could also see scenarios where rates move in ‘either direction’ and things were more dovish than the pound would have liked," says Connor Campbell at Spreadex in London.

So while inflation is above the 2% target set in the Bank's mandate, it is the wrong kind of inflation:

"Rising inflation doesn’t have to mean pushing up interest rates, though. The catalyst for rising prices in the UK can be put down to Brexit-induced weakness in the Pound, rather than an overheating economy, and thus the Bank may take a stand off approach to raising rates throughout 2017," says Paul Sirani, Chief Market Analyst at Xtrade.

The Bank will likely only act once it believes inflationary pressures are being driven by wage growth which remains relatively subdued.

To reflect this view, they lowered the equilibrium employment rate of the economy down to 4.5%. Thus, unemployment must fall further before upside prices to wages are generated.

When wages start accelerating then we could see a strong tick up in expectations for a rate rise.

We will be watching pay growth . . . quite closely over the coming months,” said Ben Broadbent, deputy governor. “We do expect wage growth to rise but not by that much.”

Pound Falls, But Could Recover Again

The Pound to Dollar exchange rate has hit a multi-week best at 1.27 in the lead-up to the event - however we must point out that the gains were almost exclusively due to broad-based Dollar weakness.

Sterling was actually looking pretty poor heading into the event with losses against most of its rivals.

That there was no major shift towards a rate hike only pushes the trend.

"The pound, which had been rising prior to the BoE’s Super Thursday, sold off. It was a classic case of 'buy the rumour, sell the news' type of a reaction, although some would argue that the BoE sounded a little more dovish than expected," notes Fawad Razaqzada at Forex.com. "I, however, think the tone was not that dovish and there was a scope for it to bounce back once Mark Carney starts speaking at his presser."

Analyst Shaun Osborne at Scotiabank says short-term price signals turned negative on the intraday charts as the Pound slips back; "price patterns suggest that the move higher from the mid 1.24 area has stalled at least. We see some support in the low 1.26 area but price action suggests a greater risk of a short-term top forming and Cable easing back to the mid 1.25s".