Pound Sterling A Sell With BCA Research, "Big" Move Seen Coming

- Written by: Gary Howes

Image © Adobe Images

Analysts at BCA Research make the case for "short Sterling", citing technical, positioning and external vulnerabilities.

In a new research note assessing the Pound's outlook, analysts at the independent research firm say the Pound has benefited over recent months from bottoming house prices and a resilient labour market.

However, "much of this good news is already well recognised by economists and market participants," says Chester Ntonifor, Foreign Exchange Strategist at BCA Research.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

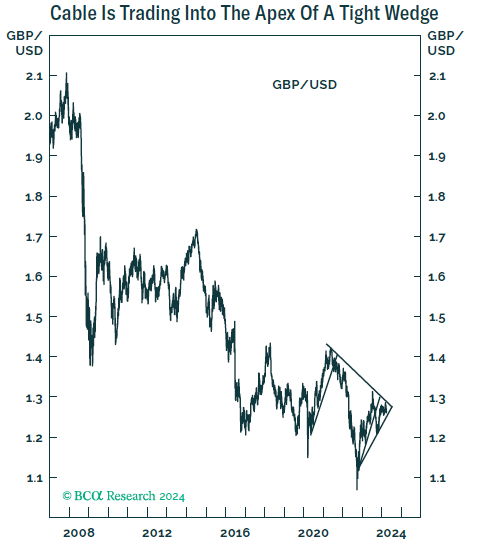

This observation comes amidst a favourable technical setup that hints at a larger move to the downside might be brewing:

"The British pound has been trading into the apex of a very tight wedge. Historically, such price action suggests a big technical move is imminent. Our bias is that this move will be to the downside," says Chester Ntonifor, Foreign Exchange Strategist at BCA Research.

Track GBP with your own custom rate alerts. Set Up Here

BCA Research says a potential trigger for a pullback in the Pound is likely to be external rather than domestic.

"Given the UK runs a large balance of payments deficit, it relies a lot on portfolio flows for funding domestic spending. A sea-change in these flows will be a likely catalyst for a pullback in sterling," explains Ntonifor.

He says foreign holdings of UK equities sit at around 70%, and for bonds, it is about 30%. "Ergo, portfolio flows have an outsized effect on the performance of sterling.

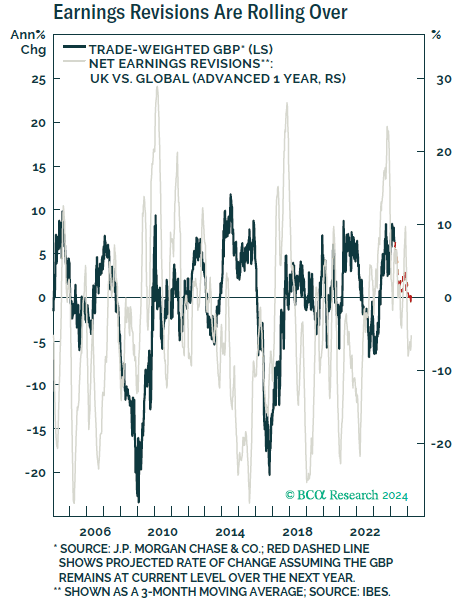

BCA Research says equity portfolio flows are at risk as the majority of UK shares are financials, industrials or in the energy sector.

"Energy prices have been soft, especially on the back of warmer weather and rising supply of LNG. Financials are likely to suffer if interest rates decline, as this will bite into net interest margins. Industrials offer some beacon of optimism, but many other markets offer much more decent exposure to reshoring and/or a green energy revolution. Put simply, earnings revisions in the UK are falling relative to its trading partners, and that has usually been a negative for cable," says Ntonifor.

BCA Research recommended selling Pound-Dollar at 1.28, saying the exchange rate will bottom around the 1.20-1.22 level "as stale speculative longs liquidate their positions".

Longer-term, GBP "is cheap" and BCA says it can recover when the dollar eventually enters a bear market.

The Pound's longer-term value will depend on capital inflows.

"The UK needs to be at the forefront of disruptive technologies such as electric cars, digital currencies, 3D printing, and green technology. We will be monitoring UK’s productivity growth in the next few quarters for evidence that this thesis is playing out," says Ntonifor.