Pound Sterling Set For Weekly Advance against Euro and Dollar Helped By GDP Beat

- Written by: Gary Howes

- Pound holding weekly advance

- GDP recovers in November

- But unless Dec. print is strong, a technical recession will be confirmed

- Genuine recovery expected in 2024 by Pantheon Macroeconomics

Image © Adobe Stock

The British Pound is currently set to record a positive weekly close against the Euro and Dollar, helped by news the UK economy rebounded in November.

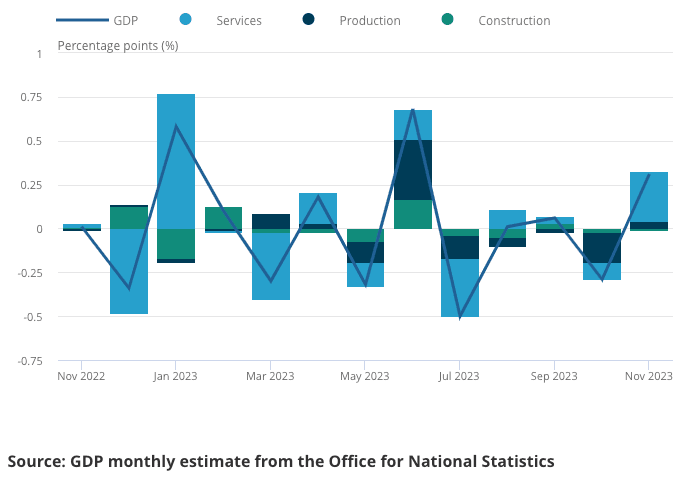

Data from the ONS shows the UK economy grew 0.3% month-on-month in November as it recovered from October's -0.3%, in the process beating consensus expectations for 0.2%.

But there were some downside surprises, too: The economy grew 0.2% in the year to November, recovering from a downwardly revised -0.1% print for October. On a rolling three-month basis, the economy contracted 0.2%, which was worse than the 0.1% expected.

Manufacturing production recovered to 0.4% month-on-month in November from -1.2% and beat expectations for 0.3%. Industrial production was on expectation at 0.3% m/m, while the index of services was also on expectation at 0.2%.

Following the release, the Pound to Euro exchange rate is steady at 1.1640, holding a weekly advance of 0.17%.

The Pound to Dollar exchange rate was slightly weaker in the immediate aftermath of the release but holds a 0.40% advance for the week at 1.2767 at the time of writing.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound is 2024's best-performing currency as markets have moved to temper expectations for imminent Bank of England interest rate cuts. These latest economic figures will build on this theme.

"Today’s numbers are evidence of an economy in better shape than anticipated. Whilst evidently good news it calls into question markets’ pricing of 120bps of cuts from the BoE during 2024. With core inflation still lingering well above target at 5.1%, housing markets continuing to be robust, and economic data coming out above expectations, it is hard to imagine the BoE beginning an aggressive cutting cycle," says Tim San Wong, Global Capital Markets Associate at Validus Risk Management.

Despite November's outturn, the bigger picture is one of a flatlining UK economy and an outturn above 0.3% is required in December to avoid a technical recession being confirmed.

"This uplift in November is just enough to bring the UK economy back to flat growth over these two months, but it leaves an awful lot of pressure on the December figures as even a slight downward turn would result in the UK entering a technical recession after Q3 GDP was revised down to a fall of 0.1% at the end of last year," says Richard Carter, head of fixed interest research at Quilter Cheviot.

PMI figures for December suggest a solid improvement in output, which suggests the country can avoid a technical recession. Indeed, foreign exchange markets will continue to emphasise the short-term surveys, while next week's inflation numbers will also prove crucial.

"While the composite PMI picked up in December, other surveys point to a decline in retail sales volumes, and the resumption of strikes by junior doctors likely dragged down output in the health sector again. Accordingly, it’s a coin toss whether GDP fell for marginally a second consecutive quarter in Q4," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Tombs says although the underlying trend still looks flat, "a genuine recovery will take hold this year."

He explains households' real disposable income should rise by about 2.0% y/y in 2024, supported by a faster decline in inflation than wage growth and a fading drag from mortgage refinancing.

Tax and benefit changes in the fiscal year that starts in April is meanwhile tipped to boost real household disposable income by 0.6pp.

Households' saving rate already is well above its pre-Covid norm, leading Tombs to suspect most of this upturn in income should feed through to households' spending.